WTI Crude Oil Weekly Forecast: Known Range Producing Technical Opportunities

Image Source: Unsplash

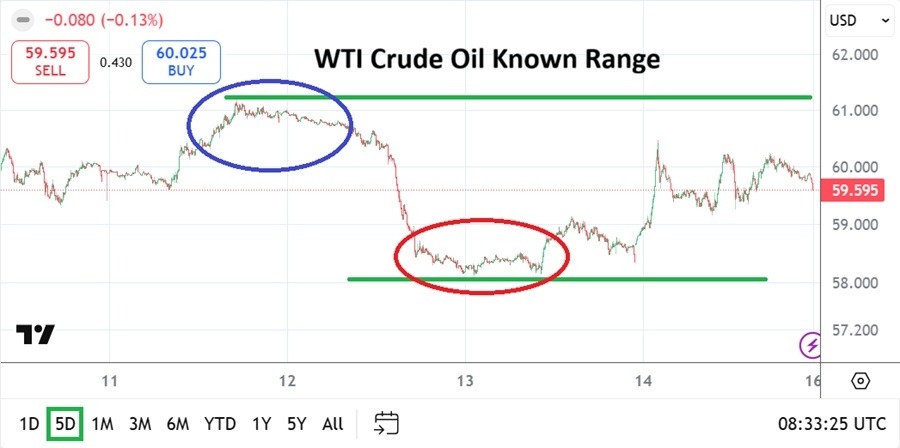

Speculators who are looking to take advantage of WTI Crude Oil via its technical range may feel as if they are being presented with a solid opportunity.

- Past results certainly do not guarantee future outcomes, but technically WTI Crude Oil demonstrated a known range last week that can be claimed to have been polite. The commodity went into this weekend around the 59.595 mark which was in the same vicinity as the previous week’s results.

- After a move higher from Monday’s low around 59.250, WTI Crude Oil hit the 61.200 level on Tuesday which turned out to be the apex for the week.

Then WTI Crude Oil started to sell off incrementally and by Thursday was touching the 58.100 ratios. Friday’s price action produced an upwards draft momentarily which again challenged and penetrated the 60.000 mark, spiking to a high of nearly 60.500, but then the commodity began to face headwinds again.

Technical Price Range Holds in WTI Crude Oil

Speculators looking to gamble on the direction of WTI Crude Oil will be confronted with an early test tomorrow. Last week the commodity used its current vicinity to open with slightly weaker price action and then reversed towards highs. However, the ability of WTI Crude Oil to maintain a balanced price band may offer gambling opportunities for day traders who want to enter the speculative gauntlet.

Perhaps waiting for early price action to be seen will allow day traders to try and read sentiment in WTI Crude Oil. But while the 58.100 support level held last week, there is reason to suspect lower realms could be found. Traders should not get over confident about values below 58.000 USD, yet from the 14th of October until the 21st the price of WTI Crude Oil tested prices below. This brings into consideration the level in which WTI Crude Oil is thought to be oversold by large players. Equally important is to try and decipher where the commodity is perceived to be overbought as its range get tested.

Reading the Trend and Boundaries

Supply remains plentiful for WTI Crude Oil. The energy sector has solid consumption, but is in no danger of being in a position in which demand outpaces production.

- The trend in WTI Crude Oil via a one month chart continues to demonstrate a rather magnetic posture towards the 60.000 level.

- Traders who have the ability to be patient and look for the 60.000 USD value to emerge again may be following a solid tactic, that is if the known range remains static.

- However, the 59.000 level below also has received plenty of price action and last week was no different.

- Technical traders may be comfortable with current levels, but they also need a bit of luck while trying to ride the existing short and near-term fluctuations which are driven by large players.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 57.850 to 61.700

There appears to be tactical speculative reasons via technical results to engage with WTI Crude Oil as it persists within its current lower price range. Resistance upwards remains rather constant. For the higher levels of WTI Crude Oil to be penetrated above and sustained it might take a rather significant amount of impetus.

Perhaps if the U.S were to escalate its current rhetoric and actions against Venezuela this could stir prices in the energy sector. However, betting on this confrontation is speculative at best and perhaps only worthy of options instead of CFDs via WTI Crude Oil. The lower realms being traversed in WTI Crude Oil appear likely to remain consolidated and day traders may feel like the known ratios offer some comfort while wagering. However, risk management should not be forgotten because surprises can always happen in WTI Crude Oil.

More By This Author:

EUR/USD Weekly Forecast: Bounce Higher From Lows And Near-Term SpeculationWTI Crude Oil Weekly Forecast: Lower Realm Back In Power As Headwinds Strike

WTI Crude Oil Weekly Forecast: Elevated Prices Falter As Values Back To Lows

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more