WTI Holds Gains Despite Big Distillates Build, Record SPR Release

Oil prices are up this morning, but off their highs following the IEA's cut to its global demand growth outlook (due to China lockdowns). Price drifted lower overnight after the surprise crude build reported by API, but the 'Biden Bottom' under prices remains in place (SPR refill bid) and seems to be sustaining a BTFD nature in the crude complex and reports that the Chinese megacity of Chengdu announced it would gradually loosen lockdowns - a bullish sign for demand - provided some support this morning.

“The market seems to be well and truly stuck with no clear direction for the time being,” said Ole Hansen, head of commodities strategy at Saxo Bank.

“The market is getting even more concerned central banks led by the FOMC could tip the global economy over the edge in their pursuit of lower inflation.”

This morning's official inventory and demand data may be the algo's catalysts for the next leg one way or the other.

API

-

Crude +6.035mm (-200k exp)

-

Cushing +101k

-

Gasoline -3.23mm

-

Distillates +1.75mm

DOE

-

Crude +2.442mm (+1.83mm exp)

-

Cushing -135k

-

Gasoline -1.768mm

-

Distillates +4.219mm (biggest build since Dec 2021)

US Crude inventories built for the second week in a row and distillates stocks exploded higher...

Source: Bloomberg

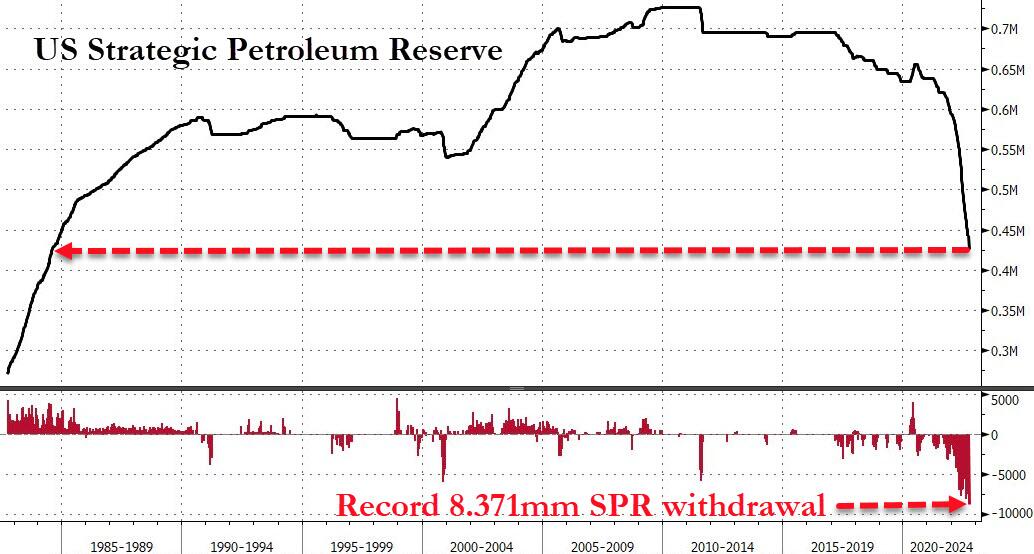

As a reminder, the Biden admin released a record 8.4mm barrels of oil from the SPR last week so the net commercial crude draw was actually around 6mm barrels...

Source: Bloomberg

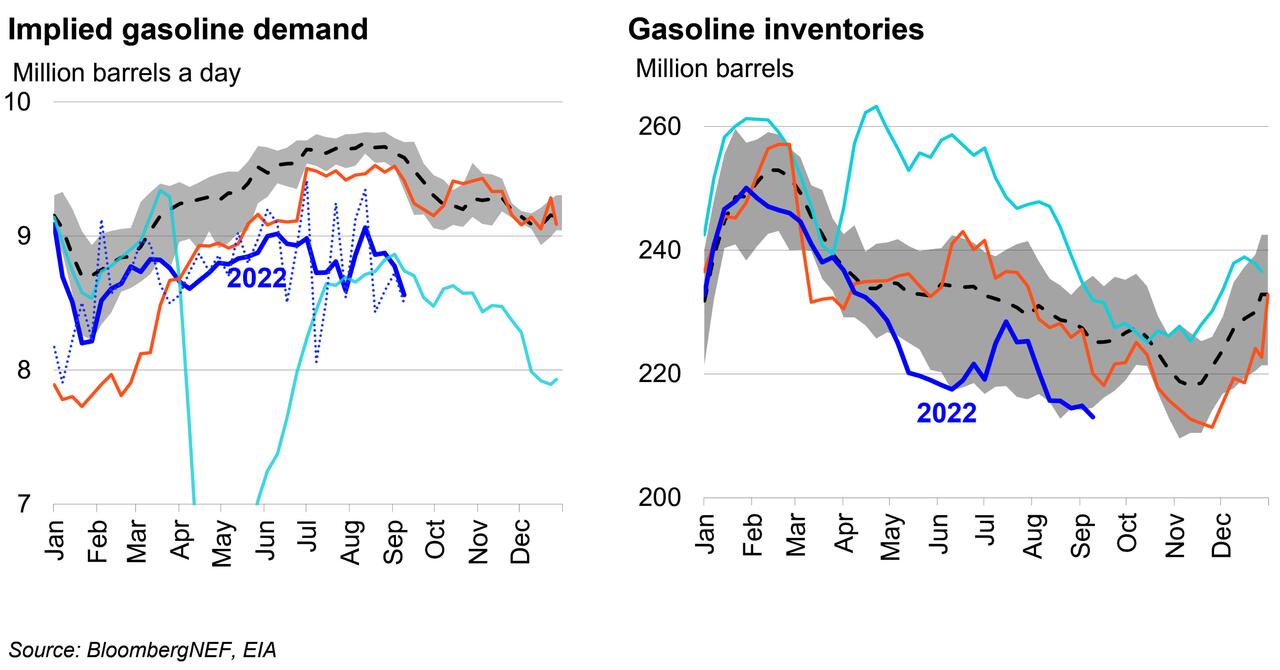

Gasoline demand plunged further below 2020 levels, despite the fact that prices continue to ease and shelved summer road trips are no longer a factor. The four-week moving average of product supplied is down to 8.56 million barrels a day, nearly 200,000 barrels below where it was at this time two years ago.

Even with demand floundering, the EIA reported a huge 1.8 million barrel draw in gasoline inventories, bringing them to their lowest seasonal level since 2014.

US Crude production was flat as rig counts have started falling (drilling activity in the US shale patch has reversed course for the first time since its collapse in 2020)...

Source: Bloomberg

WTI had slipped below $88.50 ahead of the official data and rallied modestly after the data...

Finally, Bloomberg Intelligence Senior Oil & Gas Analyst Fernando Valle notes that "a potential US rail strike may have significant consequences for diesel demand, helping to restore depleted inventories, but at a major cost to the economy. Demand may see an impact of up to 600,000 barrels a day, we calculate, close to 15% of US consumption if there’s a strike. But its long-term effects may be even greater, given the potential to disrupt supply chains and push further declines in construction and durable goods orders. Reduced economic activity may also affect gasoline demand over the coming months. "

More By This Author:

WTI Steady Above 'Biden Floor' Despite Another Big Crude BuildEscobar: Germany's Energy Suicide - An Autopsy

Most Central Banks Have Raised Interest Rates In 2022

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more