WTI Crude Oil Is Stuck In A Choppy Trading Environment

Oil prices ended the week caught between the headwinds of a tighter global supply and a lackluster economic outlook eroding consumers' purchasing power.

Macroeconomics

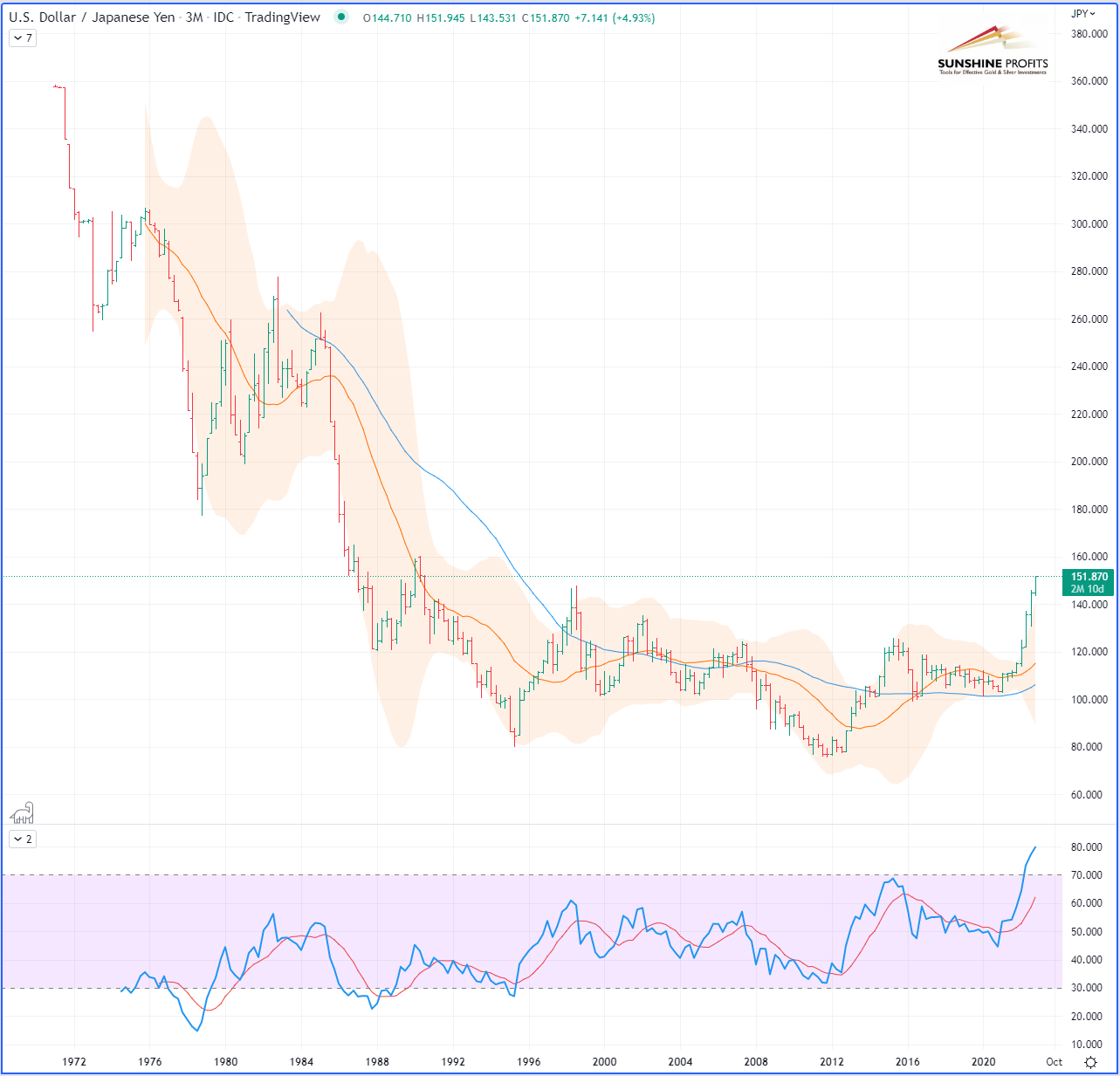

On Thursday, the greenback took off over the value of 150 Japanese yen – a symbolic price mark – for the first time since the 1990s.

(Click on image to enlarge)

A strong dollar reduces foreign investors' purchasing power in other currencies and thus demand. Therefore, the Fed reinforced expectations that the central bank could raise rates aggressively early next month, which should contribute to a significant slowdown in activity and demand. As for inflation, it barely fell in the United States in September over one year, to 8.2% against 8.3% in August.

(Click on image to enlarge)

