US Futures Start The Week With More Wild Swings In Another Volatile, Illiquid Session

After a rollercoaster week that ended just barely higher following a late melt-up on Friday, overnight volatile US stock futures swung to start the week, with Nasdaq 100 futures leading gains after rallying on Friday, before turning red and threatening to fizzle a global equity rally amid persistent worries over the Federal Reserve’s plan to hike interest rates this year.

Emini S&P futures were down 0.5% or 21 points to 4401, after rising as high as 4437 and dropping as low as 4395 in another extremely illiquid session where China being offline for the week due to Lunar New Year did not help; Nasdaq futures were down 0.1% while Dow futures were lower 0.7%. Technology stocks led gains on the Stoxx Europe 600. Meanwhile, the dollar fell and oil rallied.

As investors reconcile to a hawkish U.S. central bank coupled with strong earnings, the expensive parts of the U.S. stock market are undergoing a valuation re-rating along with the bond markets. However, traders do see opportunities in less expensive segments of the global markets, such as European and emerging-market stocks (especially China), as well as higher-yielding currencies where rate hikes have already happened. The only thing money managers are certain about for the year is greater volatility.

(Click on image to enlarge)

The equity selloff “marks a long overdue correction rather than the start of a bear market,” BCA Research Inc. analysts including Peter Berezin and Melanie Kermadjian wrote in a note. “Stocks often suffer a period of indigestion when bond yields rise suddenly, but usually bounce back as long as yields do not move into economically restrictive territory.”

"The sharp fall in many high-quality tech firms is already creating opportunities for longer-term investors to add exposure,” Mark Haefele, the ever bullish chief investment officer at UBS Global Wealth Management, wrote in a note. “Rather than giving up on tech in the face of near-term headwinds, we recommend a more selective approach.”

In premarket trading, major technology and internet names such as Netflix Inc. and Tesla Inc. rose, with the electric carmaker getting an upgrade to outperform at Credit Suisse. Citi raised its recommendation on Netflix (NFLX US) and Spotify (SPOT US) to buy from neutral after pressure on subscription-based stocks. Netflix rises 2.7% in premarket, Spotify +1.8%. Citrix fell 3.7% in early New York trading. Elliott Investment Management and Vista Equity Partners are said to be nearing an agreement to acquire software-maker for about $13 billion, marginally less than the company’s current market cap. Other notable pre-market movers:

- Tesla (TSLA US) gains 2.4% in premarket trading after Credit Suisse upgrades the electric- vehicle maker to outperform following a sharp pullback and on “highly favorable” fundamentals.

- Beyond Meat (BYND US) growth prospects in the U.S. foodservice channel and international segments aren’t properly reflected in the shares, according to Barclays, which upgrades to overweight from underweight. Shares +4.4% in premarket.

- Alibaba (BABA US) and other Chinese tech firms were in focus as traders interpreted comments by China’s cyberspace regulator as positive toward the sector. Alibaba up 1.5% in premarket.

- Pullback in Intuitive Surgical (ISRG US) shares creates a good entry point into a premier medtech name which has executed strongly during the pandemic, Piper Sandler writes in note as upgrades to overweight. Shares up 0.6% in premarket.

Meanwhile, the stellar run of profitability in US companies continues this quarter. Of the 169 S&P 500 companies that have posted results so far, 81% have met or exceeded expectations. Profits have come about 5% more than the levels predicted. Companies from Alphabet to Exxon report financial results this week in the U.S., while the European earnings calendar is also full, with the likes of UBS Group AG and Roche Holding AG publishing their figures (more in our weekly preview post).

As Bloomberg notes, healthy earnings may cushion the impact of a technology-led selloff in the U.S. as investors adjust to a higher interest-rate regime. That may also help to alleviate some of the concerns sparked by geopolitical tensions between the U.S. and Russia over Ukraine.

