WTI Crude Oil Weekly Forecast: Intriguing Bullish Signals And Highs Attained

Image Source: Pixabay

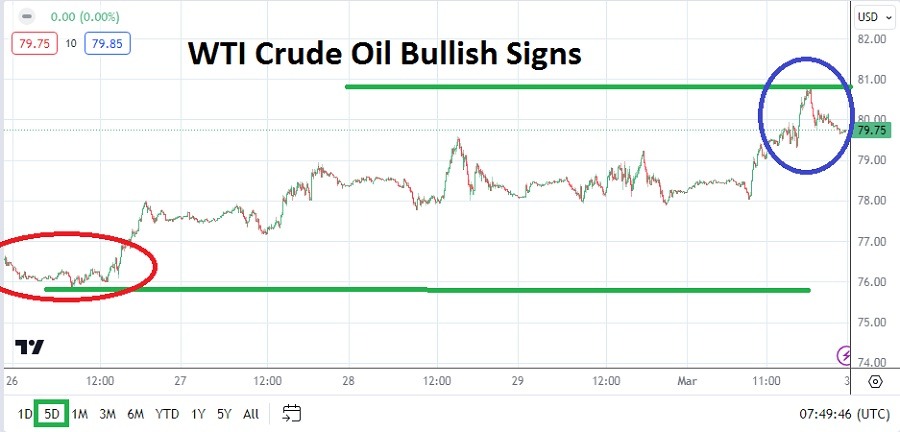

Crude oil went into the weekend with the $80.00 figure clearly in sight, and the commodity displayed the ability to incrementally trade higher most of the week. After starting last week languishing near the important support level of $76.00, crude oil began to rise in value in a steady manner.

The commodity was trading politely near the 77.90 level on Wednesday when US crude oil Inventories data was released and showed an increase over 4 million barrels in supply in comparison to the previous week, and then something interesting happened. The price of crude oil actually jumped.

(Click on image to enlarge)

Suddenly, crude oil was touching the $79.50 ratio, and the commodity’s volatility was seemingly not done yet. After reversing lower and challenging the $78.00 value on Thursday, crude oil began to rise again in price. And then on Friday it happened, the $80.00 level not only looked vulnerable, but it was surpassed, and the commodity touched a high around the $80.85 mark before it started to ebb lower.

Volatility and Supply Might Not be Correlated in WTI Crude Oil

Speculators who have held onto bullish notions in crude oil were likely rewarded last week. The commodity has been showing signs of incremental bullishness over the mid-term. In the middle of December, crude oil was briefly seen trading near the $68.00 ratio. Technical traders may be quick to point out that on Jan. 26, the commodity was seen trading near the $79.25 mark. The volatility of crude oil has been known for a long time – even decades.

Since a reversal lower from the late January high, followed by a low on Feb. 5 near the $71.50 mark, crude oil has shown rather sustained demand by buyers, who took the commodity above the $80.00 ratio last Friday for the first time since the first week of November.

The question for traders this coming week is if the highs displayed before the weekend ensued were a flash of speculative demand, or a signal that a change in the perspective of oil prices is really developing.

The $80.00 WTI Crude Oil Price and Behavioral Sentiment

While many will certainly point to the Middle East crisis in the shipping lanes of the Red Sea as a cause for the sudden rise in prices last week, this may be an inflated notion – or simply put, wrong. The conflict in the Red and Arabian Seas has been newsworthy for a handful of months, and last week’s ‘developing’ news was not extreme.

Some speculators may believe the rise in price may be due more to strong ‘buyers’ catching those who were holding selling positions in a weaker position and squeezing them. Early trading this week will be crucial in regards to the price of crude oil.

- If the $80.00 level is tested and proven vulnerable early this week, this would possibly be a bullish signal and may ignite additional buying speculation in the commodity.

- Sustained trading above the $80.00 mark would be noteworthy, but if crude oil is not able to top the ratio early on Monday or on Tuesday, this would be a sign that speculative buying may run out of power.

Weekly Outlook: Speculative Price Range for WTI Crude Oil is 76.200 to 82.100

Crude oil appears to be in an interesting trading mode. The ability since the first week of February to show a rather steady climb and to see higher support levels emerging is noteworthy. Because the $80.00 mark is within clear sight, traders will have an easy barometer to test speculative zeal early this week.

If the commodity does trade above $80.00 and is able to challenge the $81.00 level, this might set off alarm bells and start to get the attention of more speculative elements. Crude oil appears to be well-supplied for the moment, and a move higher in the commodity would be newsworthy and signal that speculative bulls may be in control of the market for the time being. Day traders should be particularly cautious this week while oil tests its higher price range, as additional volatility is almost a certainty.

More By This Author:

Weekly Forex Forecast – Nasdaq 100, S&P 500, Bitcoin, USD/JPY, Cocoa

GBP/USD Weekly Forecast: Classic Technical Support & Resistance Price Range

EUR/USD Signal: Engulfing Points To More Upside Ahead Of PCE

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more