Where The Answers Lie In The Silver Market In 2026

↵

Image Source: Unsplash

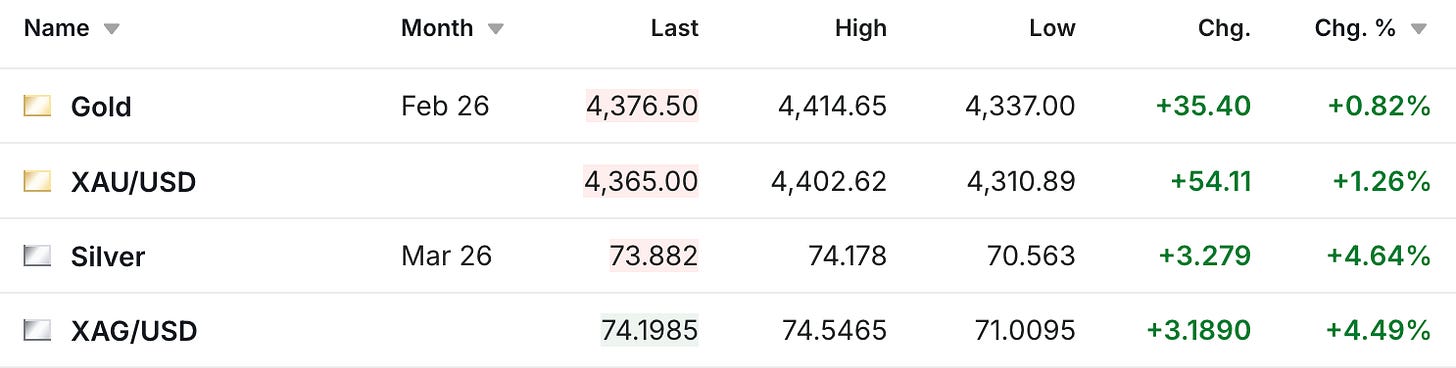

The gold and silver markets were off to a strong start in 2026, with the gold futures up $35 to $4,376, and the silver futures up $3.28 to $73.88.

(Click on image to enlarge)

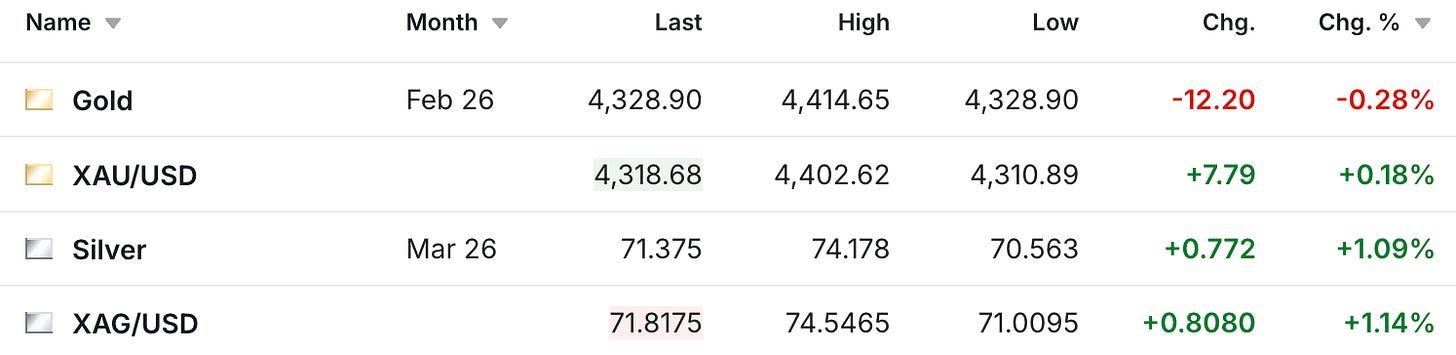

Although in the time since I started writing the column, the prices for both metals have dropped a bit, and I imagine we will continue to experience this type of volatility for the immediate future.

(Click on image to enlarge)

While both prices are slightly below their all-time peaks, they still remain in what was record territory prior to the last two weeks. But now that the historic 2025 is in the books, while the market structure on the silver side in particular looks like a raging inferno, I have a few thoughts to share about silver that I’ve been thinking about over the past few days, that are what I feel are the most important issues in the silver market going into this new year.

