USDX: What Counts More - Time Or Price?

After no significant action for a few days, something really interesting (finally!) happened in the markets. The trigger was quite random (Lagarde’s rather uninformative comments during a press conference; I’ll comment on that later today), but the way in which markets reacted was profoundly informative.

First Things First

I received a few questions about the situation in the USD Index, so let’s start today’s technical part with it.

Based on the rather random comment during the conference, the traders panicked and bought the EUR/USD, which triggered declines in the USD Index (after all, the EUR/USD is the largest component of the USDX).

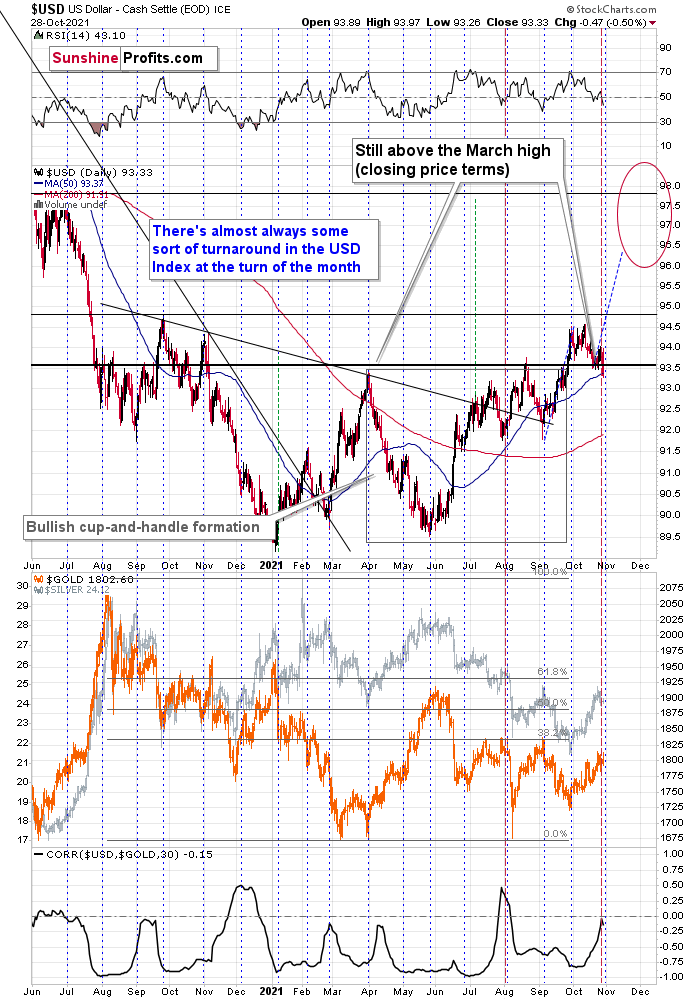

Was the breakout to new 2021 lows invalidated? No. The true breakout was above the late-March highs (the August highs also served as a support level, but the March high is more important here) and it wasn’t invalidated.

What was the follow-up action? At the moment of writing these words, the USDX is up and trading at about 93.52, which is just 0.07 below the August high in terms of the closing prices. Consequently, it could easily be the case that the USD Index ends today’s session (and the week) back above this level.

You’ve probably heard the saying that time is more important than price. It’s the end of the month, so let’s check what happened in the case of previous turns of the month; that’s where we usually see major price turnarounds. I marked the short-term turnarounds close to the turns of the month with horizontal dashed blue lines, and it appears that, in the recent past, there was practically always some sort of a turnaround close to the end of the month. Consequently, seeing a turnaround (and a bottom) in the USD index now would be perfectly normal.

Moreover, please note that despite USD’s sizable daily decline, gold was barely up. This is not a bullish type of reaction for the PMs, but a bearish one.

