US Retail Sales Growth Slowest In 13 Months As Online Spending Plunged

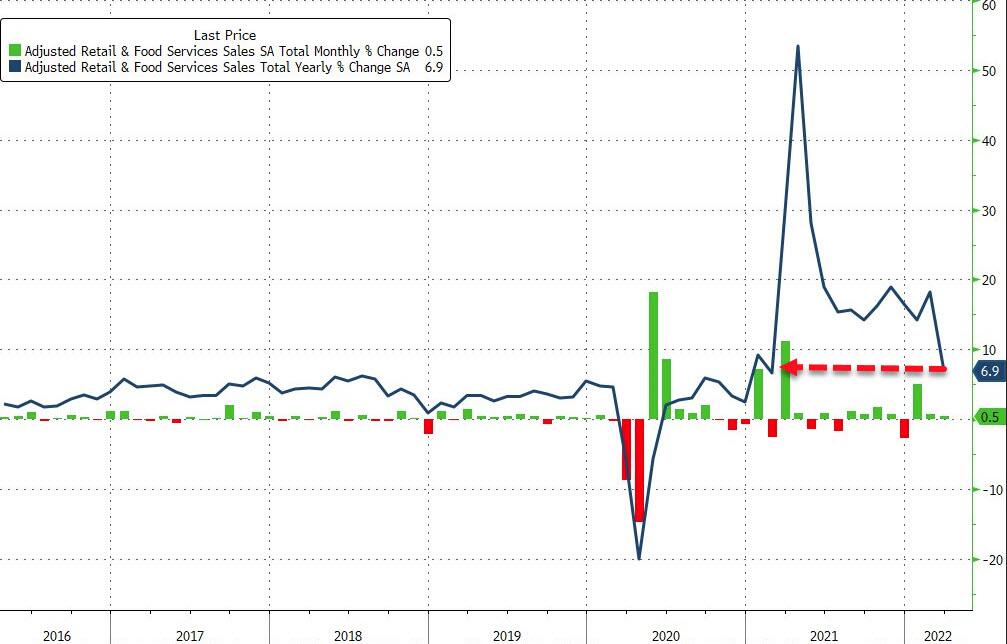

Americans' credit cards are taking a beating - as was evident in the plunge in the savings rate and the surge in revolving consumer credit - to enable them to keep the dream alive and spend beyond their means and that over-reach enabled them to increase retail sales spending by 0.5% MoM - as expected in March. Notably, the rise in retail sales year-over-year is decelerating dramatically (up only 6.9% YoY - the lowest since Feb 2021)...

(Click on image to enlarge)

Source: Bloomberg

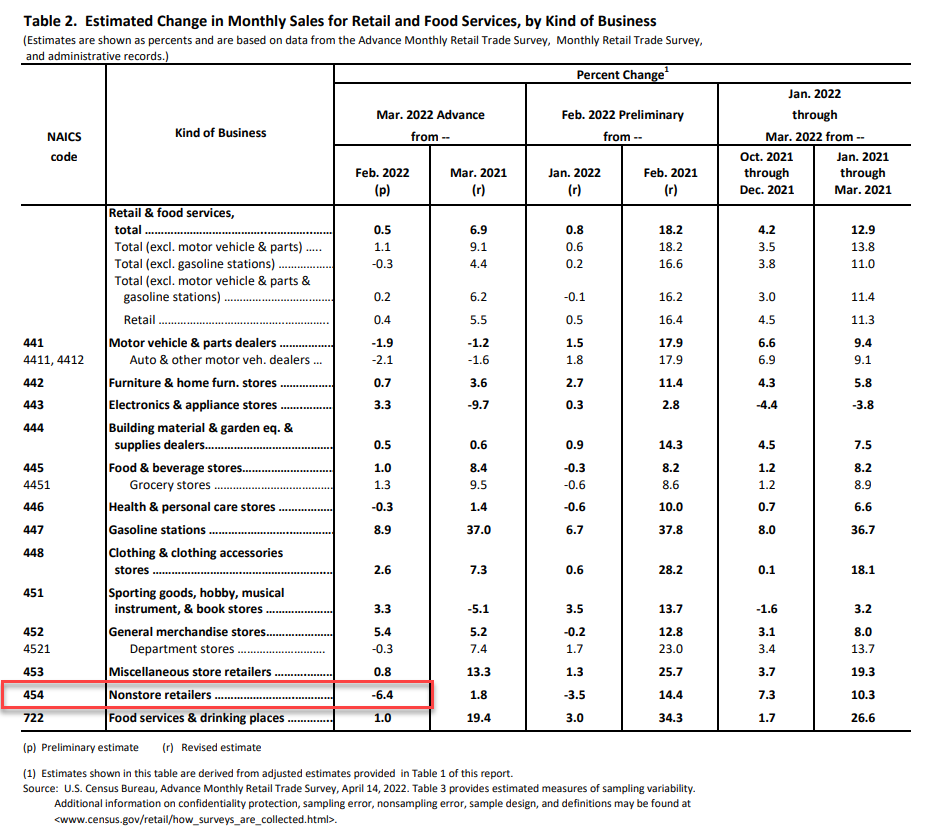

The relative weakness was driven by a huge drop in non-store retailer sales (online) MoM leaving sales up just 1.8% YoY.

