Visualizing The Supply Deficit Of Battery Minerals (2024-2034P)

(Click on image to enlarge)

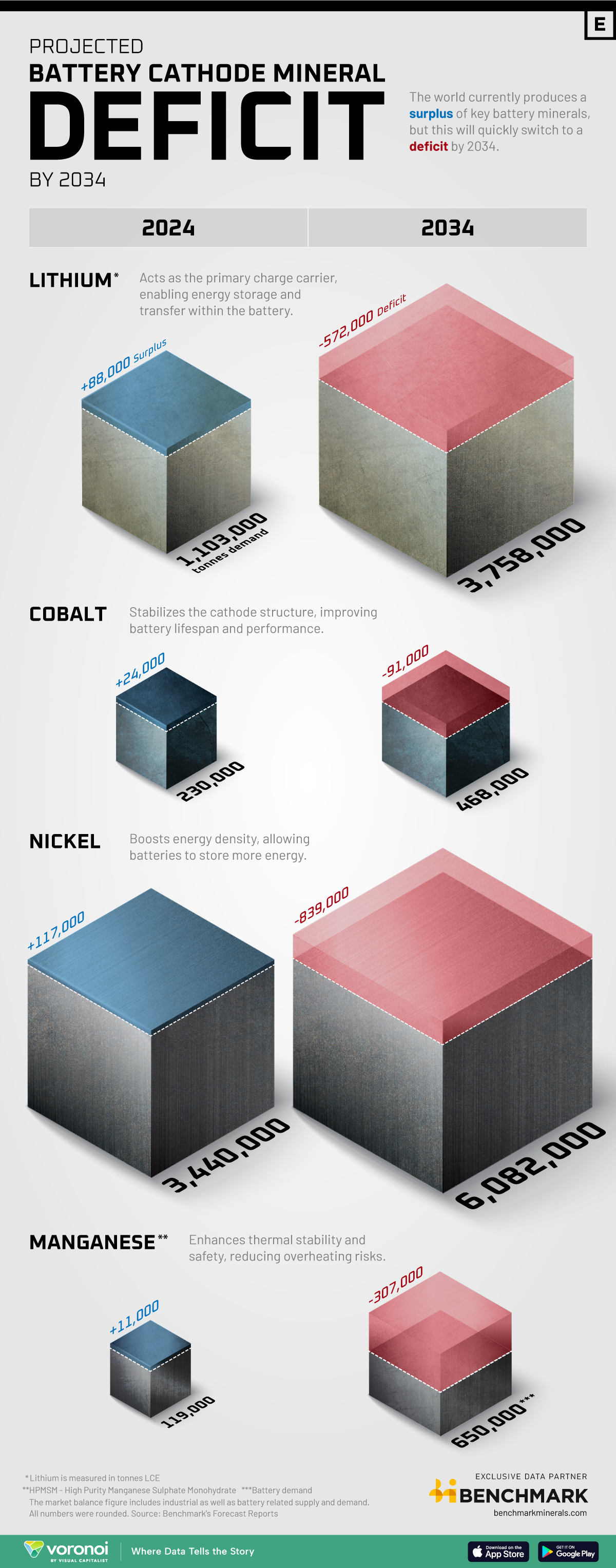

The world currently produces a surplus of key battery minerals, but this is projected to shift to a significant deficit over the coming decade.

This graphic illustrates this change, driven primarily by growing battery demand. The data comes exclusively from Benchmark Mineral Intelligence, as of November 2024.

Minerals in a Lithium-Ion Battery

Minerals make up the bulk of materials used to produce parts within the cell, ensuring the flow of electrical current:

- Lithium: Acts as the primary charge carrier, enabling energy storage and transfer within the battery.

- Cobalt: Stabilizes the cathode structure, improving battery lifespan and performance.

- Nickel: Boosts energy density, allowing batteries to store more energy.

- Manganese: Enhances thermal stability and safety, reducing overheating risks.

The cells in an average battery with a 60 kilowatt-hour (kWh) capacity—the same size used in a Chevy Bolt—contain roughly 185 kilograms of minerals.

Battery Demand Forecast

Due to the growing demand for these materials, their production and mining have increased exponentially in recent years, led by China. In this scenario, all the metals shown in the graphic currently experience a surplus.

In the long term, however, with the greater adoption of batteries and other renewable energy technologies, projections indicate that all these minerals will enter a deficit.

For example, lithium demand is expected to more than triple by 2034, resulting in a projected deficit of 572,000 tonnes of lithium carbonate equivalent (LCE). According to Benchmark analysis, the lithium industry would need over $40 billion in investment to meet demand by 2030.

Nickel demand, on the other hand, is expected to almost double, leading to a deficit of 839,000 tonnes by 2034. The surge in demand is attributed primarily to the rise of mid- and high-performance electric vehicles (EVs) in Western markets.

More By This Author:

Visualizing $102 Trillion Of Global Debt In 2024

How Big Is America’s Middle Class In 2024?

The S&P 500 Makes Up 51% Of Global Stock Market Value