WTI Extends Gains Despite Huge Crude Build, Surge In Cushing Stocks

Photo by Timothy Newman on Unsplash

Oil prices were rebounding this morning after yesterday's growth-scare-driven tumble, as investors wagered China’s demand revival would sustain the market even amid signs of rising US crude inventories, as reported by API overnight.

“The reopening is proceeding sooner (by one quarter) and more rapidly than we originally expected,” JPMorgan analysts, including Natasha Kaneva, wrote in a note to clients. “This opens a possibility that China is poised for a strong economic recovery that will gather steam in February, after the end of the Lunar New Year holiday.”

Will API prove to be right, or is this 'noise' hanging over from the 'deep freeze' impact on refiners?

API

- Crude: +7.6mm.

- Cushing: +3.7mm.

- Gasoline: +2.8mm.

- Distillates: -1.8mm.

DOE

- Crude: +8.408mm (+4.8mm exp).

- Cushing: +3.646mm - biggest build since April 2020.

Confirming API's report, the official data showed another huge crude build of 8.41mm barrels and a massive rise in stocks at Cushing.

Source: Bloomberg

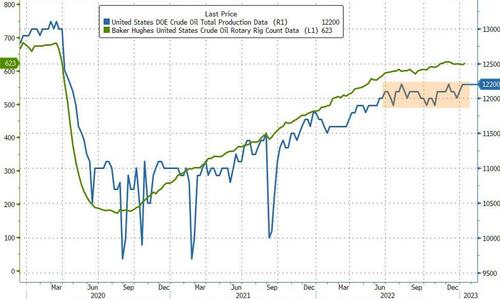

US crude production was flat at its cycle highs.

Source: Bloomberg

WTI was hovering at $80.50 ahead of the official data and bounced after the data was released.

"Two wild cards dominate the 2023 oil market outlook: Russia and China. This year could see oil demand rise by 1.9 mb/d to reach 101.7 mb/d, the highest ever, tightening the balances as Russian supply slows under the full impact of sanctions. China will drive nearly half this global demand growth even as the shape and speed of its reopening remains uncertain," the IEA said.

More By This Author:

Beige Book Finds "Little Growth" Ahead", Increasing Difficulty For Retailers To Pass Cost IncreasesRecord-Breaking 20Y Treasury Auction Sends Yields Tumbling

Stocks & Crypto Are Suddenly Puking...

Disclosure: Copyright ©2009-2023 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more