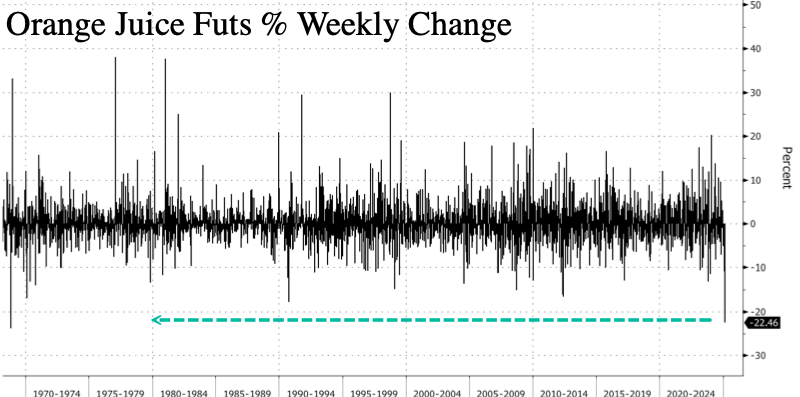

What Snapped? OJ Futures Crash Most Since 1968

Image Source: Pixabay

Orange futures in New York were on track for the sharpest weekly drop in 57 years on Friday. Over the past several weeks, the market has been engulfed in a downright panic, as prices slid for ten consecutive sessions. The catalyst behind this sharp selloff still remains unclear.

By Friday afternoon, the weekly percentage change for orange juice futures in New York was around 22.5%, marking the worst weekly decline since the first week of November 1968.

OJ futures established a record high of $5.5 a pound in mid-December on news that Florida's citrus production fell to the lowest levels since 1930. Since the peak, about two months later, the maximum drawdown has been a whopping 41%.

The futures spread between the March and May orange juice contracts shifted from backwardation to contango, which seemed to signal a drastic change in market dynamics and the potential easing of near-term supply constraints.

No single factor was driving the sharp decline in orange juice contracts -- that we can see. There's no word on whether drivers included improved weather conditions in Florida and Brazil, or if a liquidity crunch forced long positions to unwind in panic. Whatever the catalyst, the selloff was swift and severe.

The OJ crash brings to mind the movie "Trading Places," starring Eddie Murphy and Dan Aykroyd, in which the duo profits from a collapse in frozen concentrated orange juice futures contracts. The iconic line from the movie: "Sell, Mortimer! Sell!"

More By This Author:

Buffett Did Not Sell Any Apple This Quarter, Sold More BofA & Citi, Exited Ulta And Entered Constellation Brands: Full 13FMeta Plans For New AI Humanoid Robot For "Household Chores"; Headline Fuels Stock Rally

January US Retail Sales Tumble Most In Almost 2 Years

Disclosure: Copyright ©2009-2025 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more