What Will Reddit Do With Silver?

The hot story this week is the incredible run-up in the stock price of GameStop GME. A week ago, this was a $40 stock, with the company losing well over $4 a share. That’s not surprising for a retail store operator in the world of lockdowns. What is surprising is what happened this week.

The share price ran up to almost $500.

To understand why let’s take a step back and look at the context.

What Caused GameStop to Run Up?

The stock is heavily shorted, including by hedge funds—probably because the prospects for money-losing retailers are bleak. Then a group on Reddit, Wall Street Bets, promoted the idea of buying the stock because the short interest was greater than the total number of shares (they assumed that this means illegal naked shorting—not necessarily.)

But buy they did. And squeezed the short-sellers. And the price ran up.

On Thursday, some trading platforms blocked users from buying the stock. The Reddit users believe this is an attempt to manipulate the share price down, to benefit the short-sellers who are big players. We have little doubt that they blocked buying because they are afraid of lawsuits from users who will lose money buying at the top. And regulatory action.

After all, the whole sales pitch for regulation is to protect the little guy from the big guy. Forget whether this “protection” actually helps the little guy. Look only at the optics, which is what drives voters to support it. Little investors are presumed to be incapable of assessing risks or running their own affairs. Like those under age 18. They need to be protected, which is why they are prohibited from buying private placement investments.

A Call for More Regulation?

And now we have a case that turns this on its head. The institutions that would lobby regulators to force Robinhood to stop little-guy buying of GameStop make a self-serving argument. They want the buying to stop so the price will stop rising and their losses will stop. Which sounds like, “protect the little guys from the big losses when the stock crashes.” Meanwhile, the little guys think there should be regulation—of the big guys.

We hope that out of this will come a fruitful discussion of the contradiction of calling for the government to interfere in markets by force—in order to make them free and fair.

Here are some questions, if anyone is interested:

- If some multi-billion dollar guys chat via Bloomberg terminals about buying to push up the price of stocks, should that be illegal?

- What about pushing up the price of silver?

- If lots of multi-thousand dollar guys chat via Reddit about buying to push up the price of stocks, should that be illegal?

- What if the billionaires talk about pushing the price down?

- What if the kilo-dollars talk about pushing the price down?

It should be obvious that some people want higher prices and some people want lower prices. It may not be obvious, but freedom means you can invest, speculate, or bet—and risk—your own money. With no bailouts if you lose your money, for big or small players.

We are not holding our breath, waiting for that conversation.

Reddit Takes on Silver

Anyways, the Reddit community has started talking about silver. The question on everyone’s mind: can they drive the silver price up 10X (as they drove the GME price)?

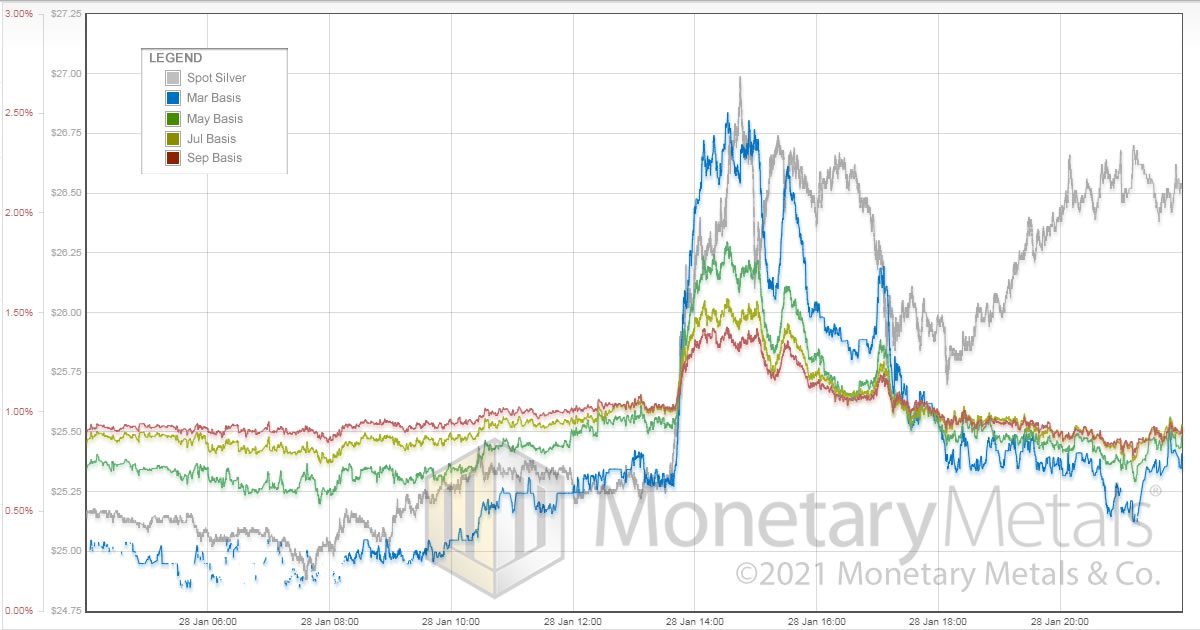

There’s little question they drove it up on Thursday. The price moved up about $1.75 in about an hour. The price subsided but then perked back up later in the day. Here is a graph of the silver price and basis (abundance of the metal to the market).

