USDX: More Sideways Trading Ahead?

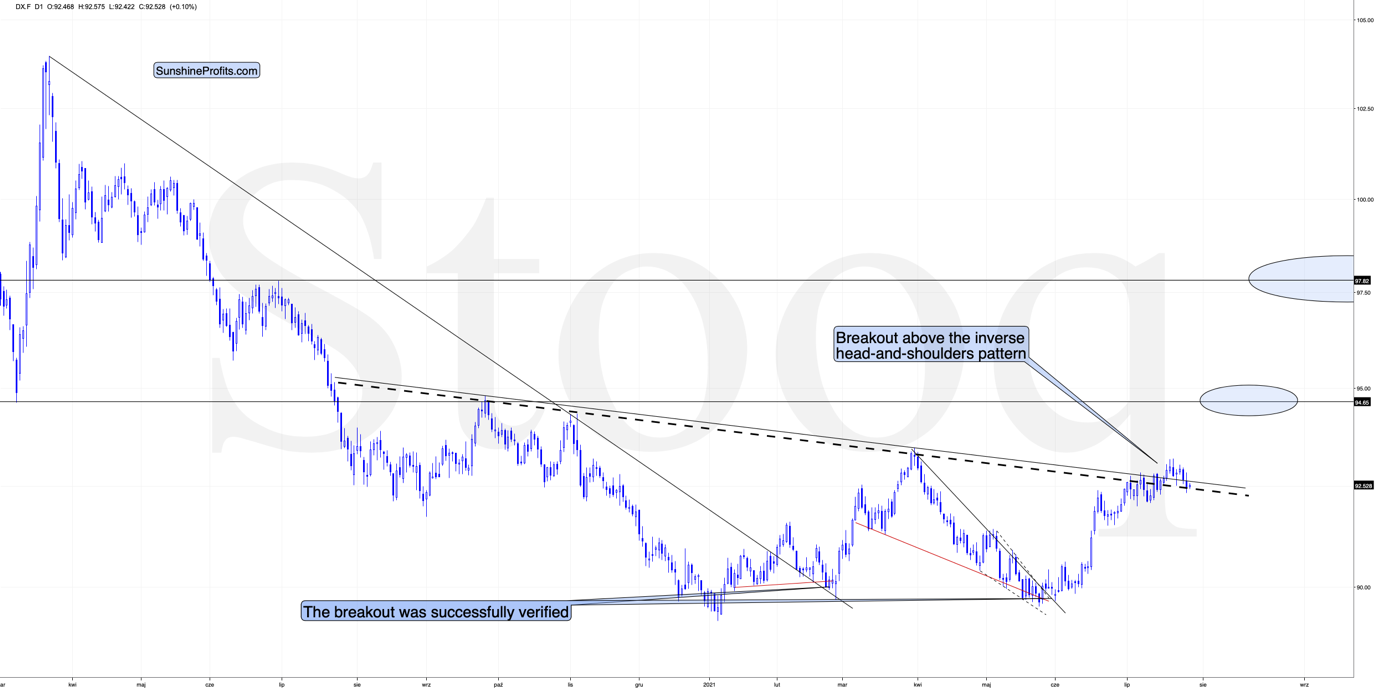

The USDX reportedly invalidated its bullish H&S pattern yesterday, but did it actually do so? The line based on daily closing prices says otherwise.

Yesterday’s (Jul. 27) supposedly big news was the breakdown below the neck level of the inverse head-and-shoulders pattern in the USD Index. Invalidations of breakouts are bearish, and what’s bearish for the USDX is usually bullish for gold, silver, and mining stocks. So, what happened? And what didn’t happen?

What happened was that the USD Index moved a bit below the declining neckline based on the previous intraday highs.

What didn’t happen was the move below the declining neckline based on the previous highs in terms of daily closing prices (dashed line).

So, was the breakout really invalidated? Not necessarily, especially that the USDX is moving back up in today’s pre-market trading (at least at the moment of writing these words).

