U.S. Oil Bullish Impulse Tests $130

(Click on image to enlarge)

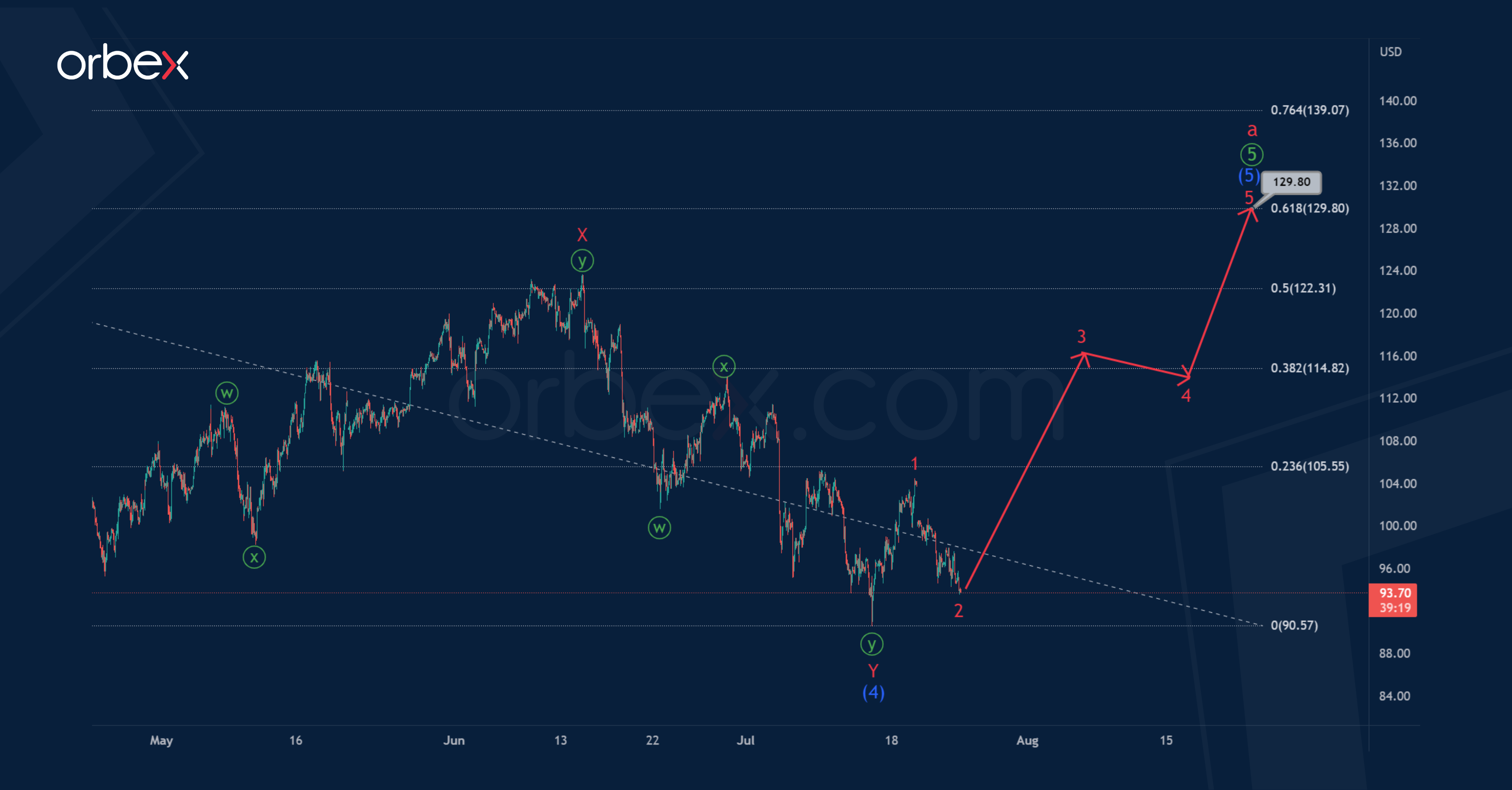

U.S. Oil suggests the development of the final part of the global impulse wave of the cycle degree. The 1H timeframe shows the final primary wave ⑤ which takes the form of an intermediate impulse.

Currently, an intermediate correction wave (4) ended as a minor zigzag. Then prices began to rise in the intermediate wave (5). The intermediate wave (5) could take the form of a standard minor impulse 1-2-3-4-5, as shown on the chart.

The end of the specified pattern is likely near 129.80. At that level, wave (5) will be at the 61.8% Fibonacci extension of impulse (3).