European equities were well bid, with the Stoxx 600 gauge advancing for a fourth time in five days and an index of global equities pared its biggest monthly drop since March 2020. Euro Stoxx 50 rises as much as 1.6%, close to recouping last week’s losses, before drifting off best levels. Germany and Italy lead gains. Tech is the best performing Stoxx 600 sector, miners and travel underperform. Here are some of the biggest European movers today:

- Electrolux shares rise as much as 6%, the most since July 2020 and the biggest gainer on the Stockholm large-cap OMXS30 index, after several brokers upgraded the shares or their target prices. Handelsbanken upgrades to buy, citing “pricing power hiding in plain sight.”

- Vodafone shares rise as much as 4.5% after a Bloomberg report that activist investor Cevian Capital has built a stake in the firm. It highlights material “hidden value” in the U.K. telecoms operator, according to Andrew Lee, analyst at Goldman Sachs (buy).

- Adva Optical Networking shares rise as much as 16%, the most intraday since August, after the approval threshold for Adtran Inc.’s voluntary offer was crossed at the end of the initial acceptance period on Jan. 26.

- Aumann shares rise as much as 9% after the company reported margin guidance which Citi sees as positive indicator for ’22 profitability.

- KPN shares rise as much as 2.7% to their highest level since March 2021 after results. Analysts are positive on the company’s buyback plans, while KBC said KPN’s results are “comforting.” KPN forecast adjusted Ebitda after leases for 2022 of about EU2.40 billion.

- Saipem shares fall as much as 29% in Milan, the most intraday since 2013, after the Italian oil drilling specialist issued a warning on 2021 earnings and said it would hold discussions with creditors and shareholders for a financing package.

Monetary-policy decisions from the European Central Bank and Bank of England will help shape the market mood in the days ahead, while investors continue to watch for evidence of economic recovery from the pandemic effects. China’s economy continued to slow at the start of the year as manufacturing and services moderated.

(Click on image to enlarge)

Earlier in the session, equities in Asia Pacific climbed in a quiet trading day, paring a portion of their worst monthly decline since July amid continued investor concerns about the pace of tightening by the U.S. Federal Reserve. The MSCI Asia Pacific Index gained as much as 0.8%, reversing an early loss of 0.4%, as consumer discretionary and communication services shares climbed. Alibaba and Tencent were among the biggest contributors to gains as the Hang Seng Tech Index closed up 2.4%. Asian tech stocks followed their U.S. peers higher after bellwethers including Apple and Microsoft announced strong quarterly results and outlooks. Benchmarks in Japan, India and Hong Kong rose, with the latter in a shortened trading session at the start of Lunar New Year holidays. Markets in China, South Korea and Taiwan were closed. The Asian benchmark is on track for a decline of about 4.7% in January, as more traders price in five interest-rate hikes this year and after Raphael Bostic, president of the Fed’s Atlanta branch, told the Financial Times that a 50 basis-point rate increase is on the table. This comes while China’s economy continued to slow at the start of the year. “Powell’s current inflation-fighting mode makes it more likely that a new policy error will occur,” Citi Private Bank strategists led by David Bailin wrote in a note. Citi has increased its overweight on China on preparations for “greater macro easing and growth support,” they wrote

Japanese equities climbed, erasing an early loss, as the market continued to rebound from losses on concerns over Federal Reserve monetary tightening. Electronics makers were the biggest boost to the Topix, which rose 1%, erasing a drop of as much as 0.8%. Tokyo Electron and SoftBank Group were the largest contributors to a 1.1% gain in the Nikkei 225. The Topix rose 1.9% Friday, paring its weekly decline to 2.6%. The gauge is still down 4.8% this year.

India’s benchmark equity index bounced back after losing 6.6% in the last two weeks, boosted by gains in Infosys Ltd., which climbed the most since mid-October. The S&P BSE Sensex rose 1.4% to 58,014.17 in Mumbai, joining peers across Asia as investors took a breather from volatility induced by possible U.S. Fed rate action. Infosys Ltd. rose 3% and offered the biggest boost to the index. Still, the gauge is down 0.4% in January, its biggest monthly decline since November. The NSE Nifty 50 Index advanced 1.4% on Monday. Fed’s near-term rate hike possibility and selling by foreign investors weighed on the key indexes this month, Prashanth Tapse, vice president at Mehta Equities Ltd. wrote in a note. “All eyes will now be on the GDP numbers and the union budget to be announced on February 1,” he said. All but one of 19 sectoral sub-indexes compiled by BSE Ltd. gained, led by a measure of realty companies. On the earnings front, out of the 25 Nifty 50 companies that have announced results so far, 13 either met or exceeded expectations, 10 missed, while two can’t be compared.

