Waiting On OPEC+

Energy

Oil prices continued to come under pressure yesterday, with ICE Brent settling 2.4% lower on the day. Uncertainty around the spreading of Covid-19 continues to weigh on sentiment, whilst comments from Saudi Arabia’s energy minister did little to support the market. Energy minister, Prince Abdulaziz bin Salman said that the group has not agreed to extend or modify the current deal yet. OPEC+ will be meeting in Vienna on the 5th & 6th March to discuss what action needs to be taken in order to offset the Covid-19 impact. We continue to hold the view that OPEC+ will need to extend current cuts, along with current Saudi over-compliance through until at least the end of June. However, if we do not see a return of Libyan supply over 2Q20, this will help reduce the burden for the rest of OPEC.

Moving onto China and Bloomberg reports that China Shipowners’ Association is set to propose to the government a delay in the implementation of IMO 2020 shipping regulations, which sees ships having to burn fuel with a lower sulphur content. The association has said that Covid-19 has had a significant impact on shipowners, given the fall in freight rates. The Chinese government has tried to help out domestic companies with the impact of the virus, and this has included issuing Force Majeure certificates. However, it is yet to be seen whether the government will allow ships to switch back to a higher sulphur content fuel. If this does happen though, we are likely to see a further narrowing in the VLSFO-HSFO spread.

Finally, the API released inventory numbers yesterday, which showed that US crude oil inventories increased by 1.3MMbbls over the last week, somewhat lower than the 2.6MMbbls build the market was expecting, according to a Bloomberg survey. The more widely followed EIA report will be released later today, and whilst there may be an immediate market response to the numbers, the market will likely shift its attention quite quickly back to the global demand story.

Metals

Indonesia is also feeling the impact from the Covid-19 virus, with a government minister saying that the outbreak in China is expected to delay US$11b worth of on-going nickel and stainless steel projects in the nation. As a result, this will likely see exports delayed by several months according to the minister. Delays are also expected in the Jakarta-Bandung high-speed rail project, which is a part of China’s ambitious “Belt and Road” infrastructure investment program.

Iron ore futures in China came under pressure yesterday, breaking ten consecutive days of gains. The latest data from Beijing Custeel E-Commerce shows that rebar inventories in China stood at 10.8mt as of 21st February, compared to 3.5mt at the start of the year. Recently, the China Iron and Steel Association highlighted its concerns over rising inventories and advised producers to limit output. Finally, the latest numbers from the World Steel Association show that global steel output in January totaled 154.4mt, up 2.1% YoY. This increase was driven predominantly by China, where output increased 7.2% YoY to total 84.3mt. Meanwhile, the EU saw a big decline, with steel production falling 12% YoY to 12.29mt. Looking ahead, and given the virus impact, we are likely to see Chinese steel output come under some pressure in February.

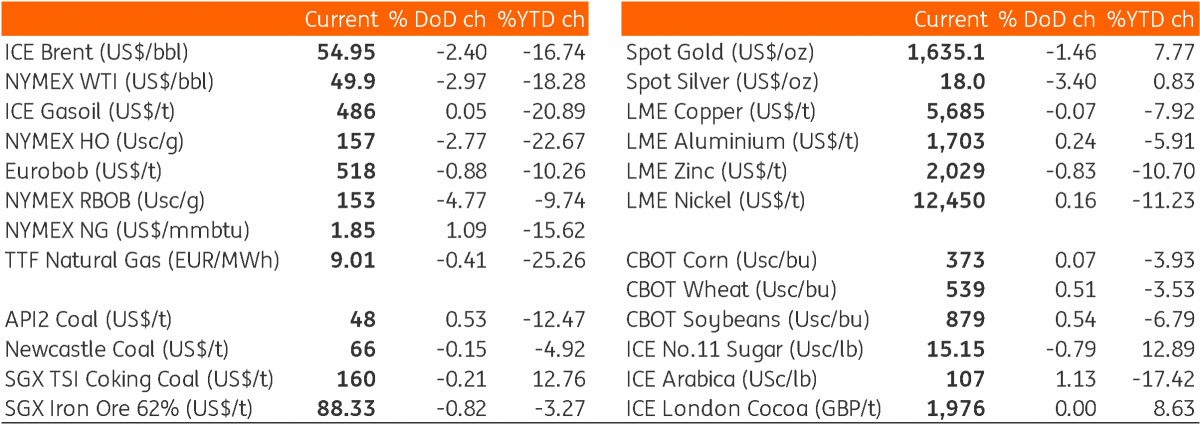

Daily price update

(Click on image to enlarge)

Bloomberg, ING Research

The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. more