US Civil War Cycle & Gold

Can market trends be predicted? Sometimes they can, but more often not.

If the prediction is a questionable tool at best, then what tools can investors use to build wealth with reliability?

(Click on image to enlarge)

In the stock, gold, and crypto markets, the big horizontal support and resistance zones (HSR) on the weekly and monthly charts offer the best opportunities for investors to take buy and sell action…

And sometimes they occur in all three markets at the same time!

I laid out Dow 7.5k, 18k, and 30k, as “buy zones of champions”, years before they happened. The bottom line is this:

If investors don’t spend significant effort preparing to buy these zones ahead of time, the emotional negativity that accompanies the opportunity can be overwhelming and investors won’t buy anything at all.

(Click on image to enlarge)

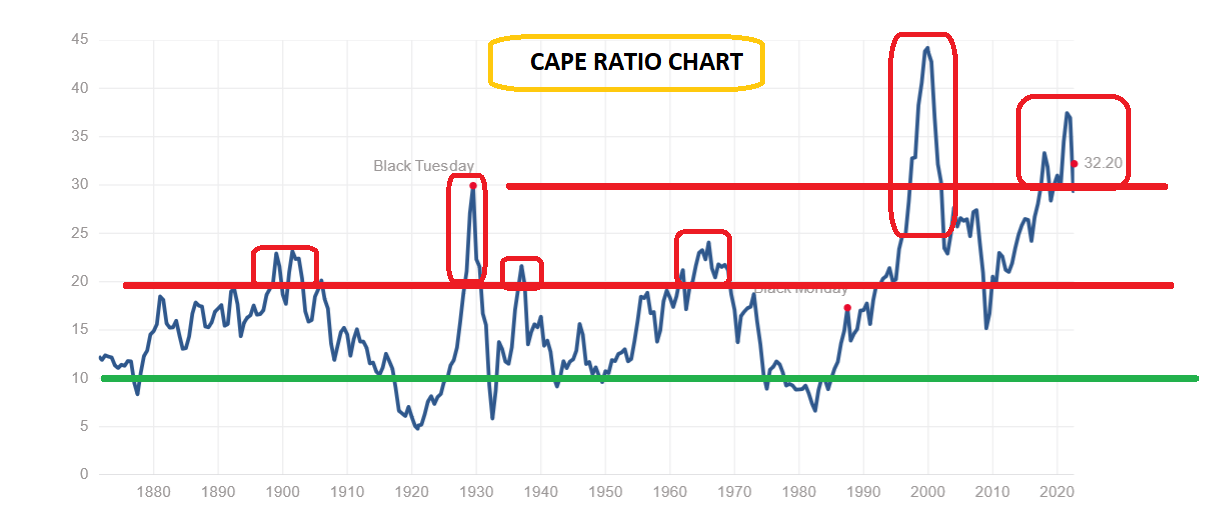

Basis the CAPE ratio, the US stock market is massively overvalued and doesn’t become a good value until the CAPE reaches 10 or lower.

That doesn’t change the fact that Dow 30k was a significant support zone and significant opportunity zone for investors.

The next Fed meetings in September and December are likely to mark the end of the party.

(Click on image to enlarge)

My preferred approach for most investors is to buy the crypto miners and the “alt coins” in the key support zones for bitcoin, for fast 50%-200% profits!

On that note:

(Click on image to enlarge)

I issued an “across the board” buy alert for the miners in the 20k zone for bitcoin, and key miners have rallied 100% in 1-2months since then.

Crypto investors who followed my big calls to buy at bitcoin for $4k, sell at $40k (and buy gold with the profits!), and buy at $20k… are in a fabulous financial position.

Gold?

(Click on image to enlarge)