In rates, Treasury yields advanced while the curve flattened as bond markets braced for successive rate hikes by Fed starting March. Yields were cheaper by more than 3bp across front-end of the curve, flattening 2s10s spread by ~2bp on the day; 10-year yields around 1.79%, cheaper by more than 2bps vs Friday’s close with bunds lagging by additional 3bp.Treasuries remain cheaper across the curve after an opening gap higher in yields led by front-end, focused on expected path of Fed rate hikes this year. Long-end may draw support from month-end flows. US outperformed bunds, gilts and most euro-zone bond markets. S&P 500 futures are under slight pressure, near Friday’s high. Bund and gilt curves bear flatten with short-end Germany underperforming. Peripheral spreads tighten on the better risk on mood. Italy snaps tighter on the open as political uncertainties ease following Sergio Mattarella’s re-election as president over the weekend.

In FX, the Bloomberg Dollar Spot Index fell as the greenback weakened against all of its Group-of-10 peers apart from the Swiss franc and the yen. The Australian dollar led G-10 gains and rebounded from an 18-month low against the greenback as traders and local exporters hedged for a hawkish tilt from the nation’s central bank on Tuesday. Month-end flows were also supporting the currency. The euro crept higher, nearing $1.12, and Bunds sold off, led by the belly and underperforming Treasuries, while the yield premium to hold Italian government bonds over German securities narrowed. The pound rallied amid a broad risk-on tone in global currency trading, with U.K. focus on this week’s BOE meeting. Asset managers added to short bets against the currency for the first time in six weeks, according to Commodity Futures Trading Commission data for the week ended Jan. 25. Figures also showed leveraged funds added long contracts to become the most bullish since early November. Norway’s krone rallied amid supportive oil prices while it shrugged off the news that Norges Bank won’t conduct any foreign exchange transactions on behalf of the government in February. The central bank sold foreign exchange equivalent to NOK250m a day in January. Japan’s 10-year benchmark yield rose to a six-year high following the recent surge in Treasury equivalents. TRY leads gains in EMFX, strengthening just shy of 2% against the dollar before fading near 13.40/USD.

Crypto markets are subdued with Bitcoin slipping back beneath the 37,000 level overnight. BoE's executive director for financial stability said cryptocurrency does not yet pose a risk to UK's financial stability, according to The Times.

In commodities, crude futures are in the green but drift off Asia’s highs. WTI slips after a brief retest of $88 in late Asia; Brent tops $91. Oil markets headed for the biggest January gain in at least 30 years. Spot gold is range bound near $1,789/oz. Most base metals trade well with much of the complex up 0.6-0.8%. LME aluminum lags.

Looking at today's calendar, it's a relatively quiet day, with Euro Area Q4 GDP, Italy Q4 GDP, Germany preliminary January CPI, US January MNI Chicago PMI, Dallas Fed manufacturing index, and Japan's December jobless rate. The Fed's Daly speaks. Looking at the week ahead, earnings are due from Alphabet, Amazon, Exxon Mobil, Ford Motor, Meta Platforms, Qualcomm, Sony, Spotify, UBS Group. Tomorrow we get the Reserve Bank of Australia rate decision, Manufacturing PMIs, including euro zone; OPEC+ meeting on output is on Wednesday as is the latest Euro zone CPI. On Thursday, the Bank of England, European Central Bank rate decisions; also we get the Fed Board of Governors confirmation hearing and the U.S. factory orders, initial jobless claims, durable goods. Finally, on Friday, we get the payrolls report for January, while in China, winter Olympics kick off with Russia’s President Vladimir Putin due to attend opening ceremony.