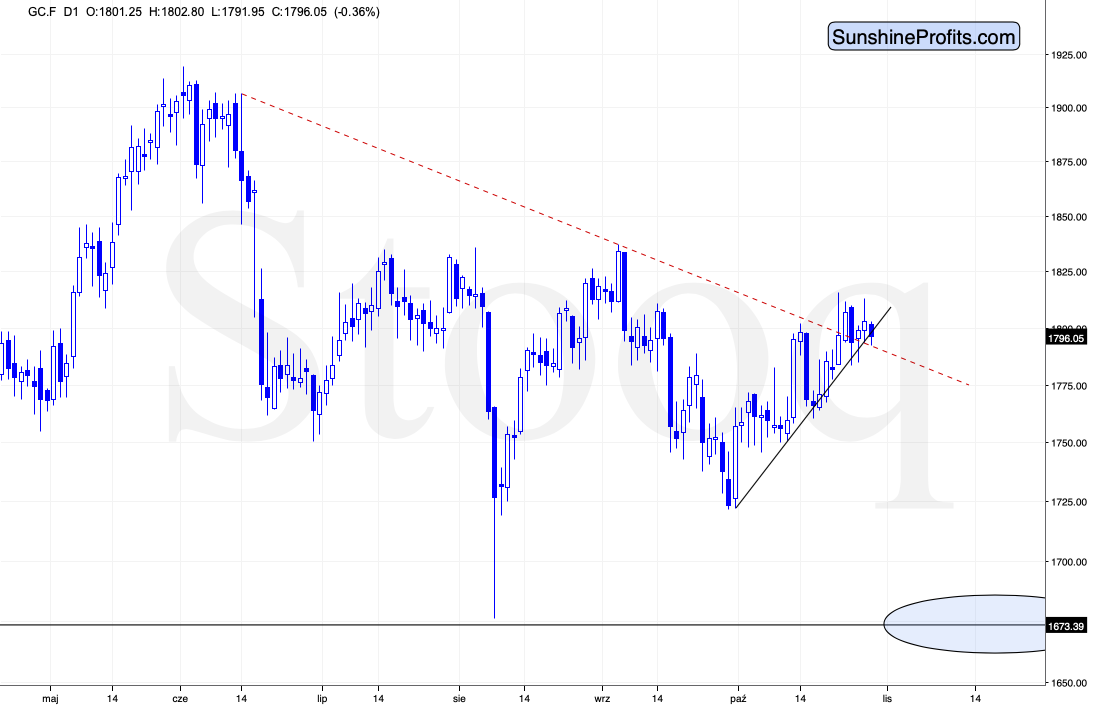

While the price of gold moved higher yesterday, please note that yesterday’s turnaround took place at the triangle-vertex-based reversal, and the fact that we saw another intraday reversal makes the current situation even more similar to what we saw in early August before the sizable slide.

Just a little more weakness and we’ll see a short-term breakdown that could take gold much lower very quickly.

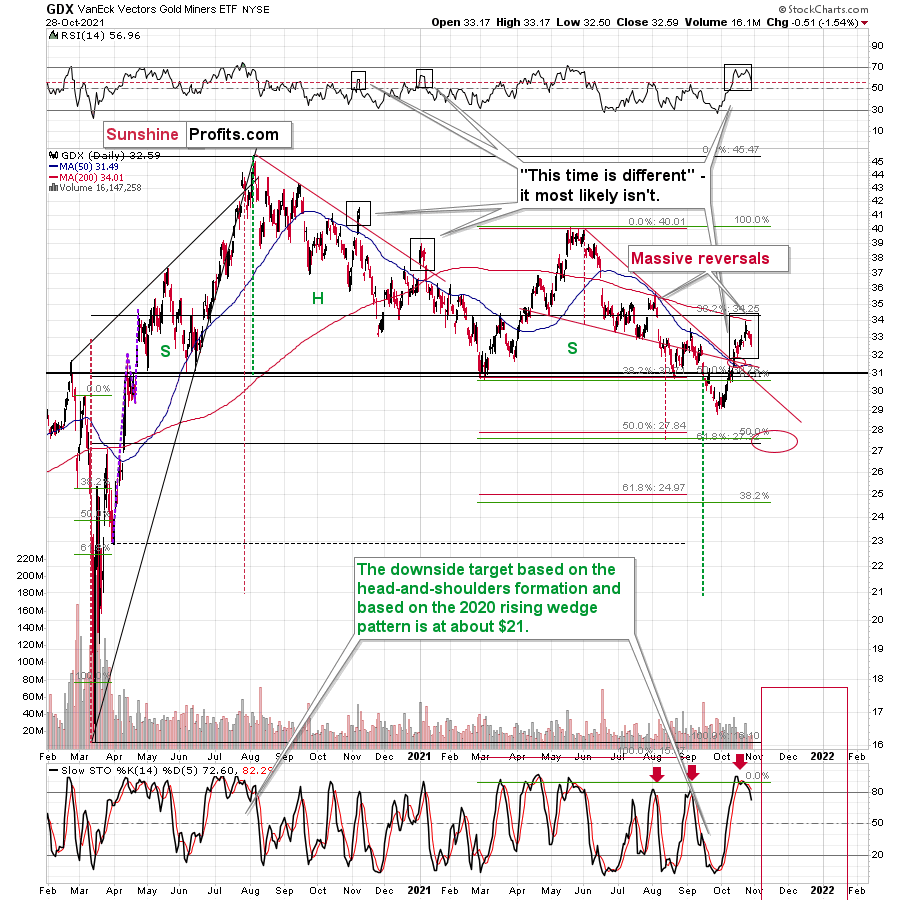

Yesterday’s price action in gold stocks confirms this scenario.

Even though gold ended the day slightly up, the mining stocks (GDX) were down by over 1.5%. In yesterday’s analysis, I emphasized that the days of miners’ strength relative to gold are likely numbered. Yesterday’s performance appears to confirm that and thus the next downswing seems to have already begun.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more