When Silver Runs Hot And Platinum Smells Opportunity

Image Source: Unsplash

While stocks are taking a breather at high levels, the Silver market is impressively demonstrating how much energy it still has. It has just broken through the US$60 mark. And anything is still possible: another strong upward surge or a pause for breath – because the market is now clearly overbought.

Ultimately, it is secondary whether consolidation sets in first or whether the Silver price continues its unchecked rise. Investors can assume with a high degree of certainty that inventories will continue to shrink. China exported around 660 tons of Silver in October – most of which was likely destined for the London and New York trading centers, which have recently been under visible pressure. However, new rules will apply from January 1, 2026, when Chinese Silver exports will be severely restricted. The website Finanzmarktwelt.de published a very interesting article on this topic. If you don’t speak German, you can easily use the translation function in the Chrome browser.

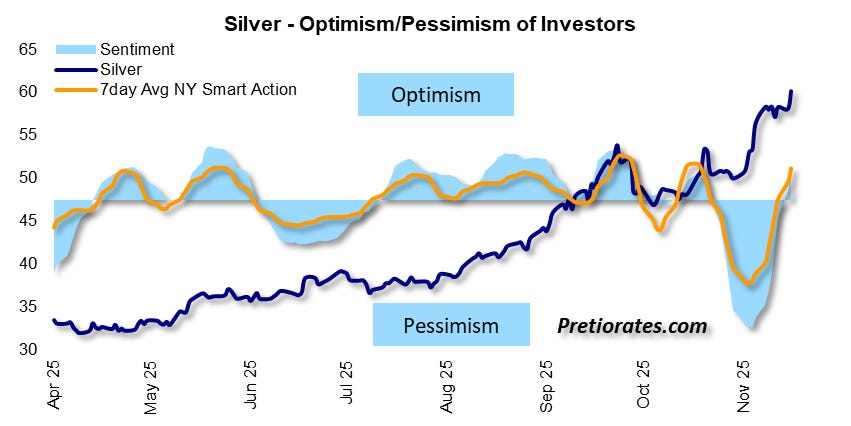

The fact is that sentiment in the Silver market has only just shifted from pessimism to cautious optimism.

(Click on image to enlarge)

It is primarily emotions that are driving the market further upwards – the fundamental background has already been discussed in detail in previous Thoughts. And it is precisely in phases of high emotionality that technical price targets, especially Fibonacci projections, have their greatest effect. Currently, it is easy to see how the Silver price has reached another key target with the 61.8% extension. If this mark is sustainably exceeded, the next medium-term milestone according to this theory is USD 71.68.

(Click on image to enlarge)

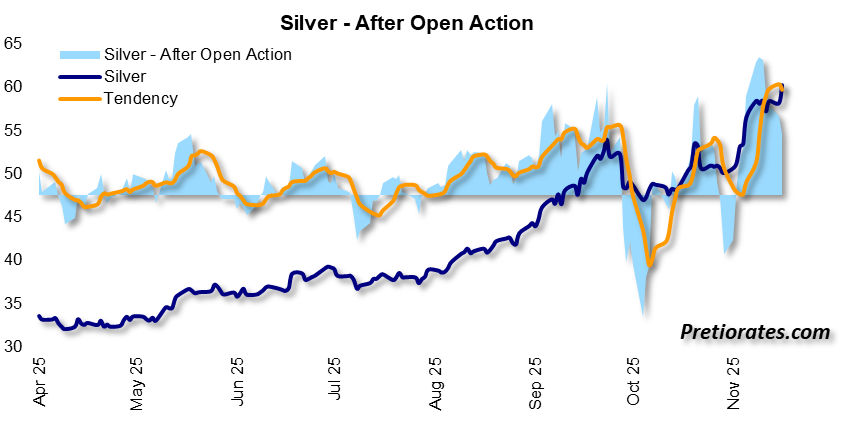

In the short term, however, the overbought situation is clearly evident. Initial resistance levels, which should not be underestimated, are in the range of USD 61.60 to USD 61.80 per ounce.

