US Oil Inventories Falling Farther Below 5yr Average, Demand Not Slowing

“Davidson” submits:

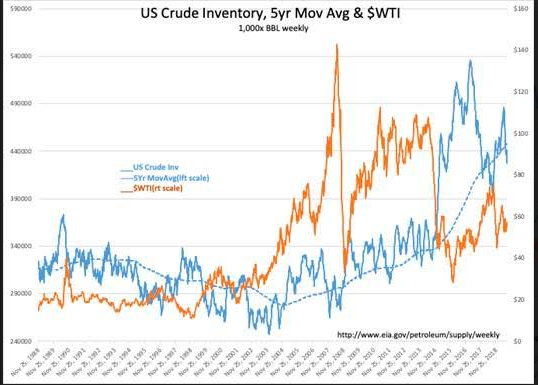

US Crude Inventories fall to 33mil BBL below the 5yr mov avg. Previous instances when this has occurred has resulted in traders driving $WTI higher.

- US Crude Inv 33mil BBL below 5yr mov avg

- US Oil Production 12.4mil BBL/Day

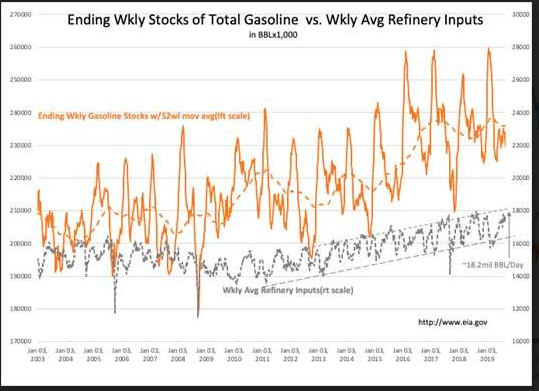

- US Gasoline Stocks seasonally low prior to fall maintenance/catalyst change-over

Refinery Input should have reached 18.2mil BBL/Day at the peak. It did not due to major refinery outages. Gasoline inventories have been drawn down as a result with summer travel usage. This also resulted in a period of higher crude inventories which investors interpreted as perceived due to slow economic activity which helped to keep traders pessimistic. Thus far, crude inventories have fallen 33mil BBL below the 5yr mov avg. Previous instances when crude inventories fell below the 5yr mov avg have resulted in a period of significant $WTI price appreciation due to the perception of oil shortages relative to economic activity.

Market psychology plays a bigger roll in $WTI pricing than does economic demand (shown in previous studies). While $WTI is well correlated with US Crude Inv vs Inv 5yr mov avg and there is an expectation that traders will respond as they have in the past, there is no guarantee that market psychology will repeat. In my opinion, we are likely to see the same response as witnessed historically primarily due to continued economic expansion not being a factor in consensus outlook. Trader perceptions of higher oil prices and economic expansion tend to be correlated.

Disclosure: The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or ...

more