WTI Dips After Biggest Crude Build In 6 Months

Image Source: Pixabay

Oil prices were steady early on Wednesday, rising for a third session even as the API reported an unexpected rise in US crude inventories.

Oil prices have been supported by U.S. threats to impose secondary sanctions of buyers of Russian oil after U.S. President Donald Trump this week cut his deadline for Russia to reach a ceasefire in its war on Ukraine from 50 days to 10 to 12 days.

"Displaying frustration with the lack of tangible progress in peace talks between Russia and Ukraine, the US President has shortened his ultimatum for the aggressor from 50 days to 10-12. The prevailing assumption is that, after this period, new sanctions, including measures targeting Russia's energy sector, will be introduced ... The geopolitical risk surrounding key oil-producing regions has therefore risen," PVM Oil Associates noted.

Still, the geopolitical risk is countered by rising supply. With Western hemisphere production also increasing, OPEC+ is returning 2.2-million barrels per day of production cuts to market in monthly tranches that began in May, with the full return expected to be complete in September.

The question for traders this morning is simple - will the official data confirm API?

API

-

Crude +1.54mm (-2.5mm exp)

-

Cushing

-

Gasoline -1.74mm

-

Distillates +4.18mm

DOE

-

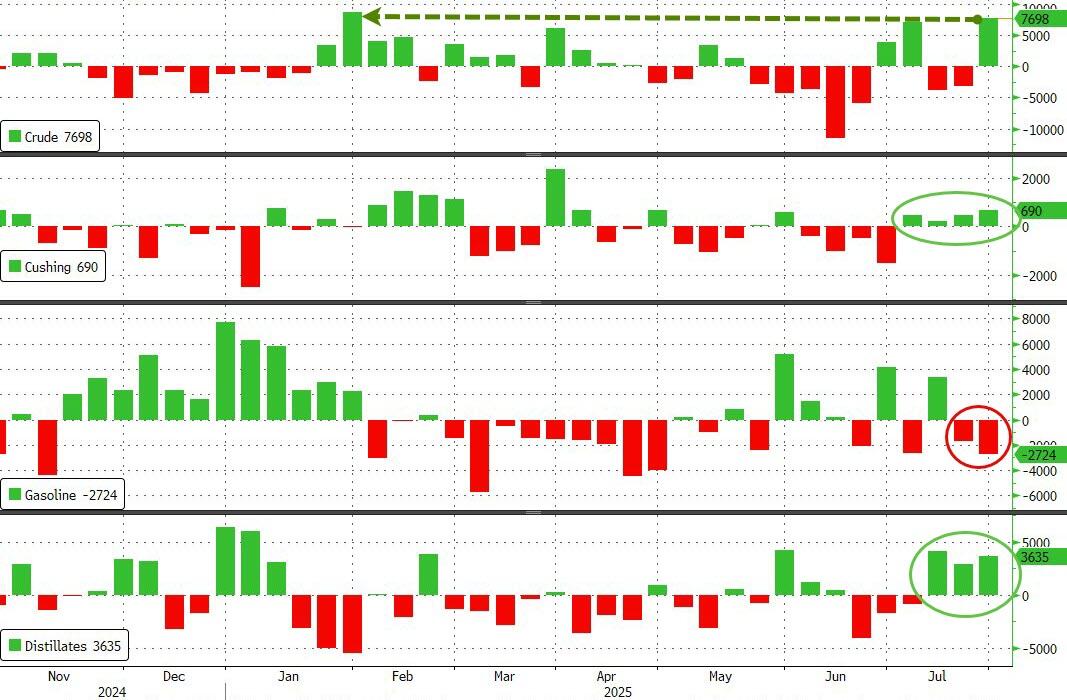

Crude +7.698mm - biggest build since January

-

Cushing +690k - biggest build since March

-

Gasoline -2.724mm

-

Distillates +3.635mm

Against expectations of a small drawdown, the official data showed a large build in crude stocks last week (the biggest since January and far bigger than the API-reported level). Cushing stocks rose for the fourth week in a row while gasoline inventories fell for the third week in a row...