(Click on image to enlarge)

Our “After Open Action” indicator suggests that short-term market participants have recently been accumulating aggressively. However, it also indicates that momentum may be temporarily exhausted. The orange curve, which reflects the trend, suggests a possible pause.

(Click on image to enlarge)

So while we should continue to hold our Silver positions, Platinum is increasingly coming into focus. The potential of Platinum has already been pointed out several times this year – especially in May 2025, when the background factors were examined in detail. Since then, the price of Platinum has risen by over 50%, but compared to Gold and Silver, there is still considerable catch-up potential. During 2012 and 2013, Platinum was at times even valued higher than an ounce of Gold.

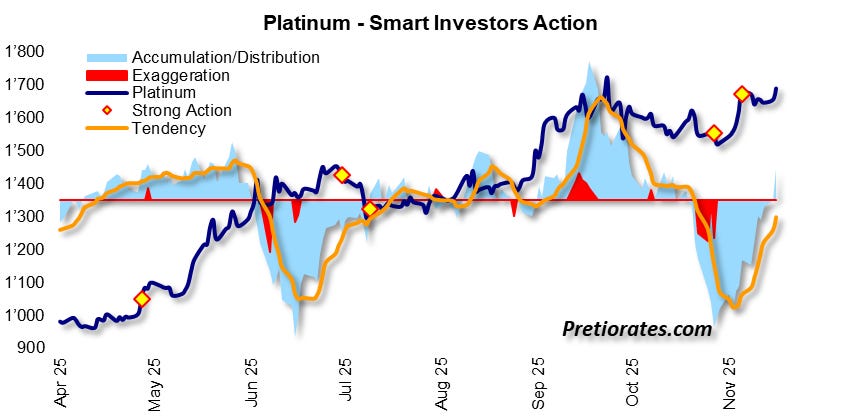

(Click on image to enlarge)

The massive distribution by large investors, which was still evident in November, now appears to be complete. This is clearly visible in the chart with the pronounced light blue area pointing downwards, which now seems to be over.

(Click on image to enlarge)

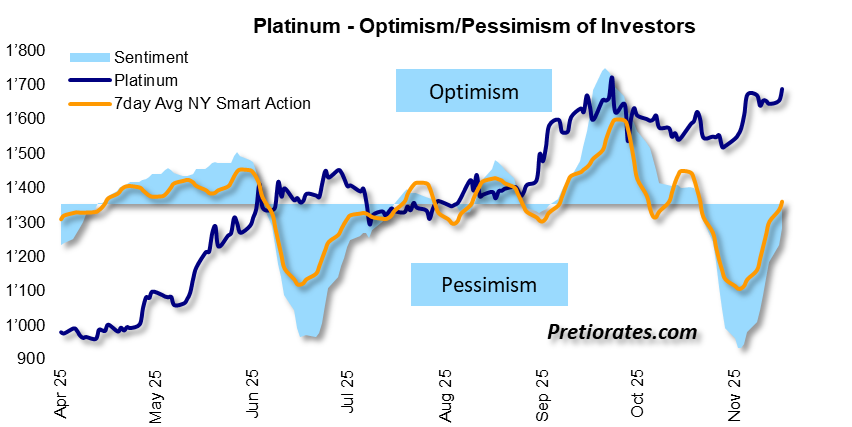

And as with Silver, pessimism has evaporated for Platinum – with the crucial difference that Platinum may just be emerging from a three-month consolidation phase.

(Click on image to enlarge)