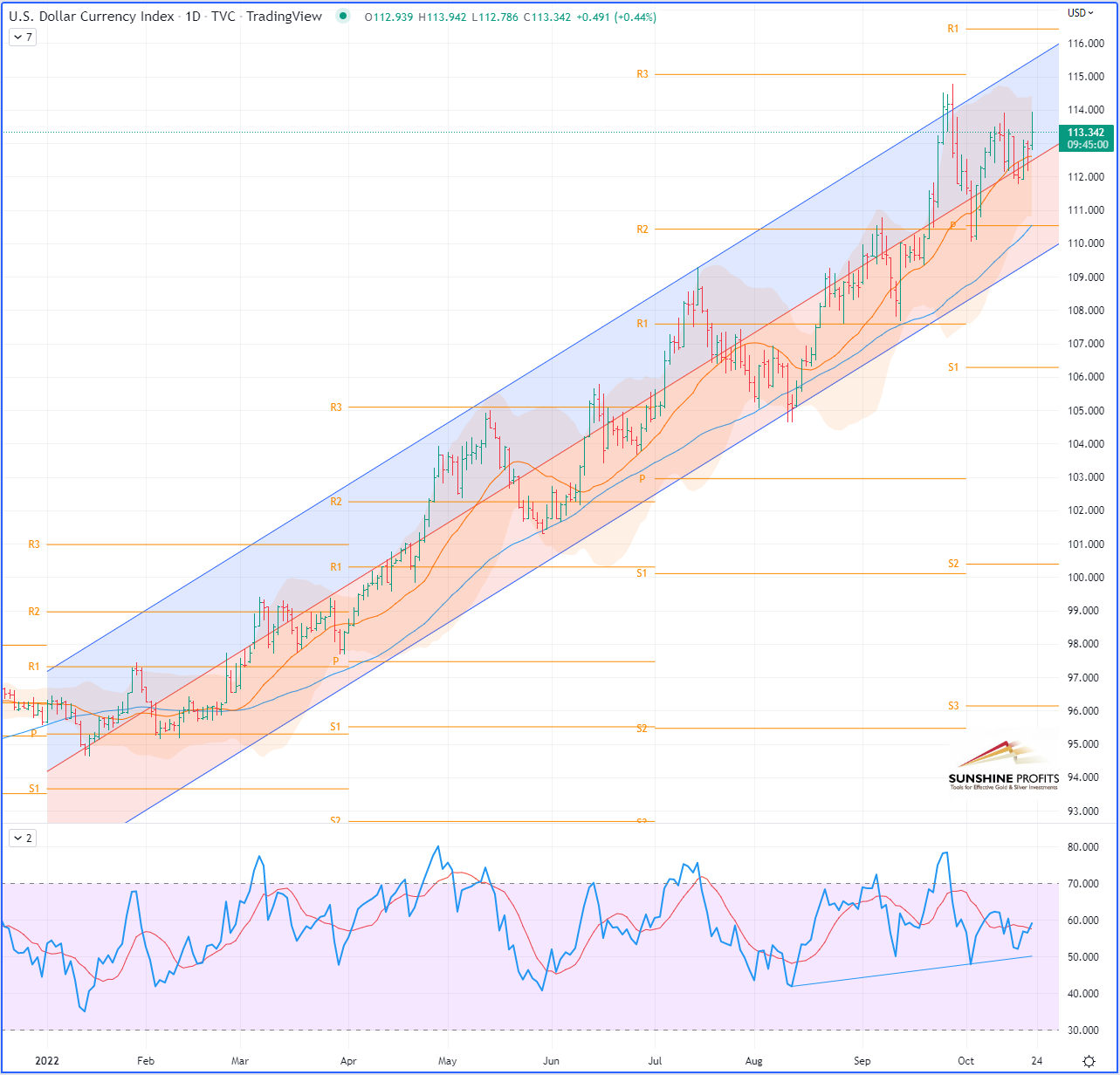

U.S. Dollar Currency Index (DXY), daily chart

Fundamental Analysis

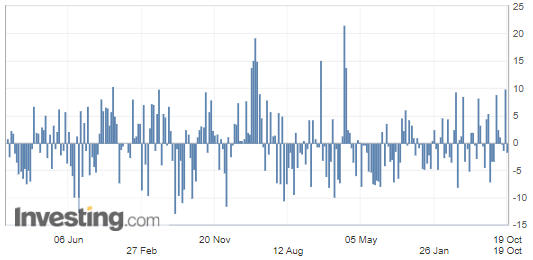

Crude prices have oscillated between losses and gains this week as concerns over the global economic slowdown clash with caution over tighter supply. The market seems to be receiving mixed signals now, with falling US oil inventories indicating increased demand in the country, while weak economic signals are having an adverse impact (on prices).

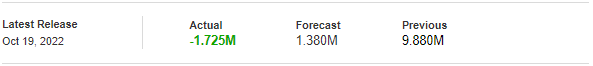

U.S. Crude Oil Inventories

On Wednesday, the Energy Information Administration's (EIA) released the weekly change in crude oil stocks, showing a drop of 1.725M barrels, while the forecasted figure predicted 1.380M barrels in excess.

(Source: Investing.com)

Geopolitics

Belarus could take further steps towards direct involvement in the war in Ukraine, As food corridor talks continue between representatives from the United Nations and Russia in order to maintain an agreement on the departure of ships from Ukrainian ports. A "hidden mobilization" would be underway after the announcement of the creation of a joint military group between Russia and Belarus, according to the independent Belarusian newspaper "Nacha Niva". So far, the Belarusian army has not participated in the fighting on Ukrainian territory. Since the beginning of the conflict in Ukraine, Belarus has served as a logistics platform for its Russian ally.

Technical Charts

(Click on image to enlarge)

WTI Crude Oil (CLZ22) Futures (December contract, daily chart)

(Click on image to enlarge)

RBOB Gasoline (RBZ22) Futures (December contract, daily chart)

(Click on image to enlarge)

Brent Crude Oil (BRNZ22) Futures (December contract, daily chart) – Contract for Difference (CFD) UKOIL

That’s all, folks, for today. Have a nice weekend!

More By This Author:

Oil Hesitates, Facing Speculation And Winds From All SidesWill Europe Be The Biggest Loser In The Russian-Ukrainian War?

Bearish Signals Remain For Brent And WTI Crude Oil

Disclaimer: All essays, research and information found in this article represent the analyses and opinions of Sunshine Profits' associates only. As such, it may prove wrong and be ...

more