US Plains Weather And The Black Sea Conflict Remain Price Factors

Market Analysis

For the third year, the Kansas wheat crop tour will not occur before the USDA’s May winter wheat crop report out on May 12. Two years ago, the tour was canceled because of the coronavirus. Kansas State’s main wheat agronomist & district observers provide virtual field assessments from across the state. The Wheat Associates staged a Kansas tour starting on May 17 with their results being published the following week. This year’s event begins on May 16 in Manhattan & proceeds to Colby, then Wichita, and back to KC on Thursday with results announced that afternoon. 2022’s dryness & crop development probably was the reason for this year’s later start.

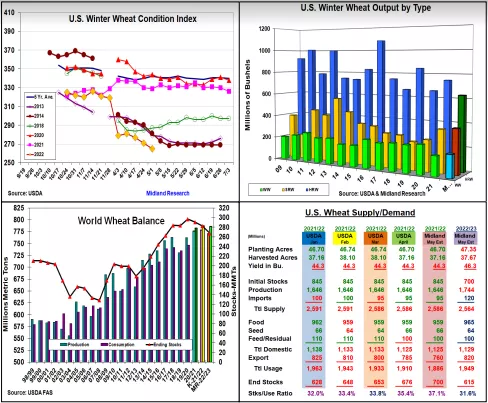

2022’s 236,000 increase in hard red acres & 588,000 jumps in total US winter wheat plantings probably won’t increase this year’s W. wheat output given the extensive drought in the SW. Major states of KS, OK, and TX good/excellent ratings of 25%, 17% & 8% are the lowest in decades, The current record US total wheat index of 265 (includes 43% very poor & poor national ratings) suggests 2022 harvested area could drop 549,000 vs March’s 588,000 rises in overall US WW plantings. This year’s HR crop may only be 629 million bu, down 120 million from 2021. Better conditions in the Eastern US & PNW suggests 375 & 190 million bu SR & WW crops. A 1.194 billion bu 1st USDA WW crop is expected, off 83 million from 2021.

Including spring & durum outputs of 550 million, 2022’s US wheat crop could be up nearly 100 million to 1.744 billion bu. The USDA also issues their 1st 2022/23 world wheat supply/ demand data this month. Currently, prospects appear mixed with the Black Sea, US & Canada up while Europe, Argentina & Australia possibly down leaving the major world producers about unchanged. India, N Africa & Mideast crops look smaller prompting 7 mmt smaller world crop of 771. With demand likely holding steady, the world’s stocks could drop 268 mmt & the smallest stocks/use level since 2017.

Sluggish US old crop exports could raise 2022 stocks by 25 million or more, but new crop's US total supplies could be smaller than last year. Even with a modest rise in exports, US wheat stocks could dip to 615 million bu in May’s US update.

What’s Ahead:

The next 30-45 days of US weather in the S Plains remain highly important to the upcoming 2022 US wheat output. The impact of the ongoing Black Sea conflict on Ukraine’s harvest and trading activity will be a major factor in the world’s export flows and prices. Hold any remaining old crop supplies if prospects have been poor. Keep your new-crop 2022 KC & Chicago sales at 20-25%.

Disclaimer: The information contained in this report reflects the opinion of the author and should not be interpreted in any way to represent the thoughts of any futures brokerage firm or its ...

more