Why We're Buying Oil… Again

Joel Bowman, exercising his privilege from Buenos Aires, Argentina...

First up today, a message from our founder, Bill Bonner, who is taking a short break from his daily writing duties to plan out the next phase of our humble BPR project. (Just click “play” to listen, below...)

As you can hear, Bill’s in good health and high spirits (thanks for asking!) and will return to these pages shortly.

Regarding that “precocious teenager,” your wary correspondent would have plenty more to say... were it not for a series of inconvenient, immutable characteristics that, according to Greta, make it “weird” for us to so much as express our opinion.

Speaking freely herself, of course, Miss. Thunberg told multi-talentless TV host Russell Howard earlier this week that it was “weird” when “heterosexual, cis, white, privileged, middle-aged men” were threatened by children “just stating the facts” about climate change.

Now, if it seems strange (or even “weird”) to you that peoples’ opinions ought to be qualified by their race, sex, age or sexual orientation... what in the “olden days” people used to call “racist,” “sexist,” “bigoted” and “ageist”... well, you might just be part of the problem!

You see, our job is not so much to have opinions (much less express them!), but rather to listen, meekly and mutely, to those who would tell us what to think instead. This is especially important if the lecturer registers a favorable score on the intersectional victim matrix.

Miss Thunberg, for example, is a teenage (tick!) female (tick!) with mental health problems (double tick!!)... so her opinion ranks ipso facto higher than anything we could possibly muster. Whether what she has to say about the climate is true or not is hardly the point. It’s the intersectionality of victimhood that counts.

But don’t take your “heterosexual, cis, white, privileged, middle-aged” editor’s opinion for it (trash that it is). This is the Gospel according to St. Greta.

Alas, by this same measure, Miss Thunberg suffers from her own shortcomings, too (ineradicable whiteness and, being from capitalist Sweden, a certain amount of – gulp! – first world privilege.)

Accordingly, the #brave activist was quick to shift the focus away from her own original sins and toward those more deserving of praise and attention. From the same interview:

“I feel that [some activism stories dominating the climate crisis conversations] are kind of misleading because the ones who are really leading this fight are the ones living on the frontline.

"It is mainly indigenous people, indigenous communities, people living in the most affected areas who are in many cases risking their lives and their freedom in order to protest against this.”

At this stage, you might be tempted to think (careful!) that the best thing for people living on the “frontline” of the “climate crisis” would be to raise them up from poverty the best way we know how, to unleash the wealth creating system of free market enterprise that has so far delivered billions of human beings – regardless of race, sex, orientation, etc. – from lives of scarcity and destitution to the kind of existence that Swedish teenagers routinely take for granted. Wrong!

How DARE You!!!

“It's time to decolonize the climate movement and pass over the mic to those who have stories to tell,” snapped Greta... into her own mic.

Speaking at a tribal gathering of impoverished indigenous people in rural China her book launch in London’s Royal Festival Hall a few days earlier, Miss Thunberg told an adoring crowd (some of whom, unfortunately, were white, male, etc.) that it was time to transform the West's “oppressive and racist capitalist system.”

“It is a system defined by colonialism, imperialism, oppression and genocide by the so-called global North to accumulate wealth that still shapes our current world order.”

Renowned (actual) environmentalist, Michael Shellenberger, provided the following, helpful chart (“just stating facts”) in response to Miss Thunberg’s claims:

Indeed, as Mr. Shellenberger continued, “the ‘whole capitalist system’ has resulted in declining emissions thanks to the transition from coal to natural gas, and to less deforestation for agriculture.”

Alas, tens of millions of Europeans will find themselves on the “frontline” of severe energy shortages this very winter, as the continent fells ancient forests for firewood and burns record amounts of coal thanks to Greta & Co.’s war on natural gas. But then, Europe is ground zero for privileged, white capitalists, and we already know what Greta thinks of them.

Whatever your opinion of the contentious politics behind global energy policy, there are some hard facts that simply cannot be ignored. Facts like supply... and demand. As today’s guest essayist argues, the fundamentals driving today’s oil price suggest we’re heading higher from here, like it or not.

Long time readers might recognize Eric Fry as Bill’s “Man on Wall Street,” who co-authored The Daily Reckoning with him for many years “back in the day.” Eric is as passionate about investing as he is dispassionate about political squabbling, which makes his clear-headed insights all the more worthy of your consideration. Please enjoy his column, below...

Why We're Buying Oil… Again

Lots of folks believe the oil price bounce to $130 a barrel was just a “Ukraine thing” – a fluke. Accordingly, most investors seem to think the oil price will trend back down toward $60 a barrel, “where it belongs.”

I do not share that outlook.

Although the $60 oil scenario is certainly a comforting one, it is probably off target. The crude market has probably entered a “new normal” in which triple-digit prices become more common than double-digit ones.

Although the oil price did pop above $100 a few times in the past, it never sustained that level for long. New crude supplies would appear and snuff out those rallies.

