Weekly Forex Forecast - Sunday, Sep. 28

Image Source: Pexels

Fundamental Analysis & Market Sentiment

I wrote on the 21st September that the best trades for the week would be:

- Long of the S&P 500 Index. The Index fell by 0.31% over the week.

- Long of the NASDAQ 100 Index. The Index fell by 0.39% over the week.

- Long of Gold following a New York close above $3,700. This set up on Monday, and from there, Gold rose by 0.36% over the rest of the week.

- Long of Silver. Silver rose by 6.87% over the week.

These trades produced an overall gain of 6.53%, equal to 1.63% per asset.

A summary of last week’s most important data:

- US Core PCE Price Index – as expected, the Index saw a month-on-month increase of 0.2%.

- US Final GDP – this saw a significant upwards revision to 3.8% from 3.3%, which triggered a firm rise in US stock markets.

- Flash Services & Manufacturing PMI in the USA, Germany, and the UK – everything was a bit disappointing except the German Services data, which has probably helped contribute to a mood where analysts are looking for more signs of economic slowdown in G7 economies.

- Australian CPI (inflation) – this was a tick higher than expected, at 3.0%.

- Swiss National Bank Monetary Policy Rate & Monetary Policy Assessment – the SNB kepts its rate at zero and warned of the impact the new US tariff of 39% on Swiss imports will have on the non-financial services side of the Swiss economy.

- US Unemployment Claims – the data was a little better than expected, but not by enough to make much of an impact.

- Canadian GDP – this was a tick higher than expected, showing a month-on-month increase of 0.2%, but this has done nothing to prop up the increasingly weak Canadian Dollar.

The major takeaway from the week was increasing strength in the US economy, but the week ended with renewed fears that something will happen soon to spoil the stock market party, whether it is stubbornly firm US inflation, a potential miliary clash between NATO and Russia, or a simple extreme overvaluation which is bound to come crashing back to earth soon. An impending recession in New Zealand is also on the radar, although globally speaking this isn’t a big deal, but it certainly is making a continuing impact on the New Zealand Dollar, which fell again last week.

There were new record highs in Gold, and in the major US stock market indices the S&P 500 and the NASDAQ 100, and a 14-year high in Silver. Silver really stands out as a strong performer, with the price trading above $47, very close to the all-time high in 2011.

Turning to the Fed, markets now see a 65% chance of two further rate cuts, down from 78% last week, while only one further rate cut in 2026 is expected, so the US interest rate is still seen as likely to be 3.50% more than one year from now, and this may continue to prop up the US Dollar despite its long-term bearish trend

This is likely to be a good time to trade or invest, with Silver really taking off, while Gold and major US stock market indices remain near their recent record high prices.

The Week Ahead: 29th September – 3rd October

The coming week might see more activity in the market, as we have US non-farm payrolls data due which could impact perceptions of where the US economy is headed over the near term. The VIX is at a low level, which suggests that the stock market’s long-term bullish trend is likely to continue.

This week’s most important data points, in order of likely importance, are:

- US Non-Farm Employment Change

- US JOLTS Job Openings

- US Average Hourly Earnings

- US ISM Services PMI

- US ISM Manufacturing PMI

- US Unemployment Rate

- US Unemployment Claims

- Reserve Bank of Australia Cash Rate & Rate Statement

- Swiss CPI (inflation)

- Chinese Manufacturing PMI

It is a public holiday in China on Wednesday, Thursday, and Friday; in Germany Friday; in Canada Tuesday.

Monthly Forecast September 2025

(Click on image to enlarge)

For the month of September 2025, I forecasted that the EUR/USD currency pair would rise in value if we got a daily close above $1.1806.

This set up the week before last. The progress of this trade is shown below:

(Click on image to enlarge)

![]()

Weekly Forecast 28th September 2025

I made no weekly forecast last week.

There were no unusually large price movements in currency crosses last week, so I have no weekly forecast this week.