(Click on image to enlarge)

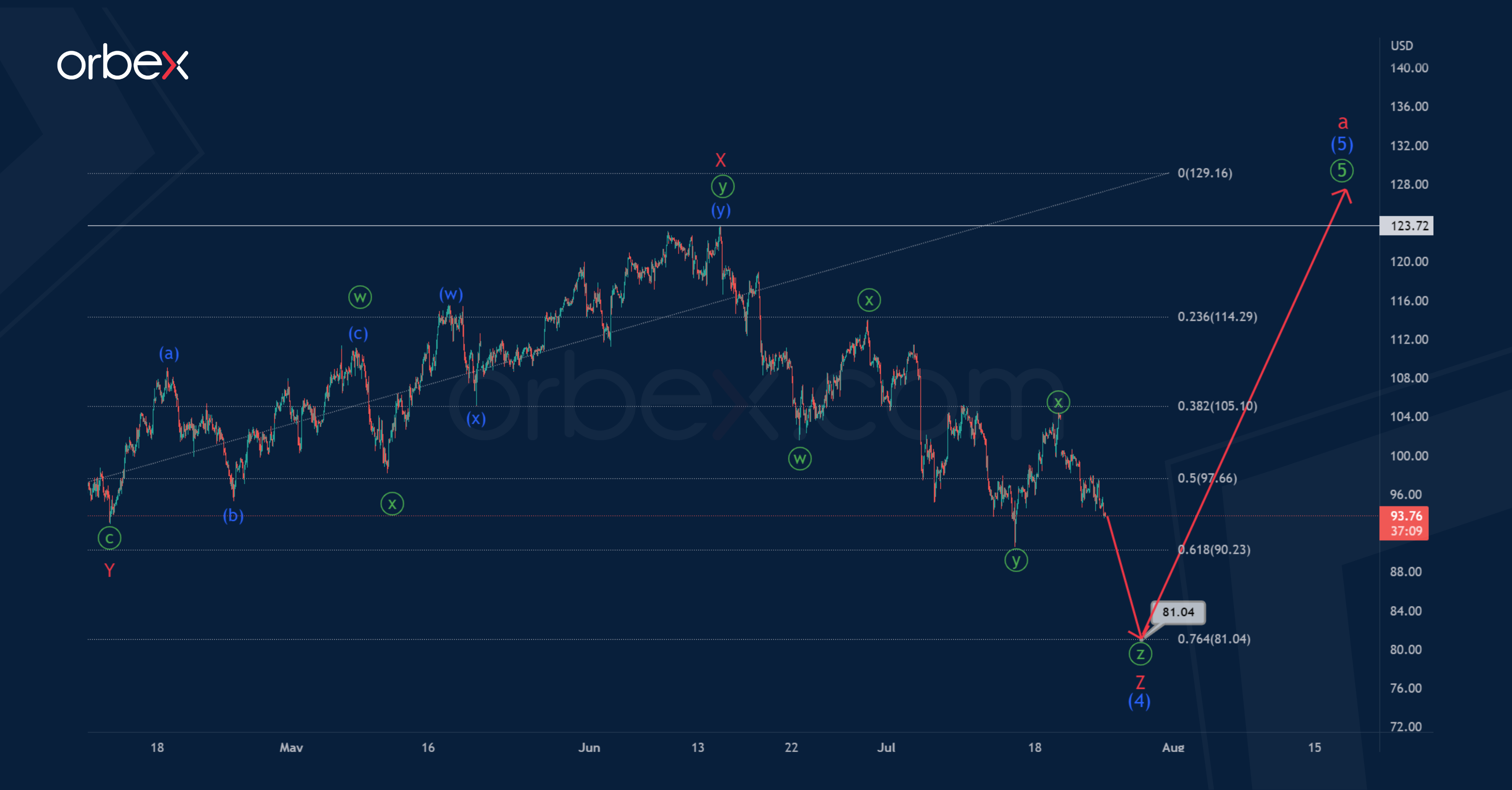

According to the alternative, we see that the construction of the intermediate correction (4) can be continued. Perhaps it will have the form of a triple three W-X-Y-X-Z.

The minor sub-waves W-X-Y-X look complete. Thus, in the near future, prices could lower in the actionary sub-wave Z. This can be completed in the form of a minute triple zigzag ⓦ-ⓧ-ⓨ-ⓧ-ⓩ.

The oil price could fall to 81.04. At that level, intermediate correction (4) will be at 76.4% of impulse (3).

After the end of the flat, the market is expected to grow above the maximum – 123.72.

More By This Author:

Will UK June CPI Change The BOE’s Rate Trajectory?

USDCNH Minor Wave Y To Complete Intermediate Correction (4)

Intraday Market Analysis – AUD Builds Support

Disclaimer: Orbex LIMITED is a fully licensed and Regulated Cyprus Investment Firm (CIF) governed and supervised by the Cyprus Securities and Exchange Commission (CySEC) (License Number 124/10). ...

more