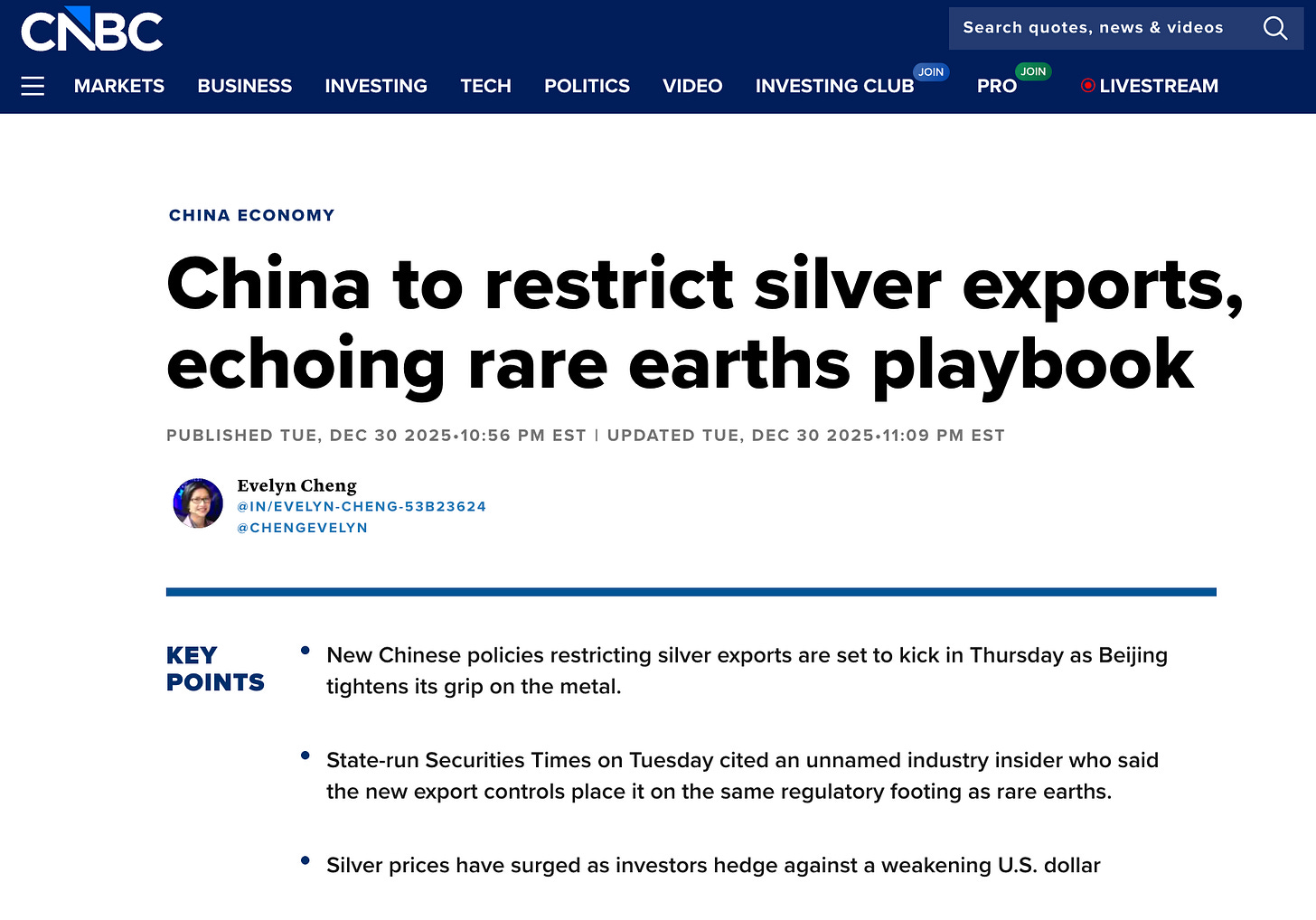

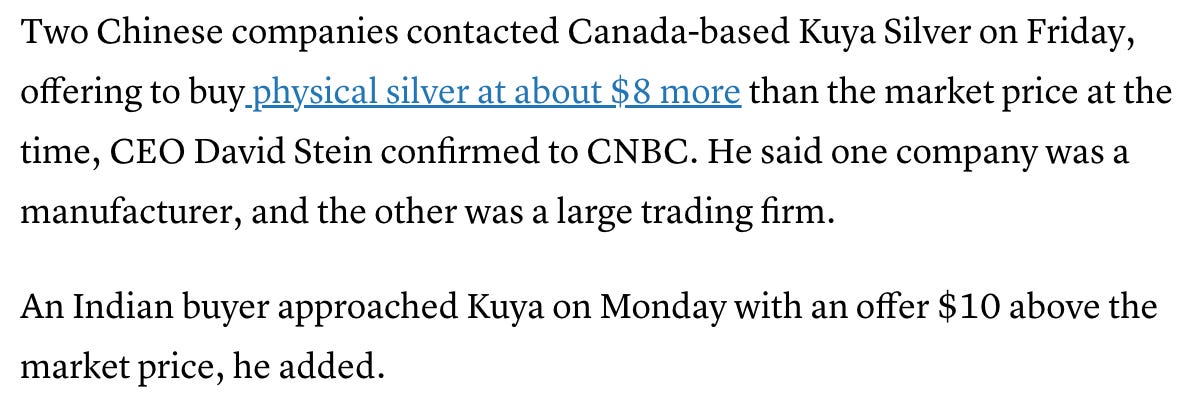

Last Sunday, David Stein of Kuya Silver joined me on our YouTube channel and talked about how when the silver spread between New York and China blew out last Friday, he was approached by two separate groups from China that wanted to buy his company’s silver production at an $8-$10 premium. Then on Monday, he was contacted by a group in India that wanted to do the same.

