We Are All Speculators Now

Like it or not, you’re now a speculator.

Whether you own gold, stocks, or bonds. Even if you leave all your savings in cash or a certificate of deposit paying you a microscopic interest rate.

The fact is, you’re taking risks, and it’s not even your fault. You may think that’s not the case with a 1-year CD with an explicit federal government guarantee. But calculate the real rate of return by subtracting inflation from your yield, and you’re losing money.

If you’ve been on the fence about buying gold, silver or their mining stocks, let me erase those doubts right here and now, with a small qualifier, as you read on.

It’s Not Even Your Fault

Central banks forcing interest rates down to 5,000-year lows means a negative return when you subtract inflation from your yield. Holding bonds to maturity will lose you money.

Bonds at historically low rates are pushing lower. In all likeliness the Fed will implement negative rates. But once the market loses faith in longer maturity bonds, that game is over.

Stocks probably still have a good run left in them. The massive global stimulus is going to get bigger, and stocks will benefit. Eventually, that game will be up too. So stocks are a speculation as well.

And that leaves precious metals.

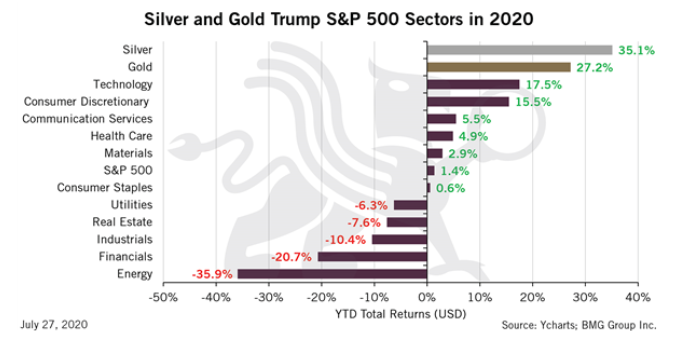

Sure, gold feels like a speculation. It’s already up 35% this year. And at all-time USD record highs, it’s only ever been cheaper, in nominal terms.

But that doesn’t mean it’s too late. In fact, I’d argue quite the opposite.

(Click on image to enlarge)

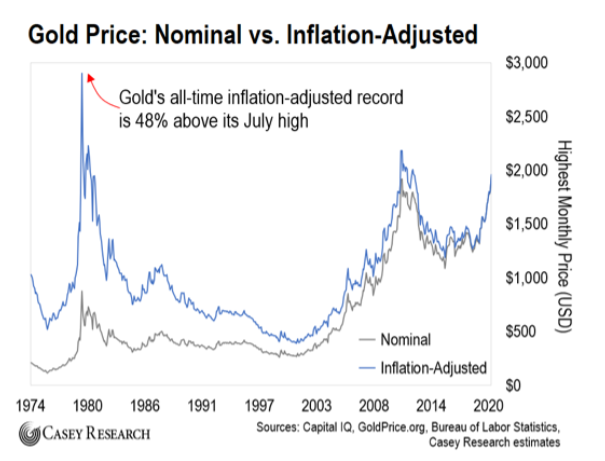

The truth is, gold’s price adjusted for inflation is still 48% below its 1980 high at $875.Today, that price would equal $2,900.

(Click on image to enlarge)

In the grand scheme, it still looks cheap. With the tens of trillions of dollars unleashed globally in the Covid-19 pandemic’s wake, gold’s just getting started.

Although you might be a speculator without wanting or intending to, that doesn’t mean you have to take huge risks and can’t be intelligent about your allocations.

Cash and short-term deposits offer some degree of certainty, security, and flexibility. Stocks should continue higher for some time, especially with ongoing stimulus. They’re even a reasonable way to hedge inflation to some extent. But the bull market in stocks is only alive thanks to the Fed. And this historically long bull market is very long in the tooth.

Gold is Still Cheap

Precious metals are, in my view, entering the second half of their secular bull market that began in 2001.

Yet, they are still cheap. But in the near term, I recommend remaining cautious.

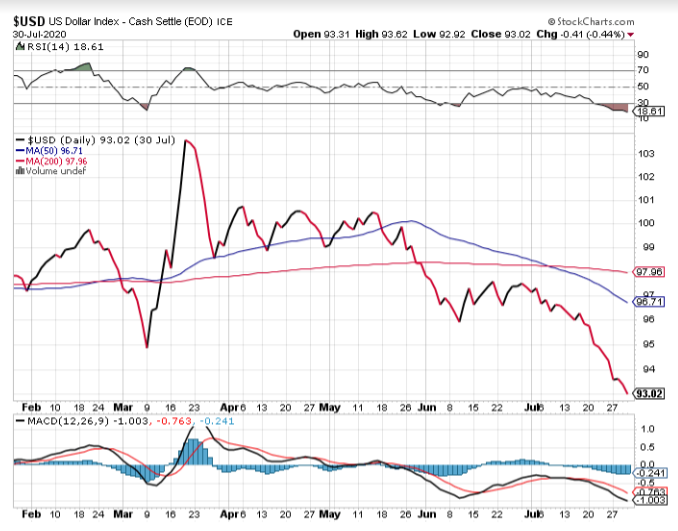

The sector has run up in large part thanks to the recent selloff in the US dollar.

(Click on image to enlarge)

Since peaking at 103 in mid-March, the US Dollar Index has become dramatically oversold. The RSI and MACD momentum indicators are confirming this.

Odds are good we’ll get a rally in the US Dollar Index to at least the 95 or 96 level, both previous support levels. That would likely weigh on the precious metals sector somewhat. But it’s going to be temporary.

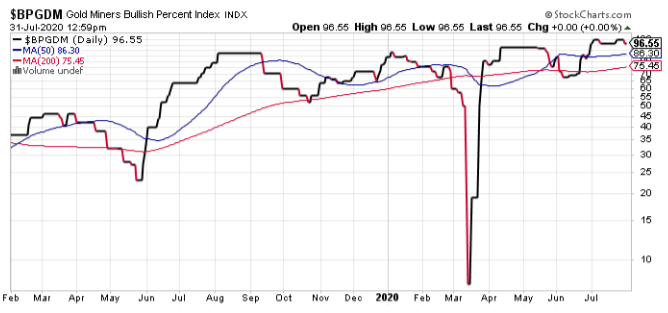

Consider too that the Gold Miners Bullish Percent Index is also suggesting the miners are very overbought.

(Click on image to enlarge)

With the index recently at an impressive 100 (meaning 100% of the stocks were in bullish technical patterns) being rare, and the current reading still at 96, there appears to be some froth in the sector.

However, despite this runup in gold and the miners, precious metals remain massively undervalued in the bigger picture versus practically every other investment sector.

Still, in the near term, odds are good you can buy in within a few weeks at better levels.

So don’t buy gold right now unless you don’t own any at all. As for the miners, I’d suggest holding off for a better entry point soon.

Stay tuned, and I’ll keep a close watch to let you know when time appears right.