US Housing's Collapse Vs. Gold And Silver Picks Up Steam

Image Source: Pixabay

This week, we will look at the median price of a single-family home sold in the United States vs Gold and Silver and see that, despite what your eyes might be telling you about home prices remaining stable to only slightly lower from their 2022 high, a historic collapse is currently unfolding when measured against real money.

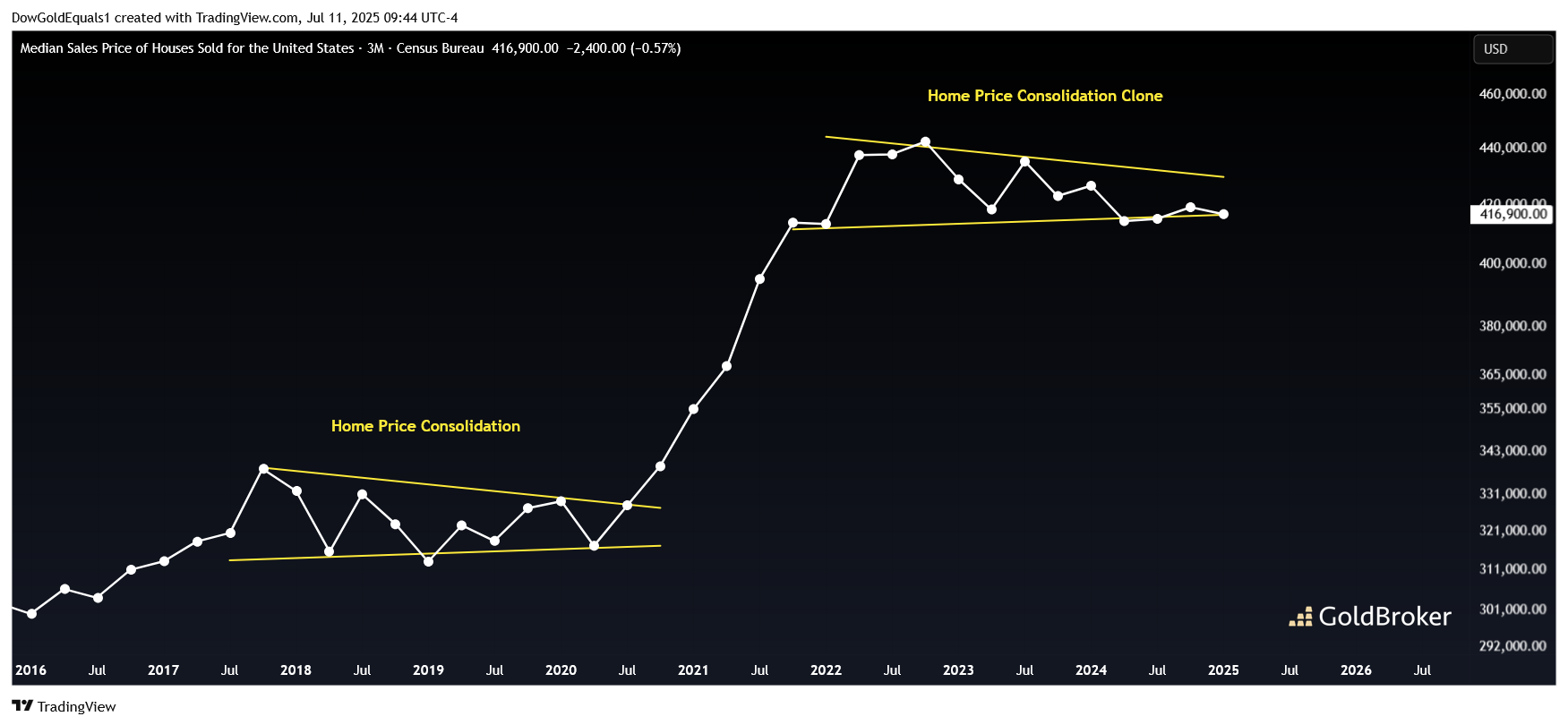

First, let's look at median home prices measured in U.S. Dollars. At first glance, the home market seems pretty healthy, down just 5% from 2022 and seemingly building out a consolidation that is very similar to the one we saw from 2018-2020 before prices took off. And if you believe your local real estate salesperson when they tell you "prices always go up," now might seem like a great time to take advantage of the recent dip in prices.

However, let's take a look at home prices vs. gold and see what that is telling us. While the channel in which I have defined this chart remains speculative for now pending a lower rail touch point, there is one certainty: we have just experienced a major quarterly breakdown from the trendline connecting the 1980 and 2011 lows. This is extremely significant technical damage that strongly suggests you are much better off saving your U.S. Dollars in gold rather than single-family homes right now. Should the ratio indeed find its way to the lower channel, that would give us $5,750 gold at the current level of median home prices. Should home prices break out of the consolidation we looked at in the first chart, the price of gold would be much higher.

