WTI Holds Gains Above $66 After Big Crude Draw

Oil prices are up for a third straight day this morning as the easing of lockdowns in the US and parts of Europe prompted hopes of an increase in fuel demand over the summer months and offset concerns about rising COVID-19 infections in India and Japan.

"A return to $70 oil is edging closer to becoming reality," said Stephen Brennock of oil broker PVM.

"The jump in oil prices came amid expectations of strong demand as Western economies reopen. Indeed, anticipation of a pick-up in fuel and energy usage in the United States and Europe over the summer months is running high," he said.

Last night's surprisingly large crude draw (reported by API) also helped support prices and traders will be looking at the official data to confirm the trend.

API

- Crude -7.688mm

- Cushing +548k

- Gasoline -5.308mm

- Distillates -3.453mm

DOE

- Crude -7.99mm

- Cushing +254k

- Gasoline +737k

- Distillates -2.896mm

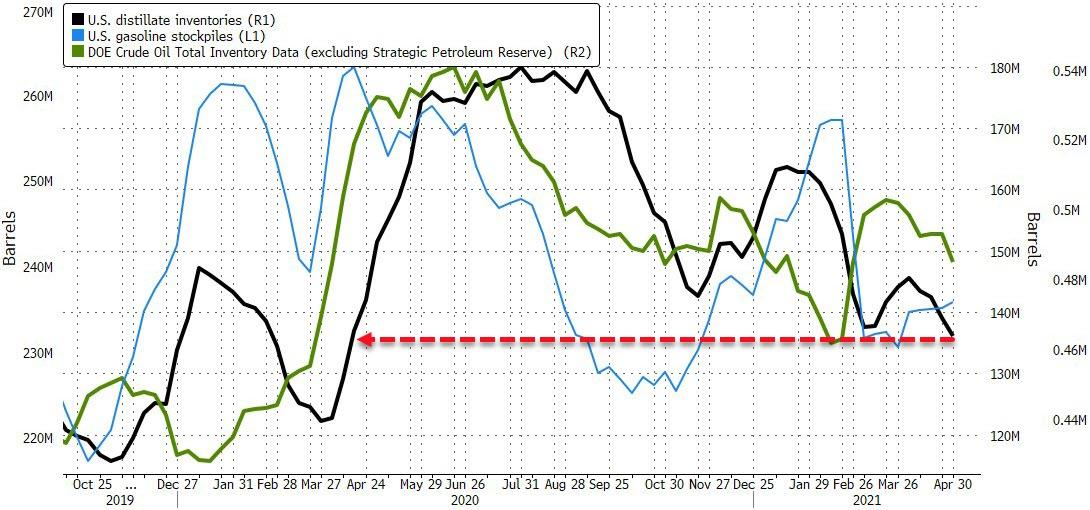

Official DOE data confirmed API's big crude draw but the major product draws were not as gasoline stocks rose unexpectedly and distillates stocks fell but less than API...

(Click on image to enlarge)

Source: Bloomberg

Distillates stocks fell to their lowest since April 2020 and crude inventories fell to 10-week lows...

(Click on image to enlarge)

Source: Bloomberg

US crude production remains 'disciplined' despite surging prices and rising rig counts...

(Click on image to enlarge)

Source: Bloomberg

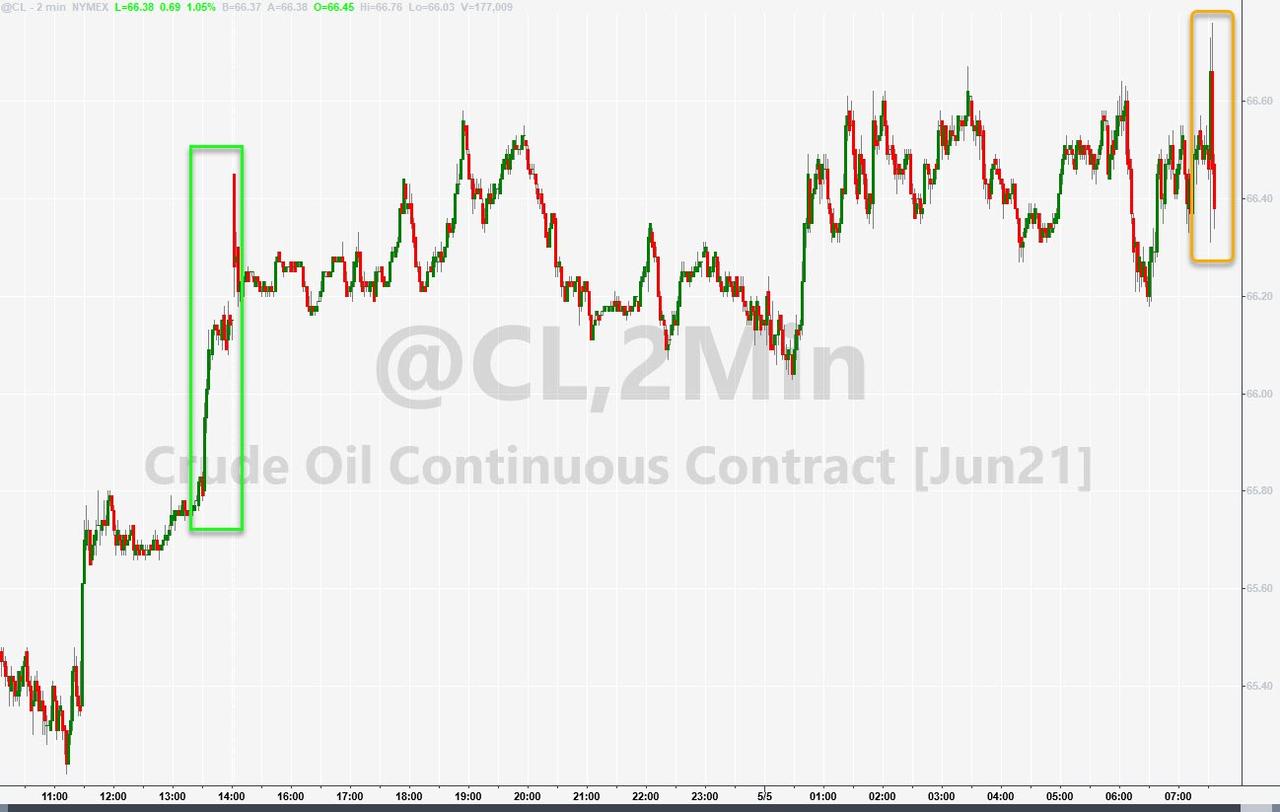

WTI traded above $66.50 ahead of the official inventory/production print.

(Click on image to enlarge)

"The partial lifting of mobility restrictions, the expectation that tourism will return in the near future, and the lure of the psychologically important $70 mark are all likely to have contributed to the price rise," Commerzbank analyst Eugen Weinberg said.

This has offset a drop in fuel demand in India, the world's third-largest oil consumer, which is battling a surge in COVID-19 infections.

"However, if we were to eventually see a national lockdown imposed, this would likely hit sentiment," ING Economics analysts said of the situation in India.

Meanwhile, gas prices at the pump have surged to a critical level...

(Click on image to enlarge)

Head petroleum analyst Patrick DeHaan at GasBuddy noted in tweets this week that gasoline and diesel prices are roughly level to where they were at this time in 2019. That suggests it might be a normal summer ahead for driving.

And it all comes in the context of what could be the first average $3 retail gasoline in the U.S. since 2014 as part of inflation in the economic recovery.

Disclosure: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more