Market Snapshot

- S&P 500 futures up 0.2% to 4,431.50

- STOXX Europe 600 up 1.0% to 470.31

- German 10Y yield little changed at -0.03%

- Euro up 0.2% to $1.1170

- Brent Futures up 0.7% to $90.62/bbl

- MXAP up 0.7% to 184.12

- MXAPJ up 0.7% to 602.30

- Nikkei up 1.1% to 27,001.98

- Topix up 1.0% to 1,895.93

- Hang Seng Index up 1.1% to 23,802.26

- Shanghai Composite down 1.0% to 3,361.44

- Sensex up 1.4% to 58,004.69

- Australia S&P/ASX 200 down 0.2% to 6,971.63

- Kospi up 1.9% to 2,663.34

- Brent Futures up 0.7% to $90.62/bbl

- Gold spot down 0.1% to $1,790.58

- U.S. Dollar Index down 0.22% to 97.05

Top Overnight News from Bloomberg

- U.S. senators are close to agreeing on a Russia sanctions bill that could include penalties even if President Vladimir Putin doesn’t send troops into Ukraine, Foreign Relations Committee Chair Bob Menendez said

- Moscow further boosted troop levels around the Ukrainian border at the weekend, adding to President Vladimir Putin’s options should he decide on a military incursion, the Pentagon said.

- The Federal Reserve could opt to raise its benchmark rate by 50 basis points if a more aggressive approach to taming inflation is needed, Raphael Bostic, president of the Fed’s Atlanta branch, told the Financial Times in an interview

- The Federal Reserve’s shift toward a major reduction of its footprint in the U.S. bond market this year has upended expectations for sustained cutbacks to the Treasury’s quarterly sales of longer-term debt -- forcing dealers to gird for bigger auction sizes down the road

- The Reserve Bank of Australia is expected to announce the end of its bond purchases at its policy decision, setting the stage for an interest-rate hike in the third quarter

- BOE policy makers led by Governor Andrew Bailey are expected to hike interest rates to 0.5% on Thursday, according to a survey of economists by Bloomberg. That would complete the first back-to-back increase since 2004 and open the question of whether more increases will follow

- The ECB’s go-slow approach to monetary policy tightening is putting a wall around local bond markets against the global turmoil sparked by its U.S. counterpart

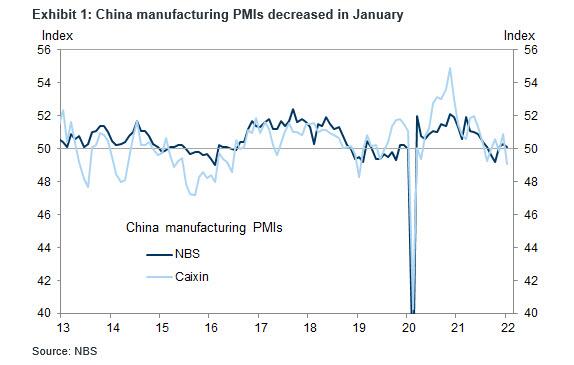

- China’s official manufacturing PMI declined to 50.1, the National Bureau of Statistics said Sunday, just above the median estimate of 50. The non-manufacturing gauge, which measures activity in the construction and services sectors, fell to 51.1, also marginally above the consensus forecast. The 50-mark separates expansion from contraction

- Investors are plowing money into hedge funds that don’t rely on the next macro genius or star stockpicker, but instead offer an army of traders who invest in an array of strategies. These behemoths secured pretty much all of the new money in the hedge fund industry last year, cementing a tectonic shift that’s accelerated since the pandemic

- Sales of bonds with sustainable targets have jumped sevenfold in Europe this month, competing with green debt to become the dominant force in the ethical market.

