WTI Dips After Surprise Crude Build - Wednesday, May 4

Oil prices extended overnight gains (on big surprise crude and product draws reported by API) after the EU proposed its Russian oil embargo (and obviously was met with a wall of vetos and exemption requests)

The European Commission’s plan “removes some of the overhang from a lack of a clear proposal in prior weeks,” said Rohan Reddy, director of research at Global X Management.

“It’s a clear signal by the EU that the bloc is willing to move on from Russian oil, despite its current dependence on it. It will need to be voted on by the EU’s member states, but putting forth a framework is a major step.”

The phaseout of Russian oil in Europe will come at a time when the world is grappling with a refined-product crisis - potentially making it all the more costly for the region to wean itself off Russian fuels such as diesel - which was confirmed by API's reported a plunge in product inventories.

API

-

Crude -3.479mm (-200k exp)

-

Cushing +978k

-

Gasoline -4.5mm (-300k exp) - biggest draw since Oct 2021

-

Distillates -4.457mm (-1.5mm exp)

DOE

-

Crude +1.303mm (-200k exp)

-

Cushing +978k

-

Gasoline -2.23mm (-300k exp)

-

Distillates -2.344mm (-1.5mm exp)

Official inventory data showed a build in crude stocks last week - completely different from the big draw API reported - but products saw notable draws (confirming API's data)

(Click on image to enlarge)

Source: Bloomberg

The headline build in crude stockpiles was more than offset by the withdrawal of almost 3.1 million barrels of crude from the Strategic Petroleum Reserve last week. Total nationwide crude inventories (including commercial stockpiles and oil held in the SPR) fell by 1.8 million barrels in the week to April 29. That’s 34 straight weeks of crude draws from the SPR, and there are going to be many more of them to come.

Total Distillates inventories fell to 14-year lows...

(Click on image to enlarge)

Source: Bloomberg

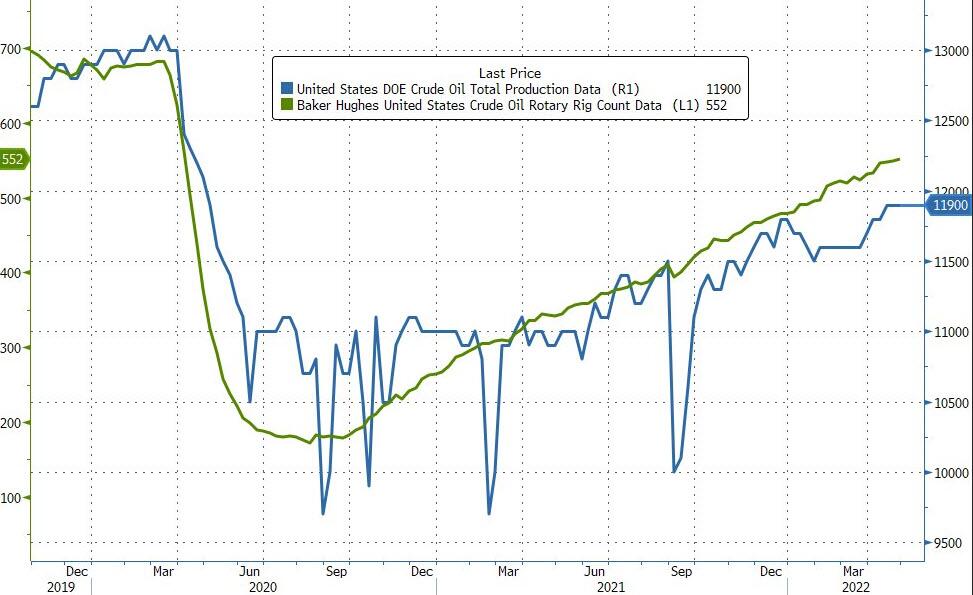

US Crude production was unchanged last week - but remains at two-year highs...

(Click on image to enlarge)

Source: Bloomberg

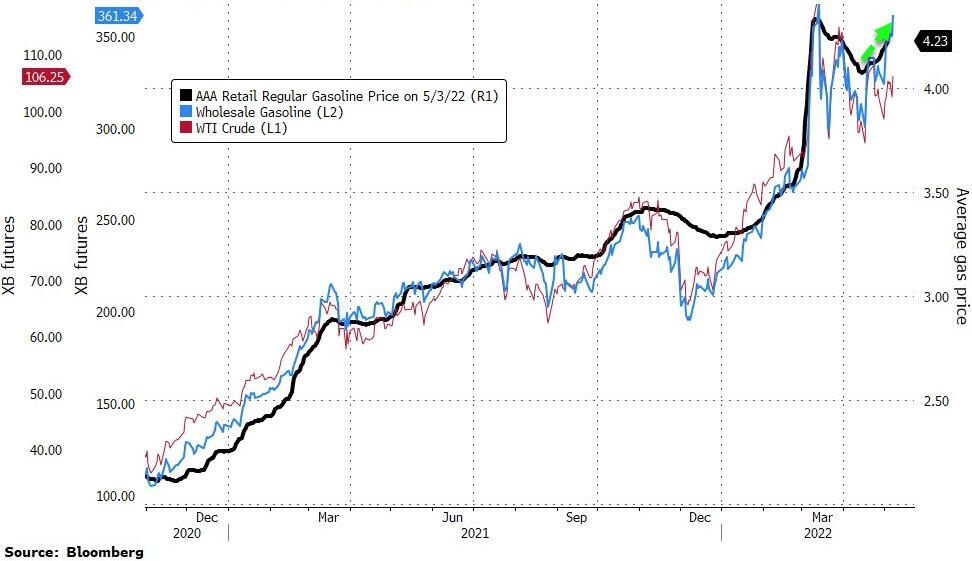

WTI was hovering above $106 ahead of the official data and slipped on the surprise crude build...

(Click on image to enlarge)

Of course, this is a disaster for Biden as retail gasoline prices are once again storming higher...

(Click on image to enlarge)

Source: Bloomberg

Will the president blame his European allies this time for the surge in prices?

Notably, amid soaring diesel prices, east coast distillate inventory levels fell to their lowest on record.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more