WTI Holds Below $100 After API Signals Crude/Product Inventory Builds

Oil prices slipped lower today with WTI settling back below $100 as global growth scare sentiment dominated any geopolitical risk premium today as inflation angst (and the policymaker response) and China's escalating COVID response raised fears of a global recession.

“Crude oil may have finally topped out,” said Fawad Razaqzada, a market analyst with City Index and FOREX.com “I know that is a brave call to make and shorting oil is playing with fire given geopolitical risks.”

However, the recent pullback should have spurred another round of buying but so far hasn’t, he added, which could signal a new, lower price range at which crude meets resistance based on chart technicals.

Additionally, European officials appeared less and less likely to actually bite the bullet on any full-blown imminent Russian oil ban... despite all the blather.

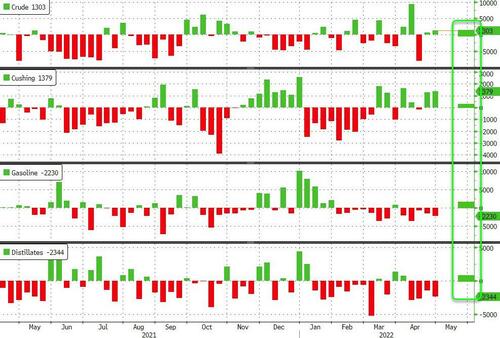

API

- Crude +1.161mm (-457k exp)

- Cushing +92k

- Gasoline +823k

- Distillates +662k

Inventories rose across crude and products and at Cushing last week - albeit only modestly. Crude was a notable miss as a small draw was expected...

Source: Bloomberg

WTI hovered just below $100 ahead of the API print and drifted to the lows of the day after...

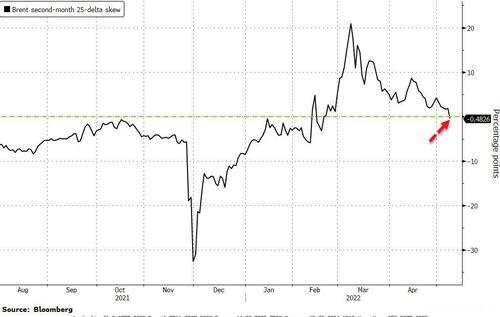

Notably, oil options markets were also caught up in the downturn, with bearish put options fetching a premium to bullish calls for the first time since the outbreak of the war in Ukraine in late February...

Source: Bloomberg

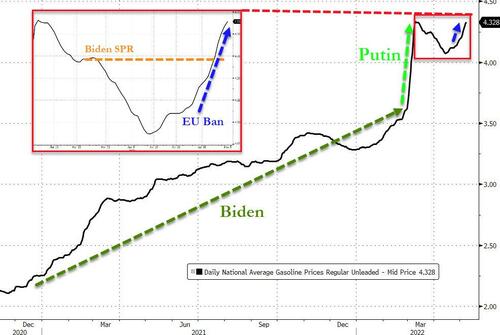

Meanwhile, US retail gasoline prices hit a new record high...

"Americans have never seen gasoline prices this high, nor have we seen the pace of increases so fast and furious," said Patrick DeHaan, the head of petroleum analysis at specialist site GasBuddy.

"It's a dire situation and won't improve any time soon."

Blame Europe, Putin, or 'Ultra MAGA'... but not Biden!

Diesel and jet fuel prices have been rising faster than gasoline, putting further inflationary pressure on agriculture, shipping and travel... also not Biden's fault.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more