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were mostly positive but with conditions thinned due to closures on Chinese New Year's Eve. ASX 200 (-0.2%) was subdued with mining names pressured by lower metal prices and weaker output updates. Nikkei 225 (+1.1%) reclaimed the 27,000 level with the index underpinned by a weaker currency. Hang Seng (+1.1%) finished the shortened trading day higher with the index unfazed by mixed Chinese PMI data, while there was also an absence of Stock Connect flows with participants in the mainland away for the Lunar New Year.

Top Asian News

- Asian Stocks Climb With Tech Sector to Trim January Tumble

- Sri Lanka’s Inflation Accelerates to Asia’s Fastest on FX Crunch

- Sri Lanka Jan. Consumer Prices Rise 14.2% Y/y, Est. +13.2%

- JPMorgan Strategists See Better Risk-Reward for China and EM

European bourse kicked off the week with gains across the board before momentum waned (Euro Stoxx 50 +0.4%; Stoxx 600 +0.6%). European sectors have reconfigured to a more defensive bias since the European cash open; Tech outperforms and Basic Resource lag. US equity futures have eased off best levels to conform to a mostly downward bias; NQ (+0.5%) remains the outperformer.

Top European News

- U.K. Homebuilders ‘Deeply Undervalued,’ Have Spare Cash: HSBC

- Virgin Media O2 Said to Open Fiber Joint Venture Funding Talks

- Deliveroo Rises; Arete Cites Takeover Potential for Upgrade

- Orban Says Top EU Court Will Likely Reject Rule-of-Law Challenge

In FX, the dollar drifts along with other safe haven currencies as risk appetite improves into month end, but rebalancing flows should help the Buck find a base. Aussie regains composure in time for RBA policy meeting and manufacturing PMIs, while Kiwi tags along in slipstream amidst calls for the RBNZ to lift OCR to 2.5% by November. Pound holds firm pending Gray report and Partygate statement from PM Johnson. Euro regroups as Italian President Matarella agrees to serve second term and Portuguese PM Costa wins snap election unexpectedly. Turkish President Erdogan said they will lower interest rates and that inflation will fall too, while he also commented that problems which stem from a volatile FX rate and inflation are temporary, according to Reuters.

In commodities, WTI Mar’ and Brent Apr’ have been somewhat choppy with eyes on Russia and the upcoming OPEC+ meeting; NatGas holds onto overnight gains. Spot gold trades sideways below USD 1,800/oz ahead of a risk-packed week. LME copper meanwhile has seen a mild rebound from the USD 9,500/t with the red metal lacklustre overnight amid the absence of Chinese participants ahead of the Lunar New Year. German Nord Stream 2 approval is not expected during H1 this year, according to FAZ. IEA said Chinese gas demand growth forecast is to slow to 8% this year from 12% growth in 2021, while European gas demand forecast is to fall by 4.5% this year on higher coal consumption in the power sector, according to Reuters.

US Event Calendar

- 9:45am: Jan. MNI Chicago PMI, est. 61.8, prior 63.1, revised 64.3

- 10:30am: Jan. Dallas Fed Manf. Activity, est. 8.5, prior 8.1

- 11:30am: Fed’s Daly Speaks at Reuters Live Event

DB's Jim Reid concludes the overnight wrap

It's deja-vu all over again. I'm having yet more knee surgery today and will spend another 6 weeks on crutches with no weight bearing. Ironically I tore a hole in the cartilage while rehabbing the other knee. The fact that I can't do squats and lunges without tearing my cartilage probably tells you the direction of travel for my knees. My surgeon wants to delay knee replacements as long as possible but I'll be there eventually. Safe to say I'm unlikely to play tennis, squash, cricket and football etc, ever again. My opponents might suggest I didn't really play them in the first place. So I exist to get my body back on the golf course asap.

Talking of football, if last week was a match it would have been one of the most exciting 0-0 draws in history. On the face of it, future historians might conclude that it must have been one of the dullest weeks in the NASDAQ's history given that we closed the week +0.01% higher than the previous Friday, the fifth smallest % weekly move in the history of the index once we get down to the decimals. However beneath the surface there was extraordinary volatility as every day saw swings between 2.75% and 6%. Friday was seeing a recovery anyway but in the last 90 minutes the S&P 500 climbed c.2% and the NASDAQ over 2.5%. The S&P also ended the week higher (+0.77%), and saw the first positive week of the year. Until the market and the Fed stop leapfrogging each other in terms of interest rate expectations, the market will stay volatile. With such an extreme month, today's month-end might see some position squaring so maybe there'll be another late swing/surge/slump in the last 90 minutes.

