Why Everything You Think About Silver Is Wrong

Image Source: Pixabay

Silver shot up 7% this morning, and I watched everyone scramble to explain why. China wants delivery. Overnight futures pressure. Global demand. Inflation hedge.

All wrong.

By 11:30 AM, SLV had traded over 840,000 option contracts. To put that in perspective, that's almost as much as NVIDIA (NVDA) (630K), Microsoft (MSFT) (86K), and Amazon (AMZN) (138K) COMBINED - 854K total.

While financial media spins stories about Chinese demand, a silver ETF is trading option volume like it's a Mag 7 tech stock.

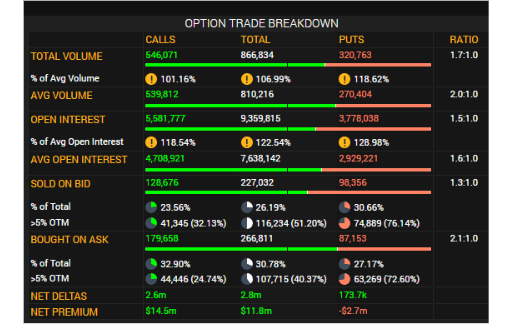

SLV Options Stats as of 11:45 AM ET

But here's what nobody gets: Everything you think you know about what moves silver is backward.

The Futures Fairy Tale

Here's the conventional wisdom: Silver futures (SI) lead, and the SLV ETF follows. Overnight action in Asia drives the opening moves. When silver rips higher in London, SLV catches up when the U.S. opens.

Complete garbage.

I argue that SLV options contracts are actually the cart leading the horse. The tail is wagging the dog, and everyone's watching the wrong end.

Think about it: SI futures have basically no meaningful options trading. Nobody trades those. But SLV options? That's where the real money plays. When the U.S. cash market opens at 9:30 AM, that's when the action starts.

Everything you see in overnight futures is predominantly hedging activity - market makers managing risk, not real directional bets. Sure, there's some legitimate buying and selling globally, but most of that overnight movement?

It's just dealers adjusting their books.

Then 9:30 AM hits, and American options flow takes over.

The Delivery Delusion

People keep obsessing over physical delivery. "China's taking delivery!" "Supply constraints!" "Industrial demand!"

Drop in the bucket, big guy.

You want to know what $40 billion means anymore? Nothing. Absolutely nothing. NVIDIA has 24 billion shares outstanding - when it moves $1, that's $24 billion in liquidity. Tesla moved about $12 billion in liquidity this morning just on a routine $4 move.

This morning's SLV options flow moved hundreds of millions in a few hours.

Even if China wants delivery, so what? The notional value of American options trading dwarfs sovereign activities.

We're not living 15 years ago anymore. Financial markets now operate at a scale where even countries are small players compared to options flow.

The delivery story is for people still thinking like it's 2009.

The Overnight Reversal Nobody Talks About

Here's the part that'll mess with your head: Those big overnight moves in silver futures? They often get completely interrupted - maybe even negated - the second real options trading starts in the U.S.

Why?

Because when someone buys SLV calls at 9:30 AM, the market maker selling those calls has to hedge immediately.

They buy shares to offset their risk. This happens in nanoseconds - not milliseconds, nanoseconds. Everything on the dealer side is measured in nanoseconds.

So all that overnight "momentum" from Asia? It runs straight into a wall of algorithmic hedging from American options flow. The futures market ends up reacting to the options market, not the other way around.

The Scale Nobody Calculates

Let me give you the rough math on this morning's action, because the numbers are wild.

Take 840,000 SLV option contracts. That's 84 million shares worth of exposure, but assuming an average 50 delta, you're looking at roughly 42 million shares of hedging activity. At $32 per share, that's over $1.3 billion in notional value. Just from the options.

That doesn't even count the millions of shares trading separately.

Compare that to whatever delivery story you're reading about. The scale isn't even close.

What This Really Means

Everything is order flow now. Not fundamentals. Not delivery. Not overnight moves from Asia. American options flow.

When SLV trades 840,000 contracts - almost matching three Mag 7 stocks combined - that's not coincidence. That's not retail investors buying silver as an inflation hedge. That's institutional flow that dwarfs everything else.

The next time you see silver move, forget the delivery stories. Forget the overnight action. Ask yourself: What's happening in SLV options?

Because that's where the real money is moving. Everything else is just noise.

More By This Author:

60,000 Contracts Hit This StockThe Bubble Of Everything

The Q4 Sector Scorecard