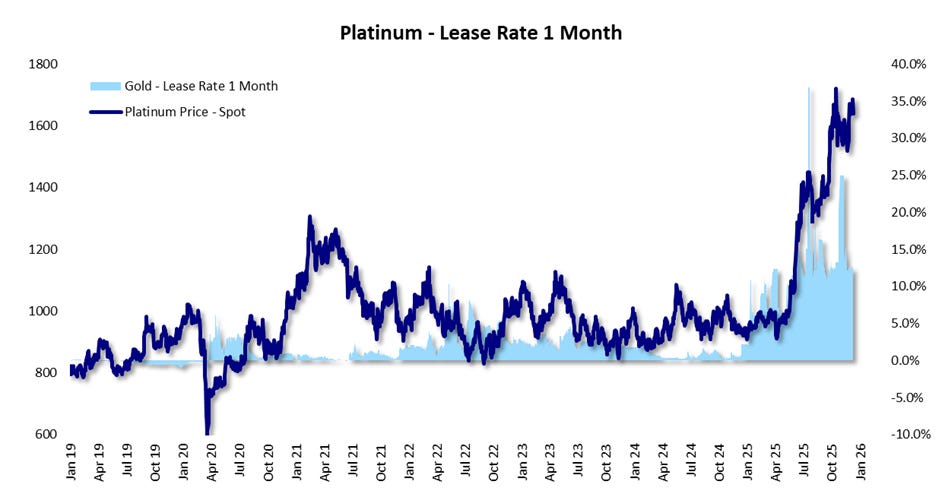

The fact that the physical Silver market is suffering from considerable scarcity is and remains one of the dominant issues. A clear signal of this is the continuing high borrowing fees of currently around 6.6%. For Platinum, however, these are even at a remarkable 12.5%.

(Click on image to enlarge)

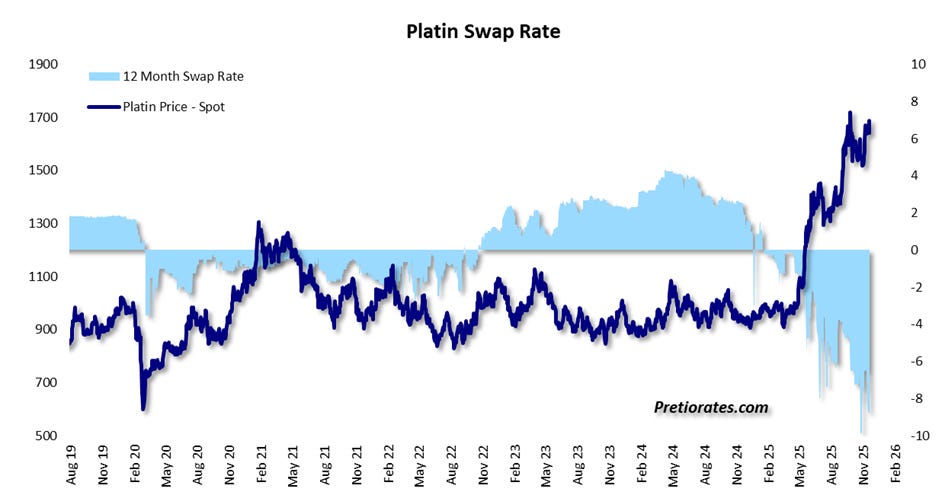

Due to high storage costs, the swap rate is normally in positive territory. If you are unfamiliar with swaps, we recommend doing a little research – for example, using ChatGPT. In a nutshell, however, a negative swap rate is an unmistakable sign of acute physical scarcity. And this situation is more tense than ever before – similar to Silver.

(Click on image to enlarge)

As with Silver, this physical scarcity cannot be resolved in the short term. Around 80% of the supply comes from South Africa and Russia. Russia shows little interest in open exports and prefers to supply China directly. At the same time, the South African mining industry remains in the midst of a crisis – both politically and energy-wise.

Demand comes mainly from China (see May 2025 update), but also from the catalyst industry. As the euphoria surrounding electric vehicles has slowed significantly in recent months, vehicles with combustion engines are likely to remain part of our everyday lives for longer than many people assume. If politicians and, consequently, the automotive industry relax their stance on fossil fuel engines again, demand for catalytic converters is likely to pick up again. And with it, demand for Platinum – and Palladium.

More By This Author:

The Silver AwakeningIs The US Treasury Market In The Right Boat?

Nvidia Is Just A Gust Of Wind, The Autumn Storm Is Likely Not Over Yet

Disclaimer: The information & opinions published by Pretiorates.com or "Pretiorates Thoughts" are for information purposes only and do not constitute investment advice. They are solely ...

more