What Is Going On With Silver?

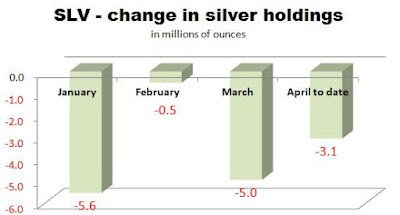

As I discussed in my previous article, since the beginning of 2017 two large gold ETFs, GLD and IAU, have been generally accumulating gold. However, the largest silver ETF (SLV), has been doing the opposite:

Source: Simple Digressions

The chart shows that every single month SLV reported an outflow of silver from its vaults. As a result, now there are 327.3 million ounces of silver at SLV vaults:

Source: Simple Digressions

It means that since the beginning of the current bull phase in gold and silver (December 2015), the SLV holdings increased by a mere 3.0% (look at two red circles). To be honest, it is not an impressive result because, for example, GLD gold holdings went up by 29.6%!

So the question is - what is going on with silver?

Disclaimer: This article is not an investment advice. I am not a registered investment advisor. Under no circumstances should any content from here be used or interpreted as a recommendation for ...

more

"To be honest, it is not an impressive result because, for example, GLD gold holdings went up by 29.6%!"

Again, I see you making assertions on GLD's holdings but I don't know how much I'd trust this data. Paper gold GLD claims to be fully backed by physical gold bullion but yet it refuses to give your everyday investors the right to redeem for any of these ‘claimed’ gold bullion. This fact alone would mean GLD shares are nothing more than paper at the end of the day. For anyone interested but have not heard about CNBC's Bob Pisani's visit to GLD's gold vault, I recommend checking it out. His visit is documented in a segment called Gold Rush: The Mother Lode. This entire segment was organized by GLD's management to prove that their gold actually exists but the gold bar held up by Mr. Pisani displayed a serial of ZJ6752. This serial did not show up on the latest bar list during that time. Cheviot Asset Management’s Ned Naylor-Leyland discovered that this "GLD" bar actually belonged to ETF Securities.

Furthermore, GLD’s prospectus is chalk full of weasel clauses and legal loopholes that allows the fund to get away without the full physical gold backing. One good example of this is the clause that states GLD has no right to audit subcustodial gold holdings. To this day, I have not heard of a single good reason for the existence of this audit loophole.