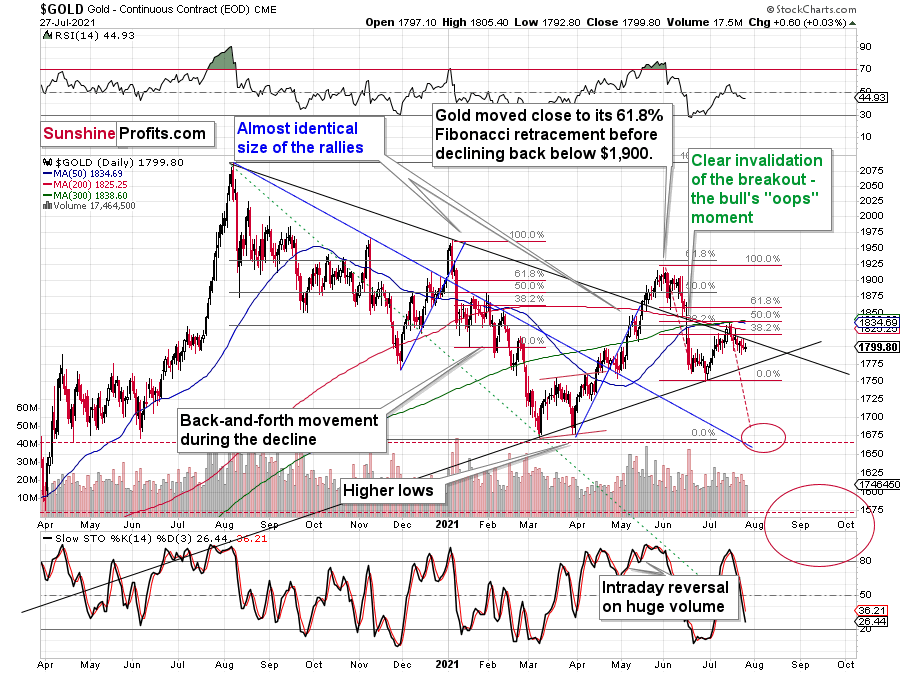

Moreover, while the USD Index moved lower yesterday, gold refused to rally.

To be precise, it did move higher, but only by $0.60, so it generally ignored the USD’s movement.

Consequently, yesterday’s session might have seemed to be a game-changer at first sight, but it seems much more likely that it wasn’t one. In my view, yesterday’s price movement was the continuation of the back-and-forth trading that’s analogous to what we saw in the first half of June. Gold was moving back and forth in a boring manner then too. The boredom was over quite quickly and a big short-term slide followed – I think the same is likely to happen shortly.