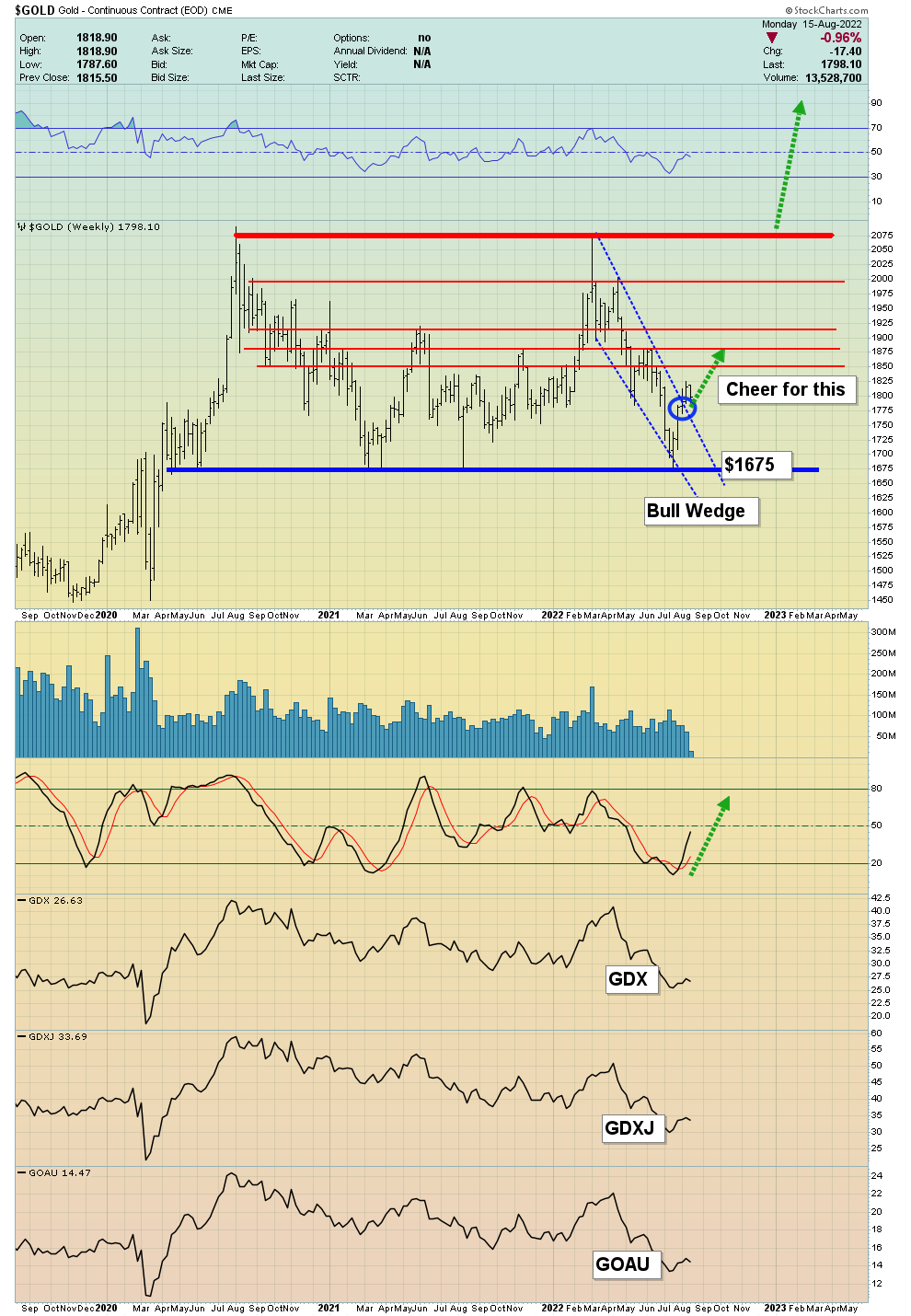

Note the GDX, GDXJ, and GOAU price action at the bottom of the chart. Clearly, gains of 20% and more are realistic for investors who take action once or twice a year at the key support zones for gold.

The most recent one was $1675, and my suggested focus “out of the gate” was the XME ETF and its component stocks.

(Click on image to enlarge)

I’m in sell mode now and investors can book profits too.

XME holds base metal miners as well as gold and silver miners, and the good news is that the next stage of the rally from the gold price of $1675 should see the GDX, GOAU, SIL, GDXJ, AND SILJ ETFs outperform XME.

As the September Fed meet gets closer, the stock market investors are likely to get nervous. Social unrest in Europe due to energy prices (and energy shortages as the weather gets cold?) is likely.

That’s good news for gold and not-so-good news for the stock market.

Also, it appears that the FBI has confiscated Trump’s passports. Is his arrest imminent? Will all his voters just stand there if that happens… or will some of them turn violent? If he’s arrested, I’ll suggest it would likely be the latter event.

Most stock market investors appear to be viewing the current lull in the 2021-2025 civil war cycle as an end to it. They may need to revise that outlook… soon!

(Click on image to enlarge)

This weekly chart tells the main GOAU story. Minor weakness needs to be bought (and I’m buying it eagerly) in preparation for a powerful run to $18 by September 21 “Jay Day”.

At that point, if Trump is put in the clink, multiples of $18 would become likely, with gold at $2500-$3000, as the American civil war cycle goes into overdrive.

The bottom line: US gold stock investors are poised to get a lot richer, but they need to stay safe too!

More By This Author:

Gold & The Intensifying War CycleInflation 18% And Sticky

Gold & A Failed Oil Price Cap