Outside of stocktaking after a hectic month, what will this week hold in store for us? Well at least the Fed is out the way for now but central banks will continue to dominate the agenda as we move into February, with both the ECB and the Bank of England set to make their latest policy decisions on Thursday. Otherwise, there’ll be plenty of data to digest, including the all-important US jobs report on Friday, the final global PMIs tomorrow (manufacturing) and Thursday (services) and in the Euro Area there’s also the flash CPI reading for January (Wednesday) and the first look at GDP growth in Q4 (today). Earnings season will continue in full flow, with an additional 111 companies in the S&P 500 reporting, including Amazon (Thursday), Alphabet and Meta (both Wednesday). 56 report in the Stoxx 600.

China’s manufacturing PMI dipped to 50.1 on release yesterday, just above the 50 expected. The non-manufacturing slipped to 51.1, also marginally above consensus. Asian stock markets are trading higher this morning amid thin trading with markets in China and South Korea closed for the Lunar New Year holiday. The Nikkei (+1.39%) is up, erasing its opening losses while the Hang Seng (+1.07%) is also in positive territory.

In economic news, Japan’s factory output shrank (-1.0% m/m) in December, its first contraction in three months and weaker than market expectations of a -0.6% drop. It followed a +7.0% increase in November. Separately, retail sales (-1.0% m/m) in December unexpectedly declined (+0.3% expected) after witnessing an upwardly revised +1.3% gain in the previous month.

Moving ahead, stock futures in the US are edging up with contracts on the S&P 500 (+0.28%), Nasdaq (+0.44%) and Dow Jones (+0.23%) all higher as we type. US 2s10s is 2bps flatter again at 58.3bps as the 2yr note has climbed just over 3bps this morning. At one point this morning we priced 5 Fed hikes for the first time although this has settled to around 4.93 as I type.

Going through some of the main events this week in more details now. Starting with the ECB, our economists updated their call (link here) at the start of last week and are now expecting a policy rate liftoff in December 2022 of 25bps. They’re also anticipating a faster pace of tightening, with 25bp hikes in the deposit rate per quarter from December 2022, until rates reach +0.5% in September 2023. In terms of what it means for this February meeting, they write in their preview (link here) that they expect the slow, step-by-step pivot to exit will continue. Their view is that President Lagarde will reiterate the ECB’s capacity to act once the inflation criteria in the rates guidance are met, whilst at the same time differentiating the needs of the Euro Area from the US.

The other central bank decision that day is from the Bank of England, and our economist writes in his preview (link here) that he expects the BoE to follow up their December rate hike with another 25bps increase, taking the Bank Rate to 0.5%. Furthermore, he expects that the MPC should confirm that any APF reinvestments will cease from here on out, resulting in around £38bn falling out of the Bank’s balance sheet this year.

The data highlight in a busy week will be payrolls Friday. Our US economists are expecting nonfarm payrolls to have grown by a relatively subdued +150k in January (in line with consensus), with the unemployment rate remaining at a post-pandemic low of 3.9%. Clearly Omicron will impact this data, so it'll be tough to get a clear read though but Fed Chair Powell has already said that his personal view is that labour market conditions were consistent with maximum employment, “in the sense of the highest level of employment that is consistent with price stability.” The JOLTS report tomorrow will also be a good indicator of the tightness of the labour market and one we've preferred to payrolls as a lead indicator during the pandemic.

Otherwise, Wednesday's flash CPI reading from the Euro Area for January will be interesting. Our economists expect that year-on-year inflation will subside to +4.3% from its peak of +5.0% in December, which was also the fastest pace since the formation of the single currency.

