U.S. Dollar Stronger For Longer

Summary

- U.S. dollar strength remains as U.S. QT continues apace while most other countries still easing.

- However, excess bank reserves held at the Fed should keep long-term rates lower for longer.

- AWMB should continue to rise and keep the U.S. economy expanding.

- Fed still playing the didgeridoo by reducing monetary base while boosting AWMB and reducing IOER.

- The price of gold should be around $1,900 per ounce.

- The strong U.S. dollar is keeping the U.S. price of gold subdued, aside from reactions to geopolitical shocks such as this week's disappearance of the UAE oil tanker.

Following up on my article “US Dollar to Rain on Gold’s Parade” of March 19, 2019:

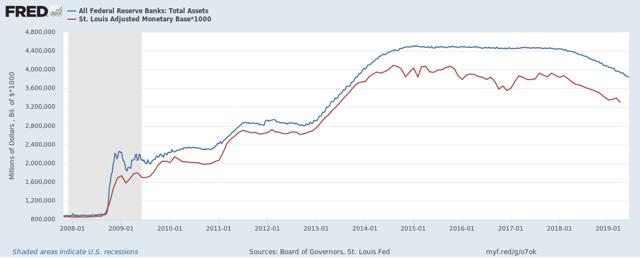

Fed continues QT by reducing Balance Sheet.

(Click on image to enlarge)

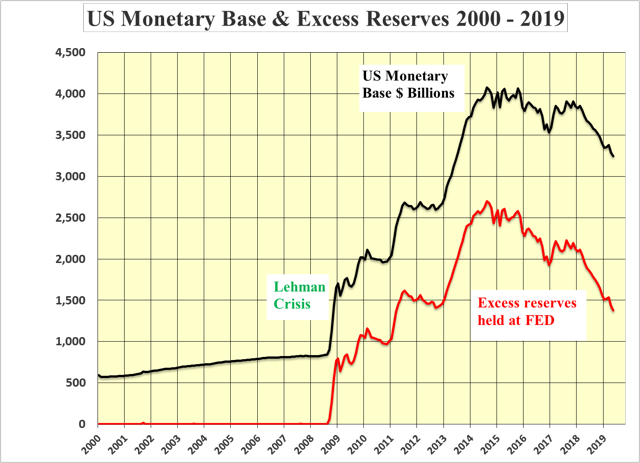

Excess Reserves also falling

Excess bank reserves held at the Fed are moving out into the real economy and pushing up the AWMB. This should keep bond rates lower for longer and the U.S. economy expanding.

(Click on image to enlarge)

Chart by Author from FRED Data

At its peak in August 2014, the U.S. monetary base stood at $4.1 trillion of which the excess reserves amounted to $2.7 trillion. The impact of 6 years of QE was essentially sterilized by the Fed.

In August 2008, just prior to Lehman, the U.S. monetary base stood at $0.84 trillion and the excess reserves amounted to a minute $2.0 billion. By August 2014, the monetary base had increased 5-fold to $4.1 trillion while the excess reserves increased to $2.7 trillion. The amount of the monetary base at work in the economy rose by only $0.5 trillion from $0.84 trillion to 1.4 trillion.

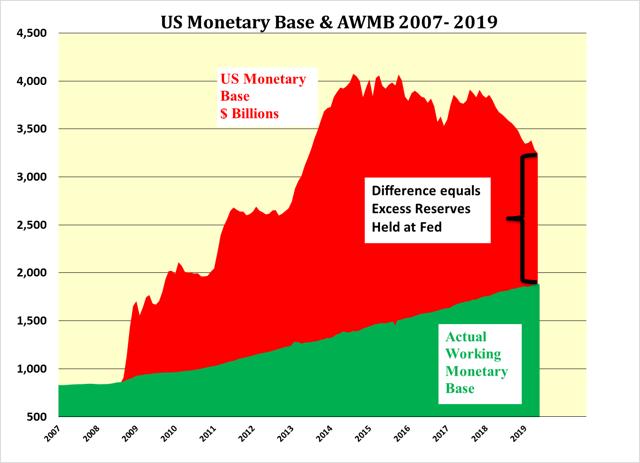

The AWMB is arrived at by subtracting the excess reserves from the total monetary base:

(Click on image to enlarge)

Chart by Author from FRED Data

Since the end of QE in 2014, the U.S. monetary base has fallen by $0.85 trillion to $3.22 trillion. Of this $0.51 trillion has moved out into the real economy as measured by the increase of the AWMB to $1.89 trillion. The remaining $0.34 trillion is the net amount of QT carried out by the Fed.

Fed Has New Levers to Pull Post-Lehman

To offset the impact of the 2008 financial crisis the Fed expanded rapidly the U.S. monetary base to re-liquefy the banking system. This continued until 2014 with most of the increase ending up as excess bank reserves held at the Fed.

However, for the first time in late 2008, the Fed paid interest on the excess reserves (IOER) which helped the banks rebuild their balance sheets. This together with fear, increases in reserve requirements and new regulations that stifled borrowing, all coalesced to delay the impact of the increased monetary base moving through to the real economy. This resulted in the very slow economic recovery from the great recession.

The IOER was increased from 0.25% by 0.25% in line with the Fed Funds rate starting at the end of 2016 until June 2018 when the Fed increased the IOER by only 0.20% to 2.40%. On May 4. 2019 the IOER was reduced by 0.05% to 2.35%. It seems that the Fed wants to encourage more of the excess reserves to move out into the real economy without lowering the Funds rate.

