WTI Holds Gains After API Reports Bigger-Than-Expected Crude Draw

Photo by Timothy Newman on Unsplash

Oil prices ended unchanged today as early Azerbaijan angst sent WTI above $92 and some chatter from the Biden admin that draining the SPR was once again the table seemed to drag WTI back down (but $90 supported).

"The Saudi appetite to withhold oil from market, supported by Russia maintaining a certain level of export constraint, points to higher prices in the short term, all else equal," analysts at Citi, led by Edward Morse, global head, commodities, wrote in a note dated Monday.

Investors have been looking past worries about China's economic growth and a sluggish economy in Europe to push the commodity higher amid ever-tightening supplies, as Russia and Saudi Arabia have each curbed production.

API

-

Crude -5.25mm (-1.00mm exp)

-

Cushing -2.56mm

-

Gasoline +732k (+500k exp)

-

Distillates -258k (-200k exp)

After last week's big surprise product builds (and crude build), all eyes remain on this week's inventory data for signs that demand is stalling. Instead, API reported a big (5.25mm barrel) crude inventory draw. Cushing stocks continued to draw down heavily...

Source: Bloomberg

WTI was hovering at $90.80 ahead of the API print.

Shrinking supplies have ignited a flurry of predictions that $100 oil could return on a roster that includes industry heavyweights such as Chevron Chief Executive Officer Mike Wirth and traditional bears at Citigroup.

"Oil trading is a sophisticated game of Chutes & Ladders" and there are some hot spots that may take Brent, and possibly WTI, to $100 a barrel shortly, said Tom Kloza, global head of energy analysis at the Oil Price Information Service, a Dow Jones company.

But whether either benchmark can average $100 for a month is "an interesting question," he said.

"When there are bullish extremes in sentiment, it is often a sign that the market is about to turn."

The biggest threats to the oil rally continuing are "changes in fundamentals," said Troy Vicent, senior market analyst at DTN.

"At current price levels, a diminished appetite for crude imports by China and rising Chinese product exports are the most likely culprits to help cool off this rally in the near term," he told MarketWatch.

"If this materializes, and particularly if we start to see demand slow elsewhere, it could quickly change the Saudi's calculus on how far they're willing to push their voluntary supply cuts."

Finally, as a reminder, history shows that surging energy costs usually play a role in tipping the U.S. into recession.

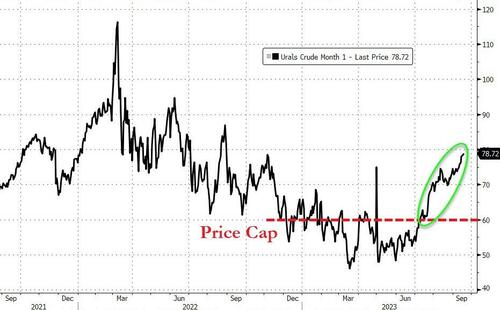

Meanwhile, Russia is killing it...

When will 'The West' start fighting back against the price-cap-deniers?

More By This Author:

FTX Sues Bankman-Fried's Law Professor Parents To Recover "Fraudulently Transfered And Misappropriated Funds"

US Debt Rises Above $33 Trillion For The First Time

Homebuilders Finally Face Reality, Confidence Plunges In September

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more