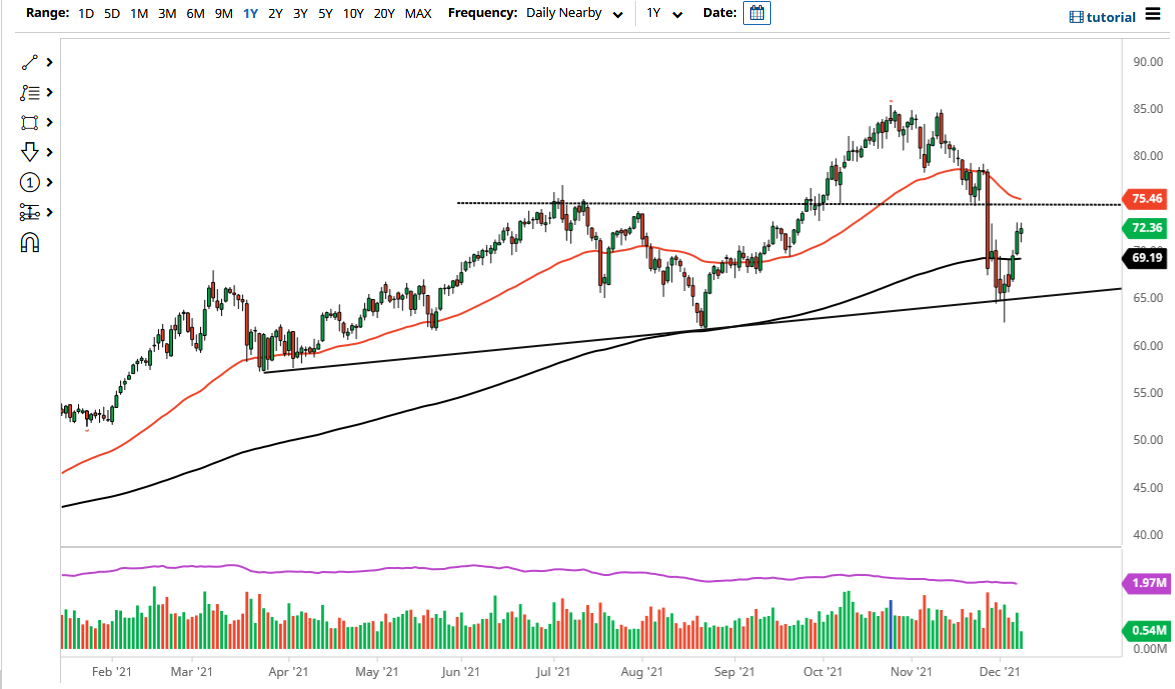

WTI Crude Oil Forecast: Trying To Break Out

The West Texas Intermediate Crude Oil market rallied again on Wednesday to test the $73 level. We have not been able to break out above it during the session, but it is clear that there is a lot of pressure building up for a potential move. If we can break above the $73 level, then it is very likely that we will go looking towards the $75 level bone, maybe even the 50 day EMA which currently sits at the $75.47 handle.

Photo by Timothy Newman on Unsplash

Keep in mind that a lot of the selling in the crude oil market has been due to fears of the omicron variant shutting down the world’s economy, and thereby driving down the demand for crude oil. Since then, we have seen headlines suggesting that perhaps this variant is actually a weakening of the virus, and if that is going to be the case it is actually a good sign. The market will continue to see a lot of volatility, but breaking out from here would not be a huge surprise simply because the selloff was so overdone. A lot of that may have been forced liquidation by hedge funds that had gotten far too long of the market.

It is worth noting that we bounced from a major trendline and the psychologically important $65 level. Because of this, the market is going to continue to see a lot of noisy behavior, but I think it is probably only a matter of time before we see some type of an attempt at a breakout due to the fact that it was so overdone during the previous week. In fact, as long as the world economy continues to reopen, it is very likely that we will continue to see demand for crude oil pick up. That being said, if we were to turn back around and break below the $65 level, that could be the beginning of the end for the bullish market. It seems to be very unlikely at this point, as we have seen so much buying of the dips, not only here but in other risk assets as well. Ultimately, I fully embrace the idea of going long oil on dips and building up a larger position until we can finally break out and continue the longer-term run.

(Click on image to enlarge)

Disclosure: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more