On the earnings side, we’ll get an array of reports this week as the season continues in full flow, including 111 companies from the S&P 500 and a further 56 in the STOXX 600. Among the highlights: ExxonMobil, PayPal, UPS, Starbucks, General Motors and UBS tomorrow. Then on Wednesday we’ll hear from Alphabet, Meta, AbbVie, Novo Nordisk, Thermo Fisher Scientific, Novartis, Qualcomm, T-Mobile US, Santander, Sony and Spotify. On Thursday, releases include Amazon, Roche, Eli Lilly, Merck & Co., Shell, Honeywell and Ford. Finally on Friday, there’s reports from Bristol Myers Squibb, Sanofi and Aon.

Finally, there’ll be a continued focus on the trajectory of oil prices over the week ahead, particularly with the OPEC+ group meeting on Wednesday to discuss a March production increase. With inflation running at multi-decade highs in numerous countries and Brent Crude having surpassed $90/bbl at points in trading over the week just gone for the first time since 2014, oil prices are likely to remain a significant issue for policymakers over the coming months. For YoY comparisons, Oil was around $55 this time last year.

Turning back on the week that was now. The Fed kept policy unchanged at its meeting, but signaled liftoff was live in March. A common refrain from the Chair was that this cycle was very different – above-trend growth, inflation well-above target, and an historically-tight labour market that now allow and call for a much faster pace of tightening. The market took the signal, ending the week pricing a 119% chance of a 25bp rate hike at March, or a meaningful probability of a 50bp hike. The total amount of 25bp hikes through 2022 also increased, to 4.7 hikes from around 4 at the start of the week. This squares with our US econ team’s updated call of five hikes this year following the meeting (link here) .

In response, 2yr treasury yields increased +16.1bps last week (-2.6bps Friday), as investors priced in a steeper hiking cycle. The prospect of a Fed-induced slowdown along with bubbling geopolitical tensions ensured that 10yr yields didn’t follow and were only slightly higher (+1.1bps) over the week (-3.0bps Friday), driving the 2s10s yield curve to its flattest level in more than a year at +60.3bps but nearly 100bps flatter in 10 months.

German yields were more subdued, with 10yr bunds +2.0bps (+1.4bps Friday) and the 2yr tenor +1.3bps higher on the week (+0.5bps Friday). Gilts, meanwhile, sold off a bit more, with the 10yr +7.3bps higher this week (+1.5bp Friday).

In equities, as has been a habit this year, the S&P 500 made an about-face late in the US session on Friday, finishing the day +2.43% higher, driving the index to its first positive weekly performance (+0.77%) of the year. Unsurprisingly, the Vix index of volatility closed the week still near its highest levels over the last year at 27.66pts. The NASDAQ also benefitted from the late Friday rally, increasing +3.13% on the day, making the index broadly unchanged (+0.01%) after whipsawing all week. Last week brought releases from a few US mega-cap companies. Tesla warned about production constraints through the rest of 2022, which sent its shares -10.37% lower on the week (+2.04% Friday), to their lowest levels since October. Meanwhile, Apple posted its biggest quarterly revenues ever, even with broader supply chain issues, leaving the stock +4.88% higher on the week (+6.98% Friday).

European stocks fared worse, perhaps due to their closer proximity to simmering geopolitical tensions. The STOXX 600 was -1.87% lower (-1.02% Friday), the DAX declined -1.83% (-1.32% Friday), while the CAC fell -1.45% (-0.82% Friday).

The geopolitical tensions out of eastern Europe also helped drive oil prices higher, as Russia is one of the world’s largest exporters. Crude ended the week +3.02% higher (+1.34% Friday), closing above $90/bbl for the first time since 2014, while WTI increased +2.53% this week (+0.79% Friday) to $87.29/bbl. Even more directly impacted, European natural gas futures gained +16.9% this week (-0.01% Friday).

Finally in data, the US employment cost index, which has been specifically flagged by Chair Powell, increased +1.0% versus expectations of +1.2% in the fourth quarter, while University of Michigan sentiment data declined to 67.2, slightly below expectations.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more