Gold Miners’ Aid

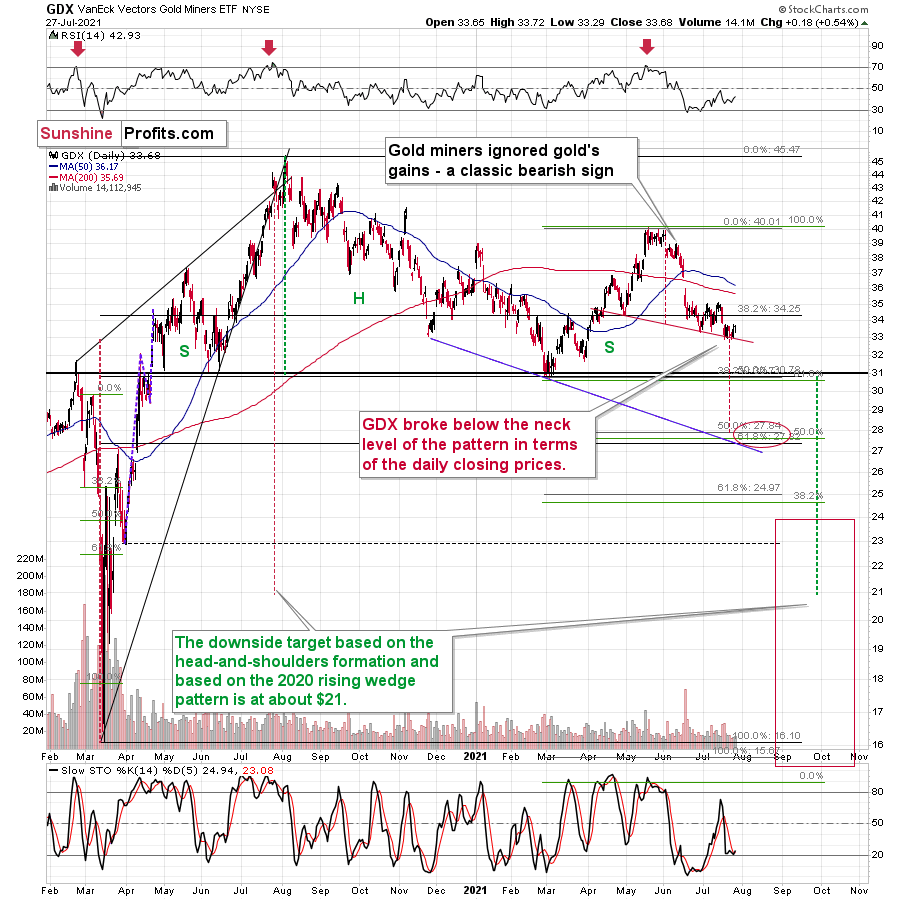

Mining stocks’ performance also supports this scenario.

If it was the beginning of another sizable move higher in the PMs and miners, the latter would be likely to show strength before gold. And that’s not taking place.

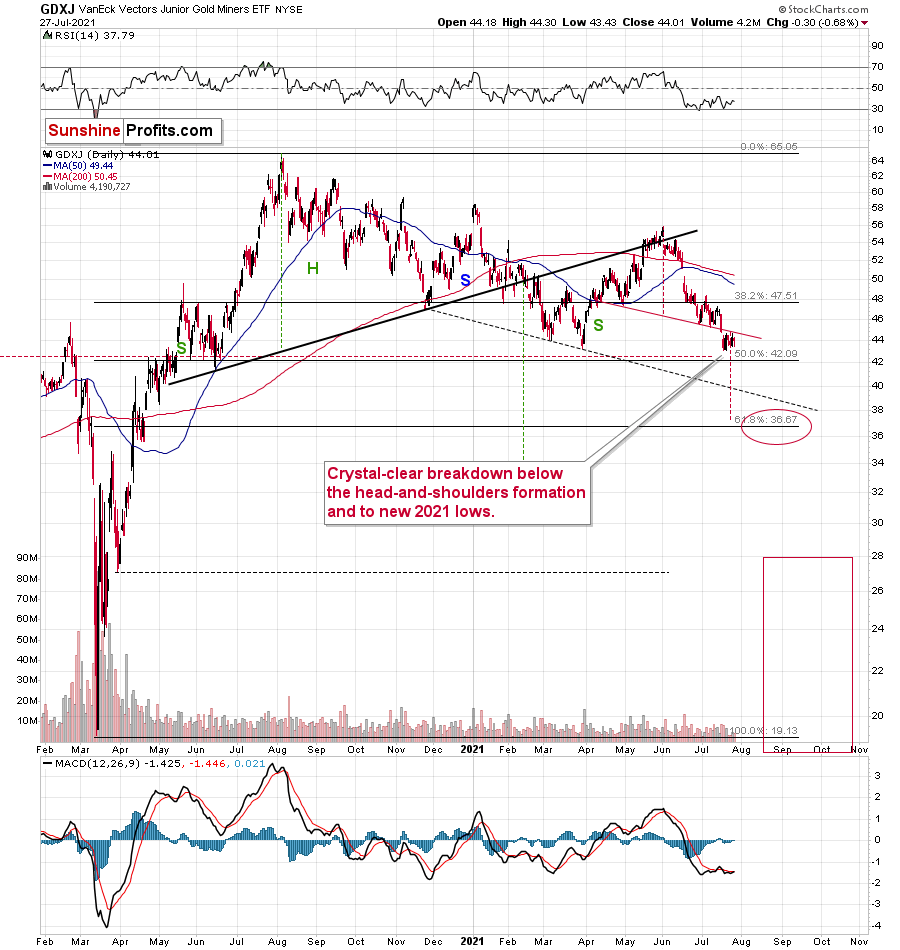

Senior gold miners were practically flat yesterday, just as gold was – that is, only slightly higher. On the other hand, junior gold miners ended the session slightly lower – very close to their previous 2021 lows.

Junior miners (the GDXJ ETF) haven’t invalidated the breakdown below the neck level of the bearish head and shoulders formation. Consequently, the very bearish implications of the breakdown remain intact.

All in all, the precious metals sector seems poised for another move lower, quite likely to the previous yearly lows in the case of gold and well below the previous 2021 lows in the case of the mining stocks. Yesterday’s decline in the USD index doesn’t change that. To clarify, the above-mentioned targets will most likely be just interim stops within an even bigger decline that will get us to the ultimate buying opportunity for the PMs and miners later this year.

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more