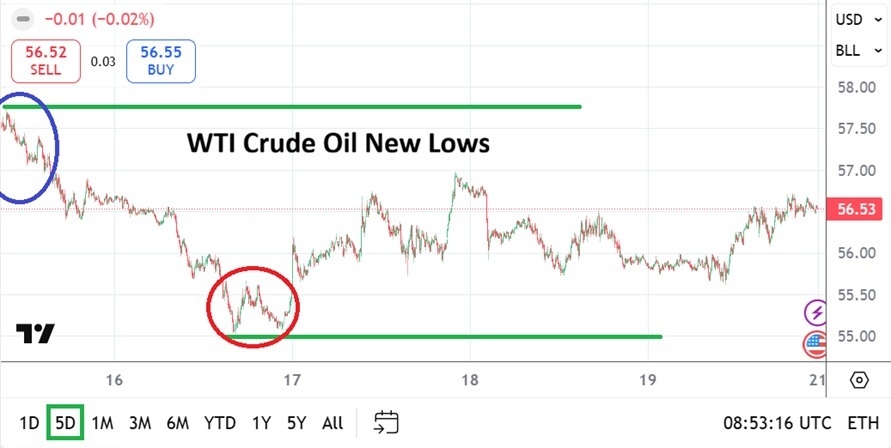

WTI Crude Oil Weekly Forecast: New Lows As Holiday Season Trading Begins

Image Source: Unsplash

Day traders will not only be confronted by the belief that WTI Crude Oil is trading long-term lows and the consideration that the commodity may remain within lower tides, but also the knowledge that full fledged holiday trading will start this week and last until the New Year’s holiday has been completed.

WTI Crude Oil touched the 55.000 vicinity on Tuesday of last week, a mark not seen since early April 2025.

However, the selling pressure this time around has been building with a definite trend in sight. April selling saw a surge lower as fears of tariffs and White House rhetoric caused a momentary scare in the marketplace. Now the stampede lower consistently is occurring as reports of solid supply are manifest. The lower price move early this week has not seen these sustained depths since January of 2021.

Speculative Lows and the Holiday Season

Traders looking for an upside rally in WTI Crude Oil based on the belief it is too low are urged to remain cautious regarding their near-term outlooks. The commodity remains within a historically lower price realm certainly, but one that has been practiced before. The addition of light trading volumes being seen early this week and then the Christmas holiday on Thursday will not make things simple.

(Click on image to enlarge)

As WTI Crude Oil traverses long-term lows the lack of volume from large players over the next two weeks and possibility someone will try to step in and take advantage with a massive speculative order is a possibility. Day traders who dare to trade early this week need to understand spikes may be seen. And while it is tempting to think a spike higher is the natural avenue, as WTI Crude Oil trades near the 56.530 ratio upon opening tomorrow, this might set the stage for another move lower – one that tests the lower depths seen this past Tuesday.

Demand and Supply Remains Consistent in WTI Crude Oil

Perhaps there will be natural support that can become durable near the 56.000 realm if it is tested early this week, but it can falter too.

- And traders may be faced with the potential of extremely quiet markets within the energy sector.

- Then the sudden appearance of a large order trying to take advantage of calm waters, which effectively tries to cause a major move and then cashes out with a profit leaving everyone else bust.

- And speculators with limited funds need to understand it will not be small wagers that move the WTI Crude Oil market, it will take ‘big fish’.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 55.1000 to 57.800

The technical trend lower in WTI Crude Oil has been dominant since June of this year, in fact it can be argued that signs of a weaker cash market have been seen since January of 2025. The reality that President Trump’s pro-drilling stance has helped garner a healthy supply of WTI Crude Oil cannot be mistaken or argued easily. Supply is abundant and buying healthy, but with the knowledge there is no WTI Crude Oil shortage in sight.

WTI Crude Oil failed to sustain a challenge of the 57.000 USD mark nearly all of last week. Once the commodity saw 57.000 prove vulnerable and no upwards momentum truly sustained for more than a handful of hours, price pressure downwards became the calling card in Crude Oil again last week. As the holiday season gets set to start, Monday and Tuesday of this week offer some hopes of regular trading, the remainder of this week will be tough to achieve solid price action. Perhaps a speculator hoping to take advantage of light volumes on Wednesday or Friday of this week can find some luck, but they should be careful in this market which has shown buying remains weak.

More By This Author:

S&P 500 Analysis: Lower Values As Selling Shows Signs Of Slow Burn

GBP/USD Weekly Forecast: Central Bank Bag Of Tricks And Speculative Traders

WTI Crude Oil Weekly Forecast: Support Levels Challenge Trading Perspectives

Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more