Wheat Forecasting The Decline After Elliott Wave Double Three

In this technical article, we’re going to take a look at the Elliott Wave charts of Wheat Futures published in the members' area of the website. As our members know Wheat Futures is trading within the cycle from the 950’6 peak. Recently ZW_F made a short-term recovery that has unfolded as Elliott Wave Double Three Pattern. It made clear 7 swings from the lows and complete at the extreme zone. In the further text, we’re going to explain the Elliott Wave pattern and forecast.

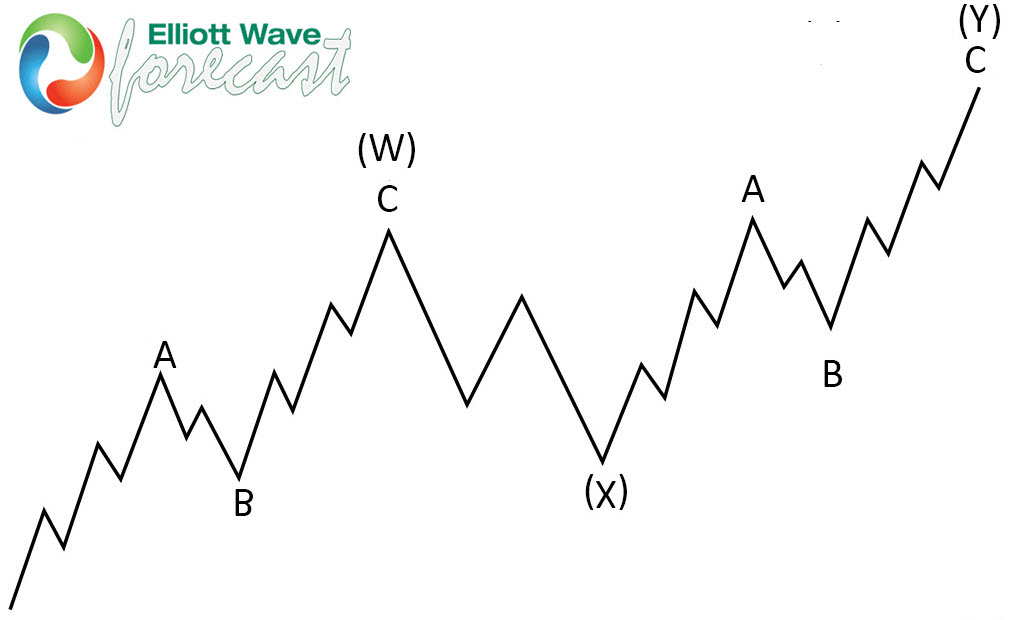

Before we take a look at the real market example, let’s explain Elliott Wave Double Three pattern.

Elliott Wave Double Three Pattern

Double three is the common pattern in the market, also known as 7 swing structure. It’s a reliable pattern that is giving us good trading entries with clearly defined invalidation levels.

The picture below presents what Elliott Wave Double Three pattern looks like. It has (W),(X),(Y) labeling and a 3,3,3 inner structure, which means all of these 3 legs are corrective sequences. Each (W) and (Y) are made of 3 swings, they’re having A, B, C structures in a lower degree, or alternatively, they can have W, X, Y labeling.