(Click on image to enlarge)

Fed Continues to Play the Didgeridoo

Using the new lever of adjusting the IOER the Fed can continue to engage in QT by reducing the total monetary base while simultaneously expanding the AWMB to keep the economy growing. In effect the Fed continues to play the didgeridoo with U.S. monetary base as it has since the summer of 2016:

Low Rates Continue as Economists Concerned About Recession

It appears that the job of economists, like that of mothers, is to worry about their charges. Something is always perceived as being about to go wrong, whether it does or not. Thus, despite the continuing expansion of the AWMB, there appears to be a great deal of worry in economic circles stemming from Mr. Trump’s trade wars with China et al. The countermeasures imposed by China on agricultural products, for example, are affecting capital expenditures by farmers which are feeding through to equipment suppliers.

This overall uncertainty is, however, holding back capital spending decisions in the private sector, which coupled with stalled government infrastructure plans, is probably another reason why long-term interest rates remain low and should continue to be so.

A reduction in the demand for money coupled with an increase in the AWMB is playing out as it should in the age-old battle between the supply of, and the demand for money. The winning result this time is lower interest rates, which should continue until there is firm evidence of a significant pick up in capital expenditures.

Gold & U.S. Dollar Battle on.

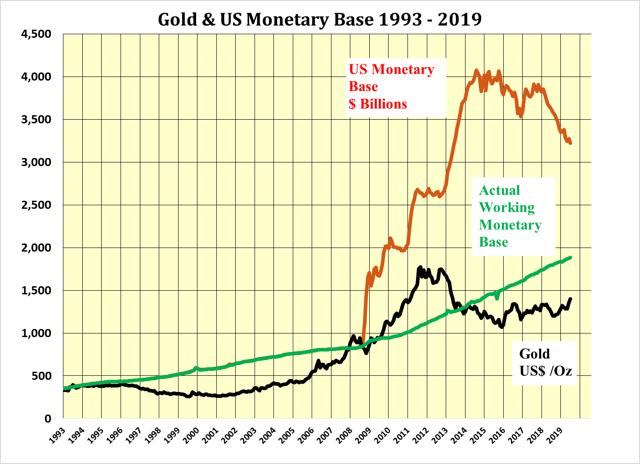

(Click on image to enlarge)

Chart by Author from FRED Data

Post Lehman when the U.S. monetary base exploded on the upside with TARP and the subsequent QE. At the time it made a great deal of sense to expect the gold price to track the total monetary base into the stratosphere. This together with massive short-covering culminated in the bullion price exceeding US$1,900 per ounce in 2011. Thereafter, the subsequent decline of the gold price was puzzling as QE continued for another three years.

It was only after recognizing that much of QE had been sterilized by the huge buildup of excess reserves at the Fed that it made sense for the price of gold to have reverted to the path of the AWMD. It was the recognition of this change that led to the tempering of enthusiasm for a runaway gold price.

In 2015, the price of gold was projected to recover to the US$1,400 level by 2016, tracking the AWMB. This was almost achieved on a daily basis but its advance was tempered by the strength of the U.S. dollar in 2017 and 2018 as later anticipated.

Following the same argument and with the AWMB now standing at $1.9 trillion, an equilibrium price for gold should be approximately $1,900 per ounce, all other things being equal. However, as the total U.S. monetary base is falling and the U.S. dollar is strengthening, it seems likely that any significant gold price advance will remain tempered until it is fully recognized that the AWMB is the important vector to watch and this should continue to rise as excess reserves are moved into the real economy.

(Click on image to enlarge)

As the total monetary base continues to fall and QE continues throughout the rest of the world, the price of the U.S. dollar should remain strong, tempering the advance of the U.S. dollar price of gold:

(Click on image to enlarge)

Buying Gold Shares Is For Patient Investors

With geopolitical events, such as the recent tension in the Persian Gulf, driving the gold price above $1,400 per ounce, interest in gold shares has picked up. This should lead to improving performance of gold funds which should see inflows of cash that must be deployed.

As gold shares have been out of favor for many moons even a modest increase in buying should lead to fairly sizable percentage jumps in gold-producing stocks. It is far too early to consider the few juniors are still alive let alone the explorers.

This notwithstanding, the gold funds will soon be asking their pet bankers for “bought deals”, which is the only way to buy large positions without pushing share prices out of reach.

The individual investor needs patience to invest in gold shares for they are unlikely to be offered any of the deals mentioned above. Furthermore, it could be some considerable time before the gold moves into equilibrium with the AWMB as the U.S. dollar seems set to remain strong as argued above.

Consider only shares of companies that have a good chance of remaining alive long enough for the U.S. to start to decline with the return of QE. Furthermore, they should have the following ten attributes:-

- Located in a safe jurisdiction. (Wherever that might be these days!)

- In production.

- High level of free cash flow.

- Low AISC Reserves of 10 years or greater.

- Selling at a discount to its 10% DCF.

- Plans to expand production with construction underway.

- Highly prospective exploration brownfield properties or the same nearby to maintain and expand reserves as mines deplete.

- Cash in the bank to explore and expand.

- Good, focused management.

- Paying a dividend to reward patience.

One example:

One company that fits the bill and has done so since 2016, and continues to do so, is Kirkland Lake KL listed on the NYSE and the TSX.

(Click on image to enlarge)

Source: Stockcharts.com

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not ...

more