Weekly Waves: EUR/USD, Bitcoin And Gas

Our weekly Elliott Wave analysis reviews the EUR/USD 4 hour chart, the Natural Gas 4 hour chart, and the Bitcoin daily chart.

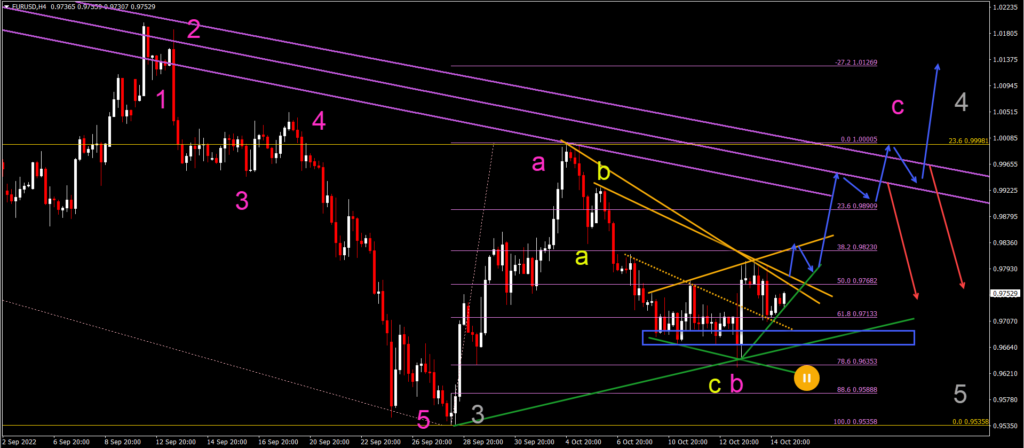

EUR/USD Bullish Bounce at the 78.6% Fib Support

The EUR/USD made a bullish bounce at the 78.6% Fibonacci retracement level:

- The EUR/USD seems to have completed an ABC (yellow) within a wave B (pink).

- There was a strong bullish bounce at the 78.6% Fibonacci support which confirms the end of the wave B (pink) and the start of the wave C (pink).

- Price action needs to now break above the resistance (orange) lines to confirm the continuation within the wave C (pink).

- The ABC (pink) is expected to complete a wave 4 (gray).

- A break below the 78.6% Fibonacci level indicates either a downtrend or complex correction within the wave B (pink).

(Click on image to enlarge)

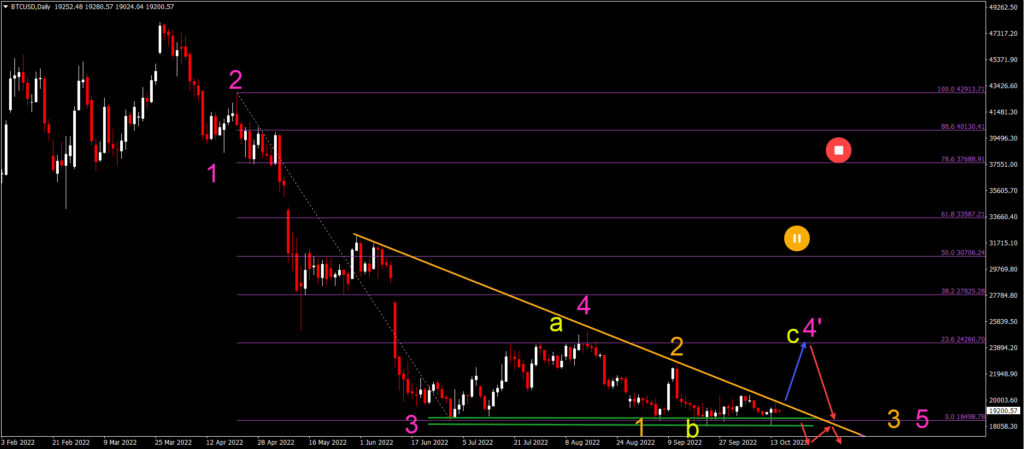

Bitcoin Builds Descending Wedge Pattern

Bitcoin (BTC/USD) is building a descending wedge chart pattern, which usually breaks bearishly:

- The BTC/USD has been testing the support zone (green) multiple times.

- So far, BTC/USD was unable to break below the support levels.

- But price action was hardly able to move up because it faced strong resistance with every bullish attempt.

- The flat bottom but descending resistance line indicates a descending wedge pattern.

- A bullish breakout (blue arrow) could indicate an ABC (yellow) within the wave 4’ (pink).

- A bearish breakout (red arrows) indicates an immediate downtrend within the wave 3 (orange) of wave 5 (pink).

- The bearish targets are at $15k, and $12.5k.

(Click on image to enlarge)

NGAS Bearish Bounce at 50% Fib Resistance

NGAS made a bearish bounce at the 50% Fibonacci level, which is probably a wave 4 (yellow):

- The bearish bounce could indicate a 5 wave (yellow) pattern within a wave C or wave 3 (pink).

- A bearish breakout (red arrows) could occur below the last remaining support line (green).

- The main targets are $6, $5.50, $5.30 and $5.

- A break below the $5 increases the chance that price action is in a bearish wave 3 (pink) rather than a wave C (pink).

- A bullish breakout (blue arrow) above the resistance (orange) could indicate an expanded wave 4.

- A break above the 50% Fib places the bearish Elliott Wave analysis on hold.

(Click on image to enlarge)

More By This Author:

Is Bitcoin About To Break(out)?The Economy Looks Bad – IMF Says

Weekly Waves: EUR/USD, XAU/USD And Bitcoin

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. On average around 80% of retail investor accounts loose money when trading with high ...

moreComments

Please wait...

Comment posted successfully

No Thumbs up yet!