But today, global crude supplies are not as elastic as they once were. Rising demand will not conjure up new supplies as automatically and easily as they did in the past.

Most OPEC members and other major oil producers are struggling to maintain production, much less increase it.

Although current OPEC production has recovered to 30 million barrels per day (MBPD), that number is significantly below the peak of 34.1 MBPD that OPEC pumped back in 2016.

While the recent U.S. crude production has been more robust than OPEC’s, it is also well below peak levels.

Tellingly, despite rising production from both America and OPEC, U.S. crude inventories are still trending sharply lower. As the chart below shows, U.S. crude oil inventories, expressed as percent of their seven-year seasonal averages, have fallen to a multiyear low.

(Click on image to enlarge)

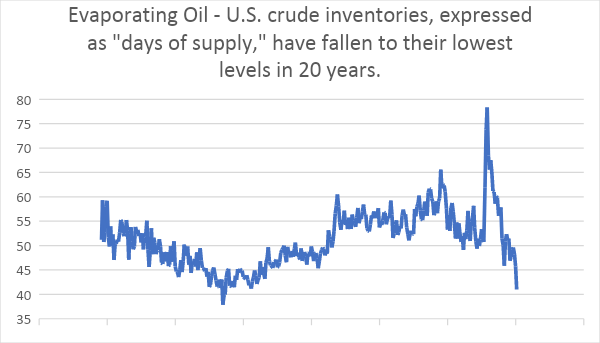

The chart below tells a similar tale. U.S. crude inventories, expressed as “days of supply,” have fallen to their lowest levels in 20 years.

(Click on image to enlarge)

These trends are unequivocally bullish for oil prices. Yet, very few investors seem to believe them. Investor skepticism toward oil and oil stocks has reached extreme levels.

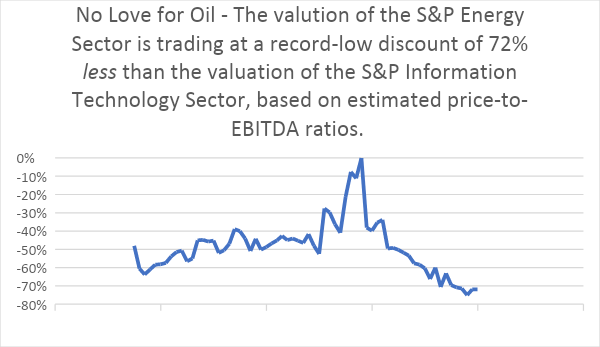

(Click on image to enlarge)

For example, two months ago the S&P 500 Energy Sector hit at a record-low discount of 72% below the valuation of the S&P 500 Information Technology Sector, based on estimated price-to-EBITDA ratios.

The valuation gap has narrowed somewhat since then, but oil stocks are still trading 62% cheaper than tech stock.

The futures markets are also showing signs of widespread skepticism.

According to Commitments of Traders (COT) reports, professional money managers have reduced their bullish bets on crude to the lowest levels in nearly a decade. In other words, these folks are turning their backs on the oil market.

Ironically, that’s a positive sign for oil prices. Whenever this particular group of investors is leaning hard to one side of a particular trade, it usually pays to take the other side of that trade.

As a group, these investors are not exactly the “dumb money,” but they are certainly not the “smart money.” I call them the “flock money” because they tend to act like sheep, especially at the extremes of a particular market.

They flock toward the identical trade at the identical time. When that happens, the trade becomes “crowded,” and there are very few investors left to buy into the trade and push its price higher. That’s when a reversal usually takes place.

So it may be noteworthy that this “flock money” is fleeing the oil market. Coincidentally, on June 16, money managers placed their largest bullish bet on crude in three years – the precise moment when the crude price topped out and began its recent correction.

These folks were wrong at the recent peak of the crude market, so might they also be wrong now?

Meanwhile, global crude consumption remains firm, despite all the scary headlines about recessions and “falling” Chinese demand. Thus far, these scary headlines are only that, with very little substantive data to back them up.

For example, while it is true that China’s crude imports dropped in August, it is also true that China’s crude oil consumption has been hitting all-time highs that are 8% to 9% above pre-pandemic levels.

Furthermore, the U.S. Energy Information Administration (EIA) expects global demand to rise 2 million barrels a day over the coming months. And let’s not forget that the 1 million BPD of “emergency” supplies coming from the U.S. Strategic Petroleum Reserve will stop completely next month.

This three-million-barrel swing alone would be enough to light a fire under crude prices.

Nevertheless, crude prices have returned to the $85-a-barrel level, thereby erasing the entire “Ukraine bounce.” It is as if nothing of importance has happened in the crude market.

But that’s not true. Global demand is running about 2 million BPD higher than it was before the conflict started, while global supplies have become somewhat less reliable than before the conflict.

Those dual trends do not guarantee a return to $100 oil, but they point in that direction.

More By This Author: