Will This Be The Gold Standard Of The Modern Age?

More often than not, the international trade and currency system works to the benefit of the US and its friends, whilst others have to take what they can. ‘No more!’ seems to be the message from countries outside of the Western world. But it is more than an expression of frustration. Deals are being done, agreements are being signed and money (that isn’t dollars) is being exchanged. It’s hardly a coincidence that those at the table are also storing up and buying gold bullion.

In a speech on a state visit to China this month, Brazil’s president Luiz Inacio Lula da Silva stated: Every night I ask myself why all countries have to base their trade on the dollar … Why can’t we do trade based in our own currencies? … Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”

Lula’s visit to China was for the inauguration of former Brazilian president Dilma Rousseff as head of the New Development Bank formally referred to as the BRICS bank.

The New Development Bank

The New Development Bank was first proposed in 2012 and the agreement on the new bank entered into force in July 2015 with all five of the BRICS countries’ support. Also, other nations can join the New Development Bank as long as BRICS nations’ voting share does not drop below 55%.

The bank is headquartered in Shanghai and according to its website has the mandate to “prioritise infrastructure and sustainable development projects that propel economic growth and improve the lives of people in our member countries.”

The New Development Bank agreement between BRICS countries wasn’t as well known, but with BRICS countries making headlines more often about de-dollarization and trade in their own currencies it is likely that the non-US-dominated institutions will also be highlighted more frequently in the media.

The drive towards de-dollarization has been on the minds of governments in China, Russia, and Saudi Arabia among others for many years now, but has gained major momentum in nations after sanctions on Russia limited its access to U.S. (and Euro) denominated reserves.

Indeed, it seems that de-dollarization is the buzzword for April 2023 in main street media. Recent headlines “De-Dollarization Is Happening at a ‘Stunning’ Pace” and “Dedollarization Gains Pace as BRICS overtake G7, React to War” (Bloomberg), “The dollar’s dominance would face a threat unlike any other from a BRICS currency, former White House economist says” (Markets Insider), “Explained: Why India & Other BRICS Nations Want to Create A New Currency For Trade Payments” (India Times).

For how long will the US dollar dominate?

Trade in U.S. dollars still dominates global trade by a large margin, but more agreements between countries are being settled each month.

According to the Financial Times: Since Russia’s invasion of Ukraine “financing data from Swift, the international payments and financing platform, shows that the renminbi’s share by value of the market had risen from less than 2 percent in February 2022 to 4.5 percent a year later.

Moreover, those gains put China’s currency in close contention with the euro, which accounts for 6 percent of the total. Both are, however, still a tiny fraction of the dollar’s share. This stood at 84.3 percent in February 2023, down from 86.6 percent a year earlier.”

If China’s growth of international settlement continues to grow even at 2 percent it will surpass the euro this year and the renminbi will account for more than 10 percent in 3 years.

And Russia does have access to the Cross-Border Interbank Payment System (CIPS), China’s alternative to SWIFT, whose settlements grew at 21 percent in 2022 compared with a year earlier. Bilateral trade on the CIPS between Russia and China that was settled in renminbi rose to a record US$185bn.

The Federal Reserve’s rapid rise in interest rates last year has also increased the appeal of financing renminbi, while the Federal Reserve raised rates 9 times over the last year the People’s Bank of China has cut its prime rate twice, which on a relative basis, makes the renminbi financing cheaper.

Russian lawmaker Alexander Babakov is reported to have said that the BRICS nations are in the process of creating a new medium for payments – established on a strategy that ‘does not defend the dollar or euro. Moreover, the reports claim that the new currency would be secured by gold and other commodities.

A coincidence?

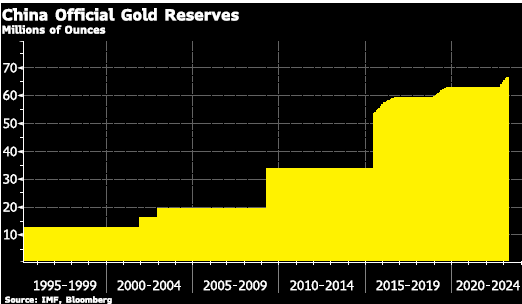

It is interesting that China starts to report its official gold reserves just before big international agreements are announced, such as the inclusion of the renminbi the IMF’s SDR basket of currencies.

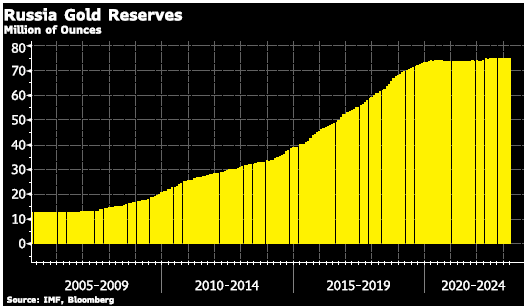

And it is no coincidence in our mind that China started reporting its official gold reserves in November 2022 and Russia reported its official gold reserves this month, along with the missing data from last year.

China Official Gold Reserves Chart

Russia Gold Reserves Chart

More By This Author:

Has The IMF Told The World To Buy Gold?

Gold Heads Over $2,000 As We Head Into Lost Decade

3 Reasons Why Patrick Karim Is Bullish On Gold

Disclosure: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation ...

more