USD/CAD Outlook: Weakening Buyers Amid Fed, Stable Oil Prices

- The USD/CAD outlook stays positive near 1.3950 amid cautious sentiment.

- The dollar stays pressured due to the ongoing US government shutdown and dovish Fed rate cuts.

- The Canadian dollar strengthens due to stable oil prices and a balanced BoC Outlook.

The USD/CAD outlook maintains a positive stance as the pair holds near 1.3950, signaling minimal market volatility as traders witness the current US government shutdown. The markets are also affected by the ongoing Federal Reserve rate expectations and the forthcoming Canadian employment figures. Traders remain sidelined in the subdued markets, awaiting monetary policy signals.

In Washington, the political impasse now enters its eleventh day. Because of this, the US government has yet to release the much-anticipated September Nonfarm Payrolls report. The situation affects more than 750,000 federal employees due to unpaid work, which further aggravates the economic outlook. Analysts emphasize that if no agreement is reached within the next 2 weeks, the US economy risks losing up to $3 billion, widely affecting consumer and business markets.

Moreover, the US dollar shows signs of exhaustion as the DXY index fluctuates to 98. The market speculates whether the Fed would accelerate rate cuts to combat potential fiscal drag. CME FedWatch cites that traders anticipate a 92% probability of a 25 bps rate cut in the FOMC meeting held on Oct 29 and a further probability of 81% of another cut in December. This shift reflects that the Fed might prioritize growth stability instead of inflation concerns amid restricted access to current economic data.

On the Canadian side, the Bank of Canada witnesses a balanced outlook. As the inflation eases and growth slows, policymakers are pressured to favor easing. However, the markets are pricing in a 55% probability of a 25 bps cut in October. This difference in expectations of rate cuts between Ottawa and Washington signals that the interest rate differential could narrow further. So, it could favor the Canadian dollar in the medium term.

The oil prices witnessed a recovery after OPEC’s decision to slightly increase production of 137,000 barrels per day for November. Despite the smaller increase, it cautioned the producers. Additionally, it raised oil benchmarks and boosted demand for the Loonie.

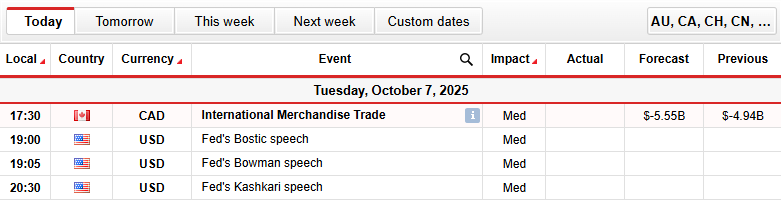

USD/CAD Key Events Today

Main events due on the day include:

- International Merchandise Trade

- Fed’s Bostic speech

- Fed’s Bowman speech

- Fed’s Kashkari speech

In the upcoming days, investors will be closely paying attention to Fed officials Bostic and Kashkari’s speeches and the Canadian Jobs report for any signals. If the data indicate a waning US growth and a strengthening Canadian labor market, the US dollar is bound to weaken further.

USD/CAD Technical Outlook: Bulls Shy of 1.4000, Aiming for 200-DMA

USD/CAD daily chart

The USD/CAD daily chart indicates a solid bullish trend since the middle of July. The pair trades near 1.3956, at the time of writing. The price lies above the 50-day and 100-day moving averages.

While the momentum is bullish, some resistance can be seen near the 1.4000 psychological level. Furthermore, the 200-day moving average sitting at 1.4100 could halt the upside. The RSI above 60.0 suggests a bullish trend, which is near overbought territory.

So, a minor pullback could take place. If the pair stays above 1.4000, the gains may extend toward 1.4200. Contrarily, failing to stay above 1.3800 could slide towards the 1.3700 support.

More By This Author:

EUR/USD Forecast: Slips To 1-Month Lows Amid French PoliticsUSD/CAD Weekly Forecast: Weaker Oil, Trade Data Weighs On Canadian Dollar

Gold Forecast: Aiming For $4,000 Amid Rate Cut Bets, Geopolitics

Disclaimer: Foreign exchange (Forex) trading carries a high level of risk and may not be suitable for all investors. The risk grows as the leverage is higher. Investment objectives, risk ...

more