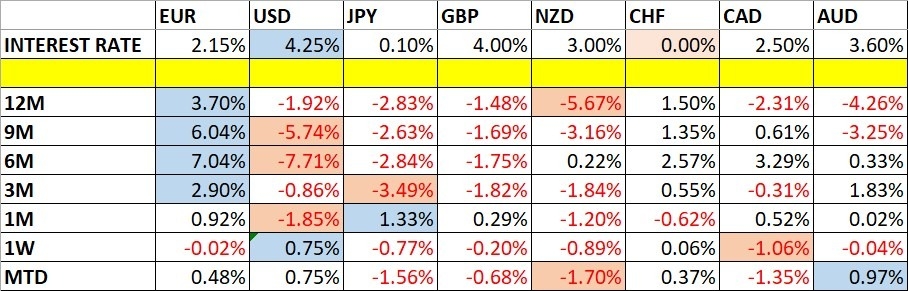

The US Dollar was the strongest major currency last week, while the Canadian Dollar was the weakest. Volatility was lower than it was last week, with only only 15% of major pairs and crosses changing in value by more than 1%.

Next week’s volatility is likely to stay the same or increase a bit.

Technical Analysis

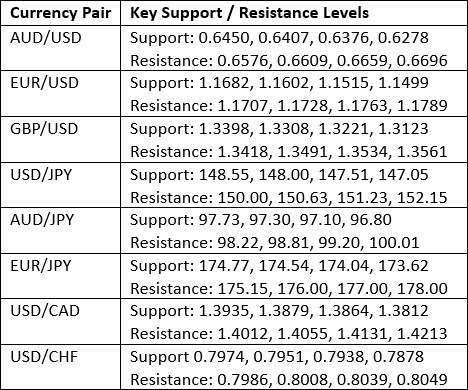

Key Support/Resistance Levels for Popular Pairs

US Dollar Index

Last week, the US Dollar Index printed a bullish candlestick following on from the previous week’s bullish pin bar. It was the most bullish candlestick here for over two months, although the candlestick did have a significant upper wick located in an area which has seen a lot of selling over the past few weeks. Also, the price is above where it was 13 weeks ago, so by my preferred metric, I can declare the long-term bearish trend is over. This places the US Dollar in an interesting position.

We can account for the new firmness in the US Dollar by declining expectations over the past couple of weeks regarding the pace of rate cuts in 2026 and the chances of two further rate cuts in 2025. Two further cuts this year is still seen as the most likely outcome, but the second cut is in some doubt.

It may not be wise to focus on short USD trades right now, although there are strong bullish trends in some assets which are priced in USD which are gaining very strongly. I think it is not so much about the Dollar, but more about funds flowing into the USA.

(Click on image to enlarge)

EUR/USD

The EUR/USD currency pair declined last week following the previous week’s large bearish pin bar, which is not a surprise. However, it is worth noting that there is a bullish long-term trend which is still valid, and last week’s decline was quite minor. There is a significant lower week in this weekly candlestick. The Euro is also showing some relative strength lately, rising to new long-term highs against several other currencies beyond the US Dollar.

Bulls should be worried that the bearish pin bar rejected a new 4-year high just above a consolidation zone just after the initial breakout.

Despite this, I remain long of this currency pair, and I see a potential new long trade entry if get a daily (New York) close above $1.1867. However, if you are going to buy on the dips, it is hard to see a suitable support level nearby, so it might be better just to rely upon naked price action.

(Click on image to enlarge)

NZD/USD

The NZD/USD currency pair fell again last week, as I thought was likely to happen, printing another bearish candlestick after last week’s large bearish engulfing candlestick which closed very near to its low. These are bearish signs, as is the fact the that the week again ended very near its low, but it is worth noting that the price is now at an area which has been pivotal in recent months, and which could be supportive. cautionary note can come from the fact that the New Zealand Dollar does not have a great track record of respecting trends and tends to reverse very easily.

Having said all that, there is a good fundamental reason behind the Kiwi’s decline over the past two weeks – New Zealand quarterly GDP came in at a much worse than expected level, showing a decline of 0.9% when the consensus forecast was a decline of about 0.3%. This raises fear of a recession which would likely prompt a series of hasty rate cuts.