(Click on image to enlarge)

As the chart shows, the price rapidly shot up from around 13:30 to 14:30 (London time) from around $25.25 to a spike around $27. During this gain of $1.75 or 7%, the March basis shot up from around 0.6% to 2.5%.

Breaking it Down

That’s a pretty big increase. It demonstrates that the buying was focused on futures. Specifically, the March contract. The bases for the other contracts rise but note that they reverse order. Normally, the nearest is the lowest, and the next is higher, the next one after that is higher, etc. But in this move, the buying intensity is so great that the nearest has the highest basis, followed by the next, and so on. September has the lowest basis from around 13:45 until around 18:00 when things revert to normal.

This buying episode was centered on futures. One fact may help readers see through the myth that so-called “paper” silver somehow “diverts” demand away from silver metal. In this facile view, the banks sell “paper” silver naked short, and if they could not do that then the price of silver metal would be a lot higher.

The fact is that the price of spot silver tracks the price of silver futures very closely. The basis is a very sensitive instrument. That increase from 0.6% to 2.5% annualized is an increase from around 2 to 10 cents. That is, the price of spot silver was pulled up with the price of the March contract, lagging behind by 8 cents. This is the exact opposite of what the naked shorting theory would predict.

The Key Question

What force keeps spot and futures prices so close together? If you want to understand the precious metals markets, this is a key question.

The only possible answer is: arbitrage. It is profitable to buy spot and simultaneously sell futures, warehousing the metal for the duration. The profit on this trade was driven up by 8 cents in this manic burst of trading, so strong was the futures-buying. Eventually, the market makers caught up, and the basis subsided back to normal.

That said, let’s look at the arguments for and against the possibility of a user group—even if it has millions of people—driving the silver price so high.

What Are the Chances?

Weighing against such a possibility is the liquidity and depth of the silver market compared to the GME market. The GME market cap was under $3B prior to its runup. Estimates of how much silver bullion is in human hands vary widely (as with gold, there is no way to tell exactly). To make the math easy, assume at least 3 billion ounces in bullion form. That means the total “market cap” of silver is 25 times greater than that of GME (not counting tea services, silverware, and candlesticks).

Another argument against is that it does not have that incredible short overhang of more than 100% of the outstanding shares (notwithstanding conspiracy theories that persist even after our Thoughtful Disagreement with Ted Butler, debunking them).

Finally, there is a strong component of “sticking it to the man” with buying GME. Teaching Wall Street a lesson. Hoisting them by their own petard. This does not apply to silver (though some people believe it does).

However, there are some strong arguments in favor as well. Being that GME is losing money, and is in a bad industry at a bad time, we assume that most people would not want to buy the stock no matter what the reason. This negative obviously does not apply to silver.

Perhaps most importantly, both the Treasury and the Fed (and their counterparts all over the world) have gone all-in to madness. The risk of holding bonds has increased dramatically, due to the dramatic increase in deficit spending. But while the risk has gone up, the return has dropped dramatically. The 10-year Treasury pays a mere 1%—while the Fed is promising 2% annual debasement or more.

Who wouldn’t want to own gold and silver under these conditions?

A subtle argument for the gold standard is that people do not dispose of their gold recklessly, the way they sometimes do with paper-falling-fast.

There are many perversities of the regime of irredeemable currency. The least of these is: rising consumer prices. We are seeing a greater one now: a failing business that is so overpriced that it attracts massive short-selling. Which attracts massive buying to make money squeezing the shorts. All of this betting is zero-sum at best, transferring capital from one party to another, who receives it as income and spends some of it. So it is not only zero-sum, but a perverse incentive to consume capital.

The world desperately needs to rediscover the gold standard. The path to that is paved with interest on gold, paid in gold (which is what we do for a living, when we are not burning the midnight oil generating silver charts and writing about the perversities of the equities markets).

Disclaimer: The content in this article is provided as general information and for educational purposes only and should not be taken as investment advice. We do not guarantee the accuracy ...

more

Certainly there foes need to be more regulation, BUT not of planning and plotting and focused discussion. That area is thin ice with deep water below.

The regulation needs to be on the use of credit, and limiting that use of credit. Make the futures a cash-only realm, and then enforce the rule. That would have put a serious damper on the run-up of fuel prices a while back, and it would probably put a damper on short sales as well. All that just by increasing the risk without really encroaching freedom. Credit is too easy a shield for gamblers, so just making the game a bit more serious may be all that it takes to solve the problem.