While Inflation Refuses To Go Away, Gold Refuses To Go Up

The recent CPI report shows that inflation remains high. It implies a hawkish Fed and bearish gold.

To paraphrase a famous Pink Floyd song, I wish you weren’t here, inflation! The CPI increased 0.4% in September, after rising 0.1% in August, according to the Bureau of Labor Statistics. The move was slightly higher than expected and occurred despite a 2.1% decline in the energy index. What’s really bad, especially for the poorest households, is that food prices continued to rise. The food index rose 0.8% for the month, the same as August, and was up 11.2% from a year ago.

Without plunging gas prices, inflation would be even higher. Indeed, the core CPI, which excludes food and energy prices, rose 0.6% last month, as it did in August. Increases in the prices of services (medical care, transportation, shelter) were the largest contributors to the increase in the core CPI monthly rate.

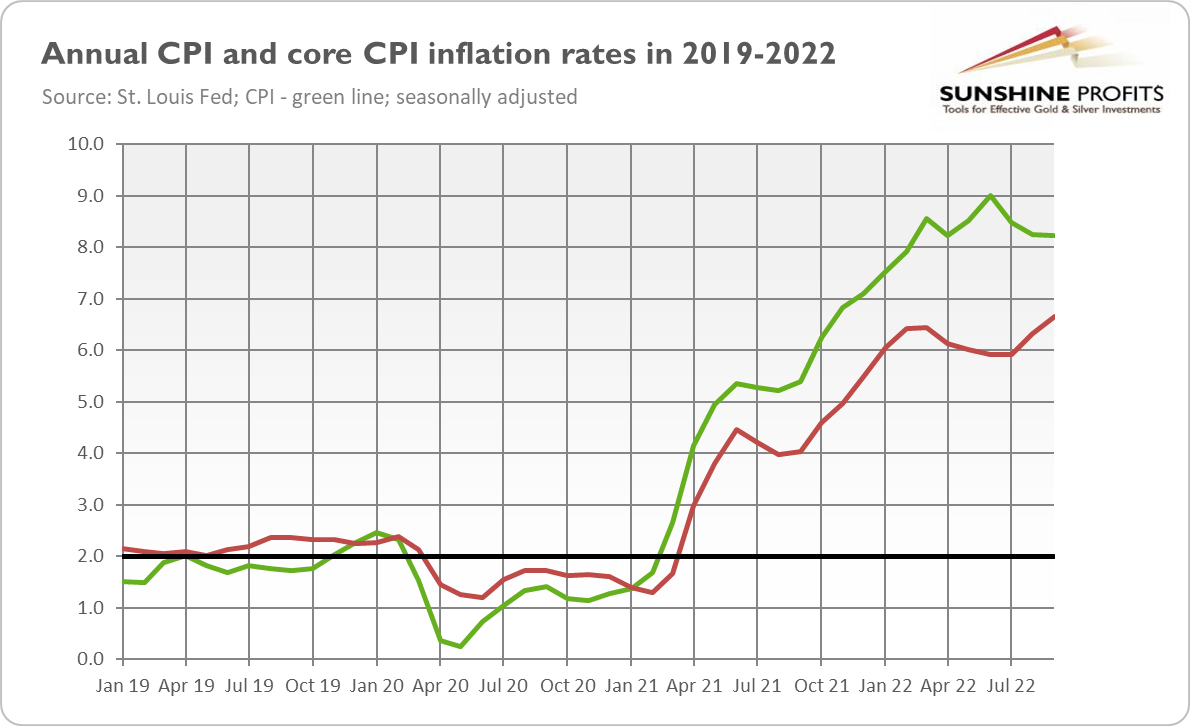

On an annual basis, the overall CPI increased 8.2% for the 12 months ending September, as the chart below shows. It’s a smaller number than the 8.3% rise in August but higher than expected (the market consensus was 8.1%). And the annual rate is still hovering near the highest levels since the early 1980s. The core CPI rose 6.6%, which means an acceleration from August, when it increased 6.3%. The rise was also above expectations. Although it seems that the overall index has peaked, at least for a while, the core CPI is once again on the rise, which doesn’t bode well for the inflationary outlook. Inflation simply refuses to go away.

Inflation Takes a Bite

What does stubbornly high inflation imply for the U.S. economy? So far, inflation has not had a significant impact on consumer spending. After all, it was caused by all the newly printed money that got into the hands of consumers, boosting their purchasing power. However, this is going to change, and inflation will eventually take its heavy toll, and we already see the first signs. Retail sales were flat in September, below market expectations. Meanwhile, the recession risk within a year rose from 65% to 100%, according to Bloomberg Economics. Yup, you read it correctly. The Bloomberg model says that there will be – for sure! – a recession by October 2023. So much for an economy “strong as hell,” Mr. Biden!

Recession will occur as a result of either inflation or the Fed's tightening cycle in response to price pressure. Bond yields rose following the release of the most recent CPI data, while the US dollar strengthened further. The odds of another 75-basis point interest rate hike at the FOMC meeting in November rose – right now, they are above 92%, compared to 60% one month ago, according to the CME FedWatch Tool.

Implications for Gold

What does it all mean for the gold market? Well, I don’t have good news. The fact that inflation remains absurdly high (and core inflation is even accelerating) implies that the Fed will stick to its hawkish monetary policy and continue to raise the federal funds rate. The tightening of monetary policy, which contributed to the rise in both interest rates and the greenback, is the main culprit behind the current bear market in gold. As the chart below shows, the price of the yellow metal declined this week to slightly above $1,630.

The problem is that as long as the Fed continues to raise interest rates, gold could continue to suffer. This week, Minneapolis Fed President Neel Kashkari said that “the Fed can’t pause its campaign of monetary policy tightening once its benchmark interest rate reaches 4.5% to 4.75% if ‘underlying’ inflation is still accelerating.” Traders are betting on another 75-basis points not only in November, but in December as well. It means that gold has, unfortunately, further room to go down this year.

More By This Author:

The Fed’s Challenge And GoldFOMC Minutes Don’t Offer Any Hope For Gold

Gold Returns Above $1,700. For How Long?

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more