I’m working on finding out if the group in India was just trying to be proactive after seeing what’s been happening in China, or if this is an indication of a greater concern that they might be worried about going back into a shortage in India, similar to what we saw back in October. But while that would give us additional information, it’s still intriguing to think about what could already be happening now.

David mentioned that on Monday after his interview he was contacted by a CNBC Asia reporter who was watching the show and wanted to talk with him before writing an article about it. I don’t know yet if that’s what also led the Indian group to contact him on Monday, but it raises the following question, which lies at the heart of something I think most silver investors have been thinking about for years, if not decades.

Because if we are at or nearing the point where the amount of physical silver being demanded by industry has simply overwhelmed the available supply (with the current dynamics and footprints suggesting that it’s at least possible that this is the case), do we start to see different groups begin to front-run the move? Could something like that already be happening?

I’ll put it like this: I don’t think there’s enough evidence yet to conclusively say that’s what happened with the Indian group that contacted David. But we also don’t have enough evidence to conclusively discount that this is what could already be happening. And regardless of whether it has started to occur or not, when you think about the chain of events that already just took place (as described above), and the fact that even CNBC is watching this and reporting on it, that is pretty much the ideal way to facilitate a rush to the exits.

Because ultimately, if you’re running a business that’s dependent upon silver and you just saw that, what would you do?

Again to be clear, sometimes situations that look on the verge of a crisis do get resolved. Although from everything I can see now, it looks like we’re a lot closer to an acceleration rather than a resolution.

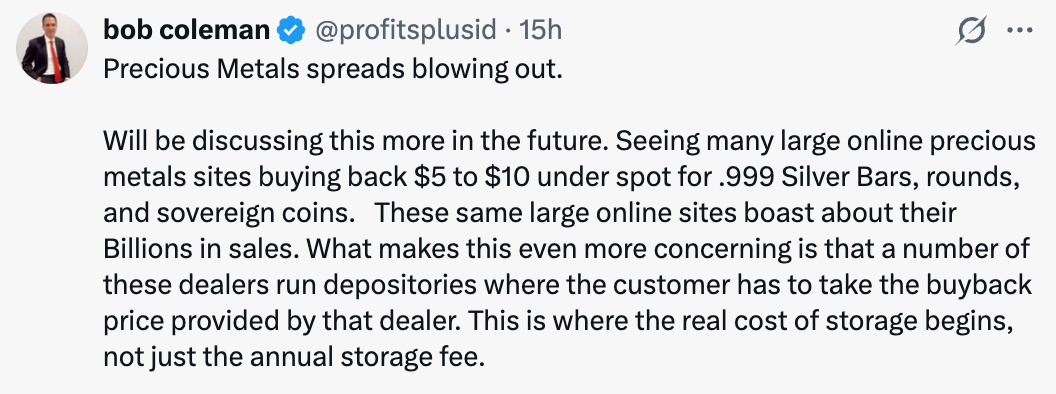

The second item that will be at the top of the list of things I’m watching going into 2026 is what happens to the arbitrage that’s currently on the board. Especially with the rather unique situation that currently exists in the U.S. retail market, where dealers are paying anywhere from $3 to $10 under spot price when people go to sell back their silver, that’s resulted in a bottleneck at the refineries, at the same time that China, India, and who knows where else is willing to pay an $8 to $10 premium.

This means that while companies in China (where I’m pretty sure there’s plenty of refining capacity) are scrambling for silver, there’s a backlog sitting in the U.S. retail supply chain that can’t get processed because there are only two LBMA-approved silver refineries in the U.S., and right now one of them isn’t even processing any silver (for more detail on what’s happening at the refineries, watch the video below).

So while I understand that it might not be the easiest task to get that silver overseas, that sure is a large premium that exists right now for someone who’s able to get it from one place to the other (anyone have a nice boat?). Additionally, you have to wonder if China and/or India would start trying to take delivery from the COMEX or the LBMA.

Obviously the spreads between different cities and countries are changing wildly by the day, unlike anything we’ve yet seen in the silver market to date. But these are some of the things that I’ll be continuing to watch in what should be a riveting year for the precious metals markets, and silver in particular.

Lastly for our long-time readers, you know how much respect I have for Luke Gromen’s work, which is why it was intriguing to see this recent message that he shared.

So happy New Year, and I’m looking forward to following this incredible story with you in 2026!

More By This Author:

India Joins The Scramble For SilverSilver's Historic Day $8 Day, & A Thesis On What Caused It

Silver Breaks $71 As Market Stress Intensifies