World Food Prices Drop In June For First Time In Year, Remain Near Decade High

World food prices fell in June for the first in 12 months, offering some relief for consumers and easing inflationary pressures.

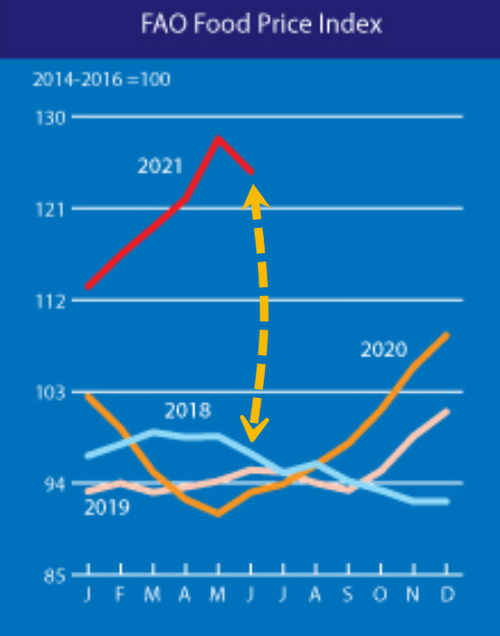

According to a new Food and Agriculture Organization of the United Nations (FAO) report, the FAO Food Price Index, which measures monthly changes for a basket of cereals, oilseeds, dairy products, meat, and sugar, dropped 2.5% in June, coming off a decade high, but still 33.9% higher than its level in the same month last year. The decline in the index was the first in 12 months.

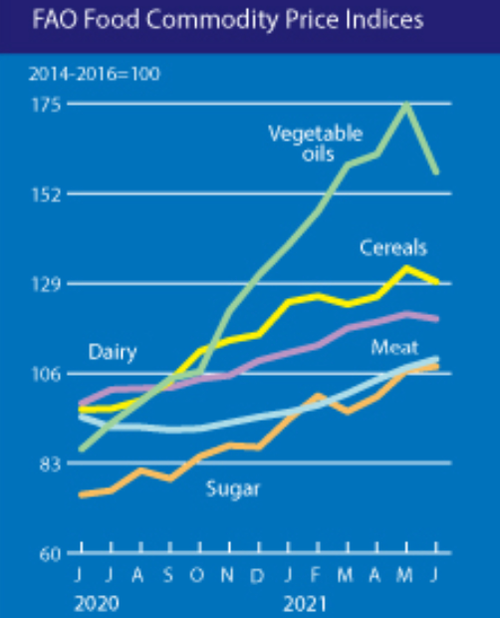

Examining the index, vegetable oils and cereal prices fell during the month, offsetting increases in meat and sugar.

The FAO Vegetable Oil Price Index fell by 9.8 percent in the month, marking a four-month low. The sizeable month-on-month drop mainly reflects lower international prices of palm, soy and sunflower oils.

The FAO Cereal Price Index fell by a more moderate 2.6 percent from May, but remained 33.8 percent higher than its value in June 2020. International maize prices dropped by 5.0 percent, led by falling prices in Argentina due to increased supplies from recent harvests as a result of higher-than-earlier expected yields. International wheat prices declined slightly by 0.8 percent in June, with a favourable global outlook supported by improved production prospects in many key producers outweighing most of the upward pressure from dry conditions affecting crops in North America.

The FAO Dairy Price Index fell by 1 percent to 119.9 points in June. International quotations for all dairy products represented in the index fell, with butter registering the highest drop, underpinned by a fast decline in global import demand and a slight increase in inventories, especially in Europe.

The FAO Sugar Price Index moved against the overall food price trend, rising by 0.9 percent month-on-month, marking the third consecutive monthly increase and reaching a new multi-year high. Uncertainties over the impact of unfavourable weather conditions on crop yields in Brazil, the world's largest sugar exporter, exerted upward pressure on prices.

The FAO Meat Price Index also rose by 2.1 percent over the month to June, continuing the increases for the ninth consecutive month and placing the index 15.6 percent above its value in the corresponding month last year, but still 8.0 percent below its peak reached in August 2014.

In previous reports, Rome-based FAO sounded the alarm on surging food prices as it may induce a "potential crisis" in lower-income countries: "Rising food imports as a share of all imports can be an early warning indicator for potential crises in some areas."

June's FAO Food Price Index is still near a decade high, and rapid food inflation hasn't meaningfully subsided to offer total relief to consumers worldwide.

Surging costs of grains to vegetable oils to meats to dairy have primarily been due to surging Chinese imports, weather volatility risks, and central banks and governments unleashing an unprecedented amount of stimulus into the global economy.

As a reminder to readers, the rapid rise in food costs was first described by SocGen's market skeptic Albert Edwards in December, where he shared his thoughts about why he started to panic about soaring food prices. And since that was before food prices began to rocket amid broken supply chains, trillions in fiscal stimulus, and exploding commodity costs, we can only imagine the situation is much worse today for emerging market economies.

More recently, Deutsche Bank's Jim Reid reminds us that emerging markets are more vulnerable to this trend since their consumers spend a far greater share of their income on food than those in the developed world.

Even though the FAO Food Price Index was slightly lower last month, it's still near-decade highs, and the Fed officials' "transitory" narrative is just a bunch of malarkey.

Disclaimer: Copyright ©2009-2021 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more