WTI Holds 'Death Cross' Losses After API Reports Surprise Crude Inventory Build

Despite OPEC+ cutting production at the margin, oil slumped below pre-Putin levels today as demand concerns emanating from China and increasingly hawkish rhetoric from central banks prompted a wave of selling that turned into a frenzy as prices breached technical warning levels.

“Elevated volatility is the story here,” said Rebecca Babin, a senior energy trader at CIBC Private Wealth Management.

“There is no way to have conviction and want to place bets when the market trades in huge ranges with limited liquidity. The risk reward is just not there.”

With prices at a key level and Putin outright threatening to withhold oil flows to 'unfriendly' nations, algos will be eagle-eyed on tonight's inventory data ahead of tomorrow's official print for signs that confirm fears of recession.

API

- Crude +3.645mm

- Cushing -772k

- Gasoline -836k

- Distillates +1.833mm

For the first time in four weeks, US crude stocks increased last week (+3.645mm). Gasoline inventories drew down for the seventh straight week...

(Click on image to enlarge)

Source: Bloomberg

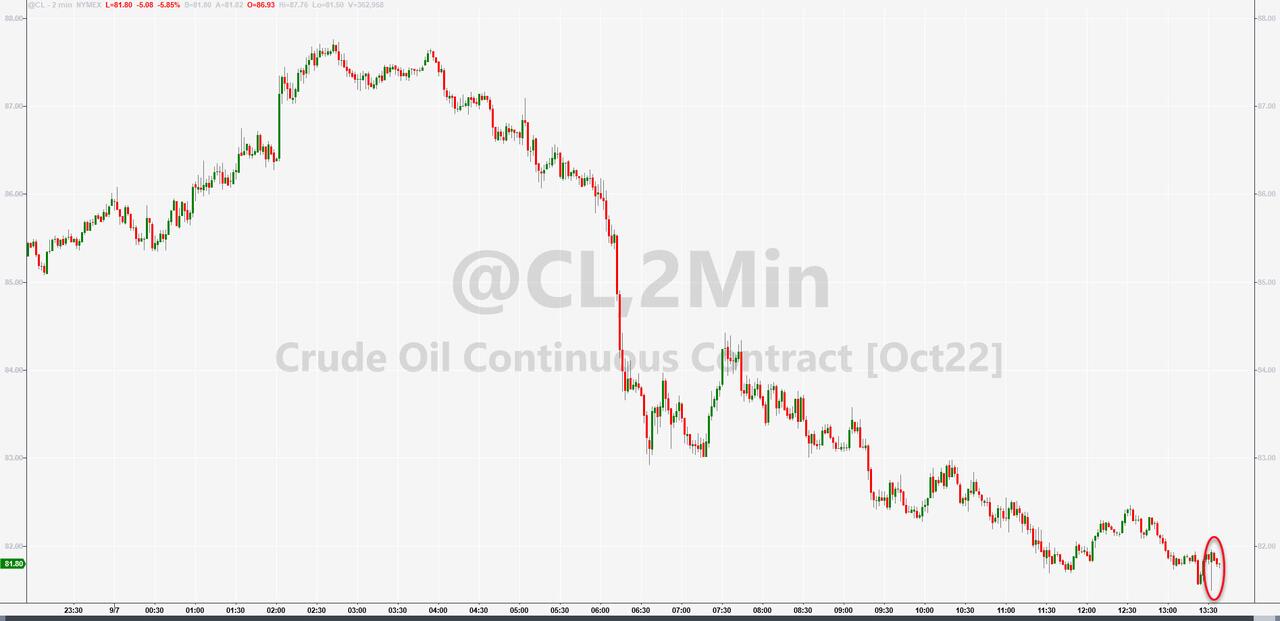

WTI suffered a 'death cross' today, pushing the price to its lowest since February...

(Click on image to enlarge)

Source: Bloomberg

WTI was trading below $82 ahead of the print and held those losses...

(Click on image to enlarge)

“WTI crude should hold $80 given how strong the US economy remains and now that most of the demand shock from China’s deteriorating COVID situation has been priced in,” said Ed Moya, senior market analyst at Oanda.

More By This Author:

Atlanta Fed Slashes Q3 GDP Estimate After ISM, BLS Data

The US Economy Is Still Being Artificially Supported By Trillions In COVID Stimulus

China Slashes FX Deposit Requirement To Prop Up Yuan... But Only Delays The Inevitable

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more