U.S.-China Trade Drama Continues As Stocks Gap Lower