Source: Bloomberg

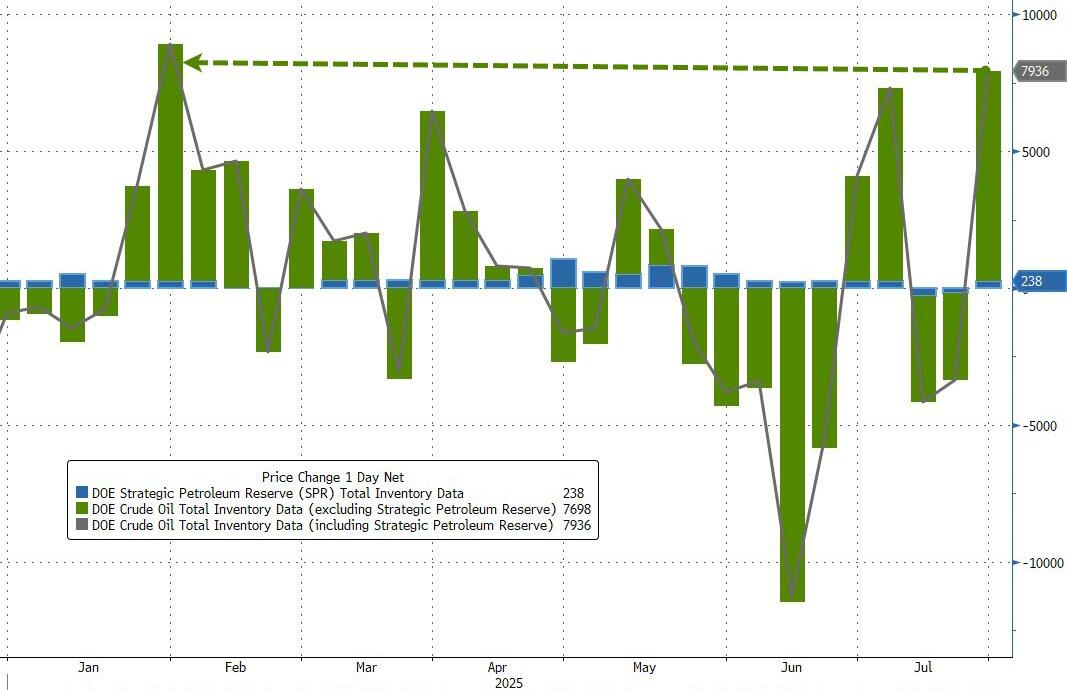

The Trump admin added 238k barrels to the SPR last week (after two weeks of drawdowns), adding to the largest rise in commercial crude stocks since January

Source: Bloomberg

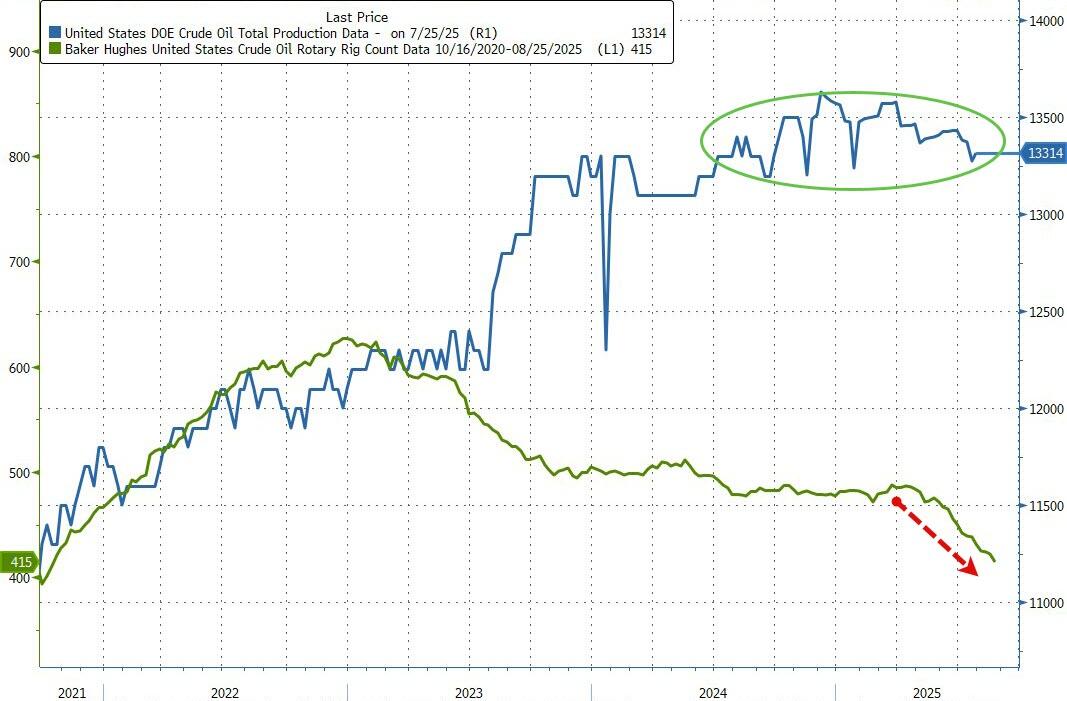

Despite the ongoing plunge in the rig count, US crude production remains near record highs...

Source: Bloomberg

WTI Crude was largely unmoved by the DOE data, coming slightly off the highs of the day...

“President Trump’s patience with Russia seems to be wearing thin, and oil markets have reacted somewhat to the prospect of a potential supply disruption,” Barclays analyst Amarpreet Singh said.

“We recognize the upside risks from a potential binary outcome, but caution against assigning too high of a probability to it.”

Oil is on track for a third monthly gain, and markets also remain focused on the US deadline to nail down trade deals by Aug. 1, and the OPEC+ meeting over the weekend that will decide supply for September.

Traders expect the group to agree on another bumper increase to crude production.

More By This Author:

"Employers More Optimistic Than Consumers" As ADP Reports Big Rebound In Jobs In JulyCorporations To Acquire 10% Of Ether Supply As Regulatory Arbitrage Accelerates

Job Openings Slide, As Number Of Hires Unexpectedly Plunges

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more