WTI Crude Oil’s Seasonal Strength Meets OPEC+ Challenges

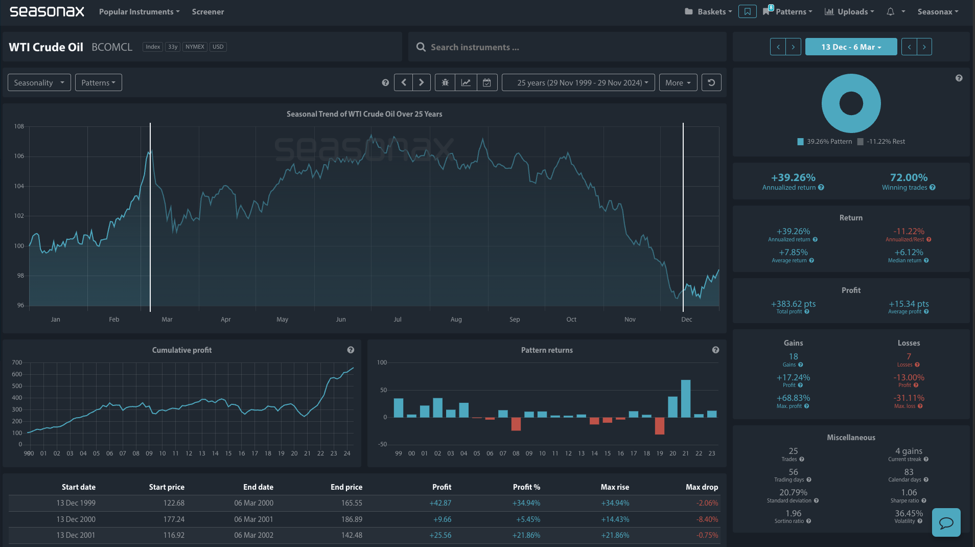

WTI Crude Oil demonstrates a compelling seasonal pattern between December and early March, historically yielding an annualized return of +39.26% over the last 25 years. The average gain of +7.85% during this period, coupled with a 72% win rate, highlights the winter season as a favorable window for oil price appreciation. Seasonal demand dynamics, particularly during colder months, and OPEC+ production strategies play a key role in driving these returns. However, the structural challenges facing OPEC+ add complexity to this bullish narrative.

(Click on image to enlarge)

A recent, now-deleted commentary from a senior Iranian official, Afshin Javan, revealed internal tensions within the cartel. Javan criticized OPEC+’s strategy of maintaining high prices through production cuts, noting it has inadvertently subsidized the growth of U.S. shale. This approach, while supporting prices in the short term, has limited the cartel’s ability to increase production without destabilizing the market. Smaller OPEC+ members, such as Angola and Gabon, are reportedly reconsidering their participation, exacerbating the group’s internal fractures.

With Brent crude averaging around $80 per barrel year-to-date, U.S. shale producers remain resilient thanks to improved efficiency, producing more oil with fewer rigs.

Technically, there is a very strong support level on the monthly chart marked below between 60 and $65. Expect this to be a major reference level for stops / buyers and sellers as we head into 2025.

(Click on image to enlarge)

Trade risks

This seasonal strength in crude oil offers traders a potential opportunity, but the risks are clear: OPEC+’s diminishing control over the market and the resilience of its competitors could upend historical patterns. Caution is warranted, as seasonal trends do not guarantee future performance, especially amid mounting geopolitical and structural pressures within the energy market.

Video Length: 00:02:28

More By This Author:

Seasonal Strength: Dax’s Strong Year-End RallyWill NFP Increase The Case For A December Fed Rate Cut

Does The Market Say No To The Nasdaq For The Start Of December?

Disclosure: High Risk Investment Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% of retail investor accounts lose money when trading ...

more