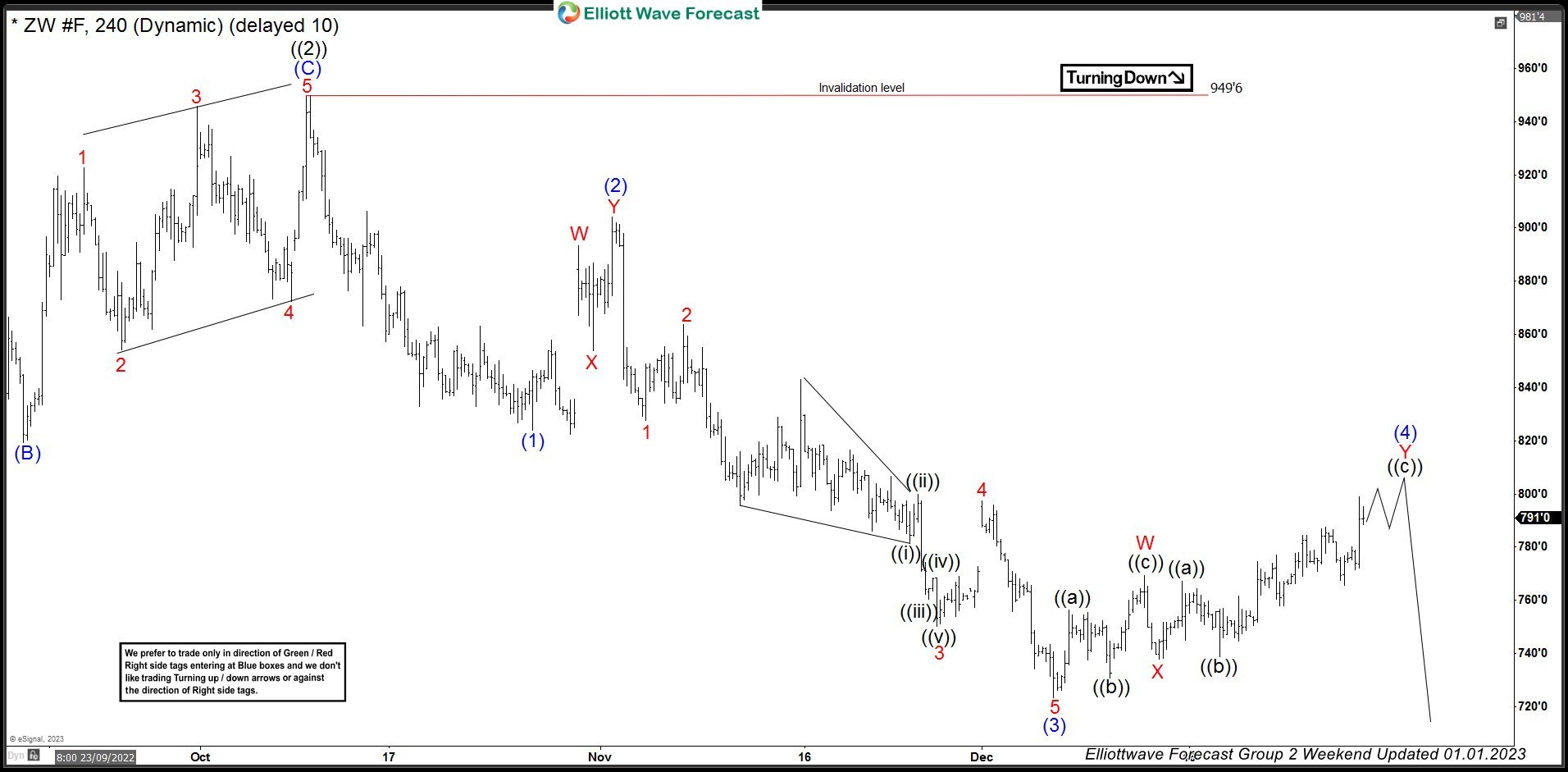

Wheat 4h Hour Elliott Wave Analysis 01.01.2023

The current view suggests cycle from the 949’6 peak is still in progress as 5 waves structure. Wheat is giving us (4) blue recovery that is unfolding as Elliott Wave Double Three Pattern with WXY red inner labeling. If we take a close look, we can see that the price structure has already reached extremes from the lows at 782’6-810’6 ( W-X red equal legs area). At that zone, buyers should be ideally taking profits and sellers can appear again. Consequently, we expect to see the reaction from the marked area. From mentioned zone, we can get either decline toward new lows or larger 3 waves pull back at least.

(Click on image to enlarge)

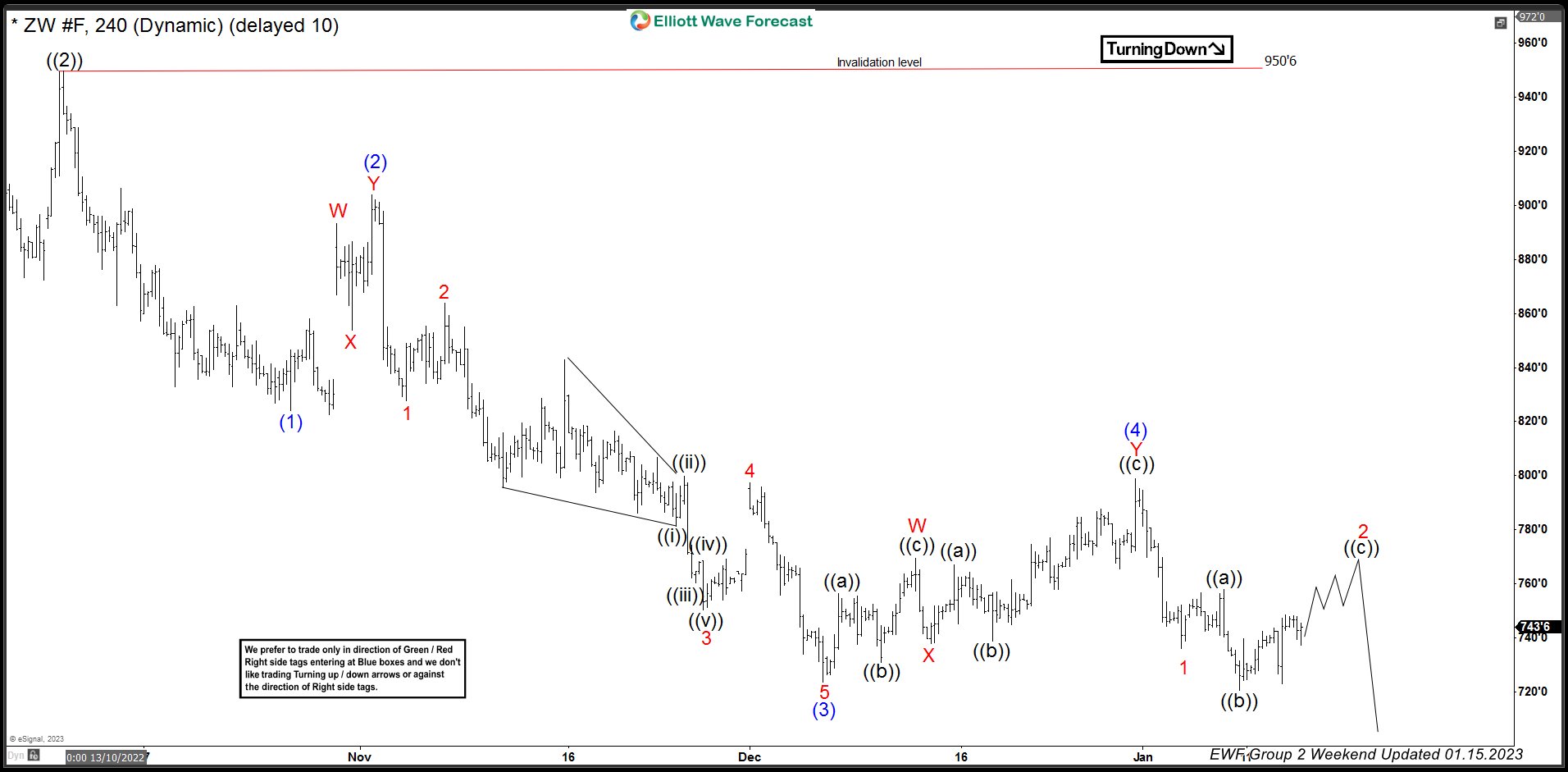

Wheat 4h Hour Elliott Wave Analysis 01.15.2023

Wave (4) was completed in the mentioned area and we got a good reaction. The current view suggests (4) blue recovery is done at 799’1 high. Currently, the commodity is giving us short-term bounce against that high, which can be unfolding as a Flat structure. The price now must hold below the 799’1 peak in order to keep the proposed view intact.

(Click on image to enlarge)

More By This Author:

CHFJPY Selling The Rallies After Elliott Wave Double Three

Disney Is Giving Us A Great Opportunity For Long Term Buying

Nasdaq 100 ETF Should See More Downside

Disclaimer: Futures, options, stocks, ETFs and over the counter foreign exchange products may involve substantial risk and may not be suitable for all investors. Leverage can work against you as ...

more