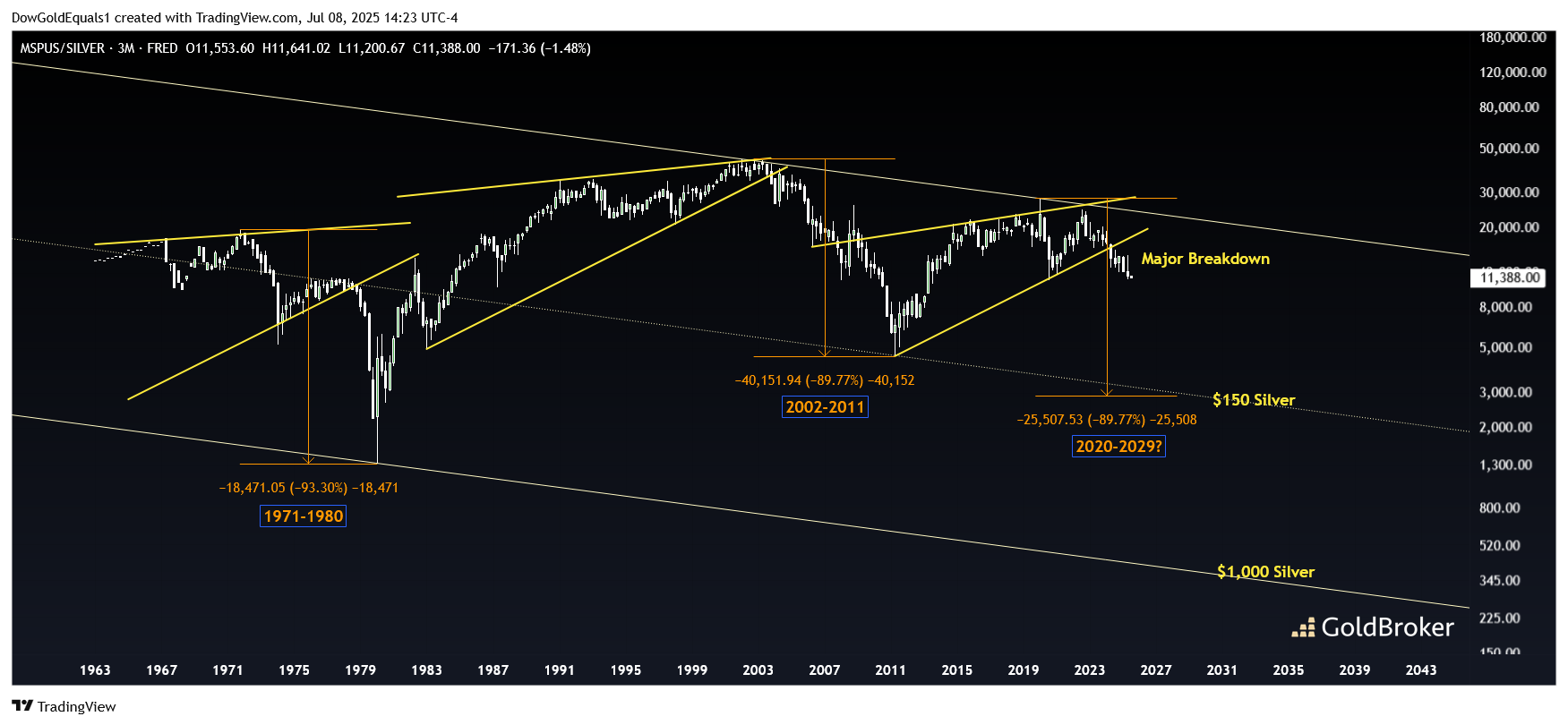

If you think home prices vs. Gold is significant, then home prices vs. Silver is mind-blowing! I have defined the chart as a series of bearish rising wedges within a descending channel. The last two wedge breakdowns lead to home prices falling about 90% against Silver within a nine year period! Now that we have just witnessed a third breakdown, history suggests that a similar move lower would yield triple-digit silver if home prices remain stable. Again, should home prices break out of their consolidation, Silver would rise even higher than the $150 target listed. A trip all the way to the lower level at current home prices would yield $1,000 Silver, which I consider an extreme outcome at this point, but I have labeled it because I think we are headed in that direction.

If you're considering buying a home in the US, you may be much better off saving your capital in gold and silver over the next several years.

More By This Author:

Rio 2025: BRICS In A Position Of Power?China And The Revaluation Of Precious Metals

U.S. Debt: Bessent's Crazy Gamble

Disclosure: GoldBroker.com, all rights reserved.