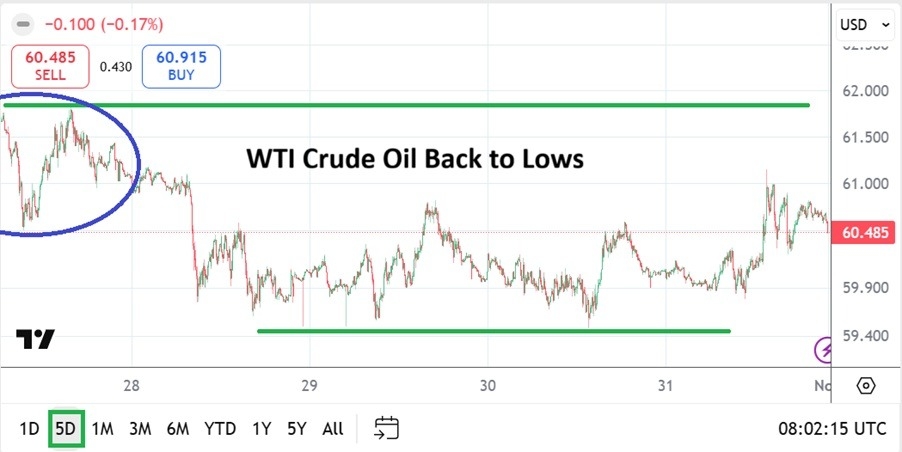

WTI Crude Oil Weekly Forecast: Elevated Prices Falter As Values Back To Lows

Image Source: Unsplash

WTI Crude Oil via futures trading went into the weekend below the 60.500 USD mark as the commodity faltered and proved speculative buying zeal could not power beyond resistance levels which have proven rather durable.

After having started last week’s trading around 62.050 WTI Crude Oil, the commodity spent most of last Tuesday below 60.000 USD.

WTI Crude Oil certainly enjoyed a moment of buying power two weeks ago, but supply continues to prove a rather strong ingredient within speculative circles and the price of the WTI does remain within rather consolidated lower realms. Day traders who believe WTI Crude Oil is priced too low can certainly look for upside, but they might want to wait until support levels technically look like they can create some bounce upwards.

Lack of Sustained Buying Power

Yes, after staying below the 60.000 USD price much of this past week and traversing rather consistently around support near 59.500, WTI Crude Oil did exhibit a bit of a move higher on Friday. However, the movement that challenged the 61.000 level was not able to be sustained and WTI Crude Oil went into this weekend a hair below 60.500. This sets the table up nicely for speculative contemplation on Monday morning.

(Click on image to enlarge)

While higher ground can definitely be found this coming week, perhaps the better perspective and wagering idea may be generated by looking at resistance levels and selling WTI Crude Oil. The energy sector continues to show that supply is vast, and while buying demand could take WTI up and above the 61.000 mark and showcase another surge towards 62.000 and maybe even 63.000, this seems unlikely. Early trading on Monday may provide some hints. If the 61.000 ratio is not toyed with on Monday and WTI Crude Oil move lower this could be a signal additional depths will be explored.

Bearish Trend and Lower Prices

The oil sector that produces WTI Crude Oil and other associated energy would like to see higher prices to help their profit ratios, but supply and even claims of new oil field discoveries continue to be rather promising. The bearish trend has been strong over the long-term, particularly since President Trump has taken office. Look up Comstock Resources ladies and gentlemen.

- Speculative forces via larger players likely understand that under the current White House administration that a rather free hand is being given to oil exploration and drilling.

- Supply is not about to suddenly dwindle.

- This knowledge is likely to keep WTI Crude Oil within the lower boundaries of its known price range.

- Day traders should consider the notion that higher prices may be considered anything above 62.000 USD for the moment.

WTI Crude Oil Weekly Outlook:

Speculative price range for WTI Crude Oil is 58.850 to 62.400

WTI Crude Oil can move higher. The price of the commodity remains speculative. Risk management is essential if a speculator wants to look for lower price values, because large players via suppliers will try to protect lower values from falling below certain levels. However, for the moment it appears bearish attitudes via price remain in control of the WTI Crude Oil market.

The attempted pushes higher that have been seen have consistently run into headwinds and the current realms between 59.000 and 62.000 looks like it may continue to be a feeding ground for wagers by day traders who are trying to ride on the coattails of larger forces. Dynamic international news could spur on a rapid change in momentum for WTI Crude Oil, but smaller speculators need to remember that big players in the energy sector are sophisticated and have plenty of insights regarding possible problems that can develop in supply. For the moment supply looks to be firm and because of this, moves higher in WTI Crude Oil continue to look like speculative selling opportunities.

More By This Author:

GBP/USD Weekly Forecast: Fears Confirms And Support Levels Prove Vulnerable

EUR/USD Monthly Forecast: November 2025

NZD/USD Analysis: Reversal From Depths And Speculative Ambitions

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more