(Click on image to enlarge)

However, before everyone celebrates this rise in retail sales, we note that the 'Control Group' - which filters to the GDP calculation - unexpectedly dropped 0.1% MoM (vs a 0.1% MoM rise expected).

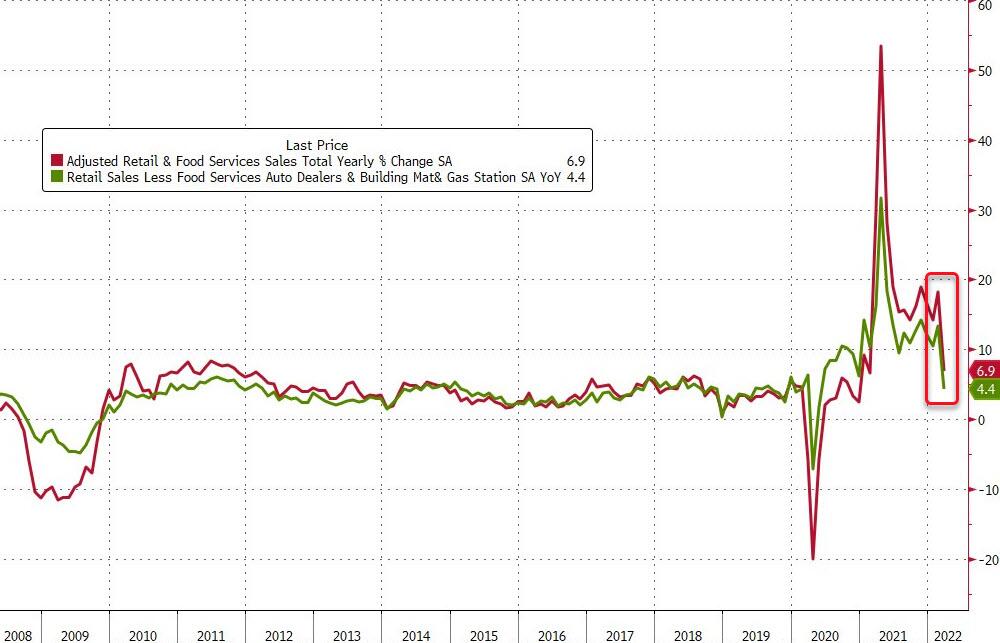

Both goods and services sales growth slowed dramatically in March...

(Click on image to enlarge)

Source: Bloomberg

Finally, as a reminder, retail sales data is nominal - i.e. not adjusted for inflation. While the two data series are not 'fungible' per se - i.e. not weighted the same by-product - we can get some idea of 'real' retail sales by reducing the headline data by CPI... It was negative for the second straight month...

(Click on image to enlarge)

Source: Bloomberg

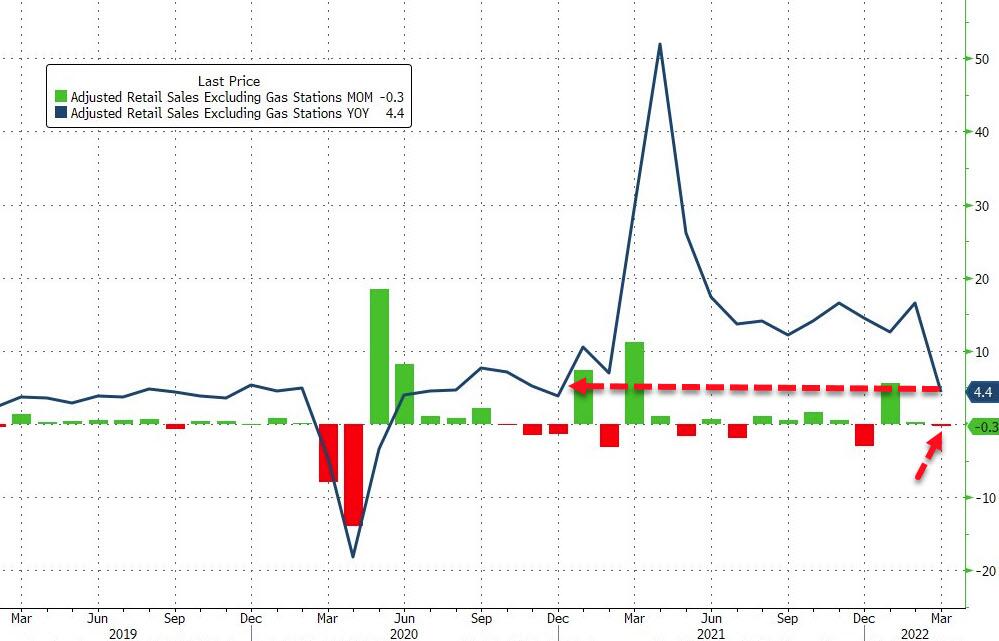

Additionally, the March advance was led by an 8.9% jump in spending on gasoline. Excluding receipts at gas stations, sales fell 0.3% last month.

(Click on image to enlarge)

Source: Bloomberg

Of course, don't forget that real wages growth has been negative for 13 straight months.

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more