US S&D Changes Usually Limited, But Strong Bean Sales Tightens Stocks

Market Analysis

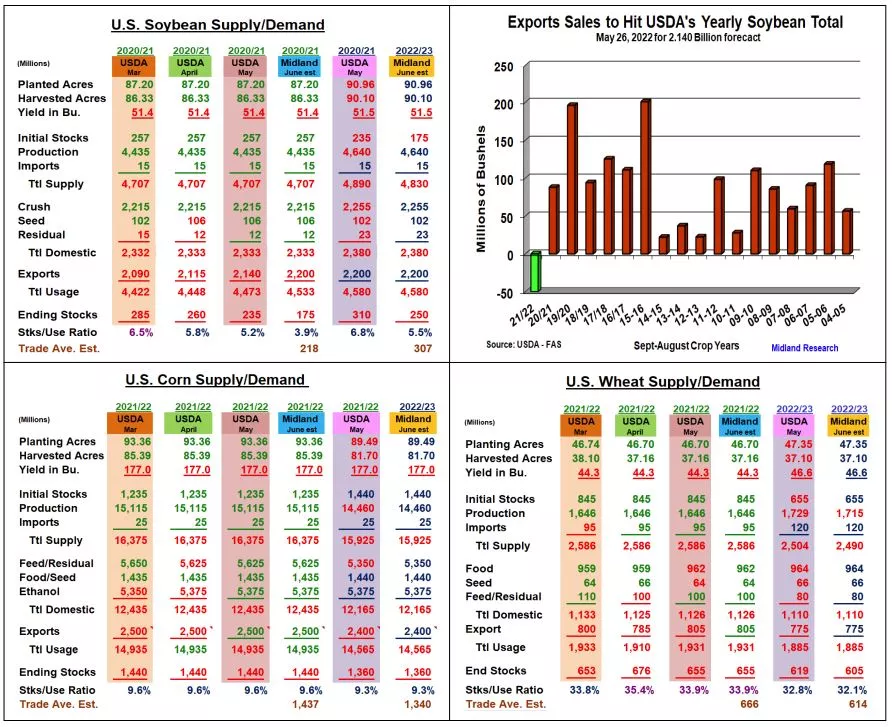

The USDA’s June 10 monthly balance sheets traditionally have modest changes after May’s initial US & World new crop supply/demand updates.

Despite last month’s late spring 4 bu cut in corn’s US 2022/23 yield to 177 bu from the Ag Forum, no changes in corn or soybeans 2022 output are expected ahead of USDA’s June 30 US acreage report. Recent domestic monthly crush & processing data along with current US export activity could cause some oldcrop US demand changes.

The USDA will also issue their 2nd US W. Wheat crop update on Friday.

Soybeans’ April US soybean crush of 180.9 million bu was slightly better than expected. With 4 months left in the crop year, the USDA may leave this demand unchanged given the monthly pace is only 180.6 million. Given the current US exports are 50 million bu over the USDA’s 2.14 billion forecast, this demand could be increased by 50-60 million to 2.2 billion bu.

The current 300 mil. of shipments has some traders expecting only a 20-30 million jump in old crop export demand. However, 3 out of the last 4 years, summer oversea shipments have been above this level. This suggests old-crop stock could be cut to 175 million which will also reduce new-crop’s forecast to 250 million.

April’s seasonal bio-plant maintenance corn use was 414 million bu. With May’s 5% higher ethanol output & summer’s usual strong gas demand, the USDA’s 5.375 billion 21/22 demand maybe left unchanged. However, record gas prices could destroy some fuel demand this summer.

Exports have been strong, but sales have slowed recently. With only 12 million bu average weekly pace, the USDA should leave exports unchanged, too. Overall, June old and new-crop stocks may be left untouched this month.

Wheat’s old-crop US demand levels normally have limited changes. New-crop’s balance sheet is determined by June’s W. wheat crop size. May rains in the central & eastern Plains will boost yields, but dryness in western areas suggests 14 million smaller crop to 1.16 billion bu.

This decline could reduce 2022/23 stocks to 605 million.

What’s Ahead:

Going into the USDA’s June 10th crop and S&D reports, we continue to hold our small oldcrop & modest 25% new-crop corn & soybeans sales. However, July soybeans have approached their spring highs.

Be prepared to half old-crop sales on strength above $18 & increase new-crop sales to 30-35% on Nov values above $16.00.

Hold corn & wheat sales with lower plantings on June 30 acreage report.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more