A further decline in the Kiwi would not be surprising, but I think this is less likely to happen than last week’s drop. Possibly it could be a good component for a short basket. I personally would avoid the trade but it would not be surprising if the Kiwi is again a relatively weak currency.

(Click on image to enlarge)

USD/CAD

The USD/CAD currency pair daily chart shows a higher low, and notably, both the two lows are also triple bottoms when you drill into the daily chart! This could be seen as a bullish price action signal, worthy of entering a long trade. However, there is a confluence of a big round number not far above at $1.4000, and a key resistance level just above it, could still stop a meaningful advance here.

A long trade here would be aligned with the new firmness in the US Dollar.

(Click on image to enlarge)

S&P 500 Index

The S&P 500 Index printed an indecisive and therefore potentially bearish doji candlestick last week, but part of that included making yet another all-time high. The price is only about a day’s average true range off that high, so this small bearish pullback cannot be said to be significant. However, it was the most bearish week in the last two months.

US stock markets are rising strongly despite the recent strength in the US Dollar.

The index has risen by about 10% since the start of 2025 and by 36% since the April low caused by the Trump tariff panic. It is an open question how much further the current bull run will go, but betting against new record highs in the US stock market is a brave and probably foolish move, unless it’s a cautious play in individual underperforming stocks.

I remain bullish on the S&P 500 Index, but it might be wise to wait for a new record high closing price before entering a fresh long trade here.

(Click on image to enlarge)

NASDAQ 100 Index

Everything I wrote above about the S&P 500 Index also applied to the NASDAQ 100 Index, except this tech index did not have its worst week in two months – it had a worse week within the past month.

(Click on image to enlarge)

XAG/USD

Silver had an amazing week, showing yet another outsize rise in value exceeding 6%, and powering up to a new 14-year high which is not far from the all-time high made in 2011. It also outperformed Gold and all other precious metals. These are bullish signs, as is the breakout from the linear regression analysis shown within the price chart below – the price is well above the upper bound.

With Silver’s outperformance against Gold, it is probably worth being bold on the long side here.

Having said, if you are just entering a new long trade here, as the move is quite extended, a smaller position size might be wise. There is an upper wick on the weekly candlestick and volatility is high, so a strong downwards movement is possible.

I remain very bullish on Silver but worry that it may have peaked on such a large move. Trading the trend with a trailing stop is a good answer to this dilemma if you do it systematically.

(Click on image to enlarge)

XAU/USD

Gold rose last week to rise to print a new all-time high, but closed a bit below that high and the round number at $3,800. It is worth noting that Gold underperformed Silver, and left a bit of an upper wick on the weekly candlestick, as can be seen in the price chart below.

The long-term bullish trend and break to new record highs are bullish factors, as is the strong US stock market, as the US stock market has tended to be positively correlated with Gold, to the surprise of many who see it as a hedge against inflation.

For anyone who is only entering a long trade now, it might be wise to use a smaller position size to account for any sudden high-volatility snapback towards lower prices. Just like the stock market, you have to wonder how much further this bull run will last – but it is backed by a very strong long-term bullish trend, and you trade against that at your peril unless you start to see clear signs of a reversal in the price action – which is not showing here yet.

I am bullish on Gold, but it might be wise to take a smaller long position here than with Silver, which looks more bullish. I would wait for a daily (New York) close above $3,800 before entering any new long trade here.

(Click on image to enlarge)

Bottom Line

I see the best trades this week as:

- Long of the S&P 500 Index after a daily (New York) close above 6,703.

- Long of the NASDAQ 100 Index after a daily (New York) close above 24,794.

- Long of Silver.

- Long of Gold after a daily (New York) close above $3,800.

More By This Author:

Forex Today: Bitcoin Testing Three Week Low

BTC/USD Forex Signal: Possible Bullish Turn Above $111,332

Verizon Communications Stock Signal: Should You Call It A Buy?

Risk Disclaimer: DailyForex will not be held liable for any loss or damage resulting from reliance on the information contained within this website including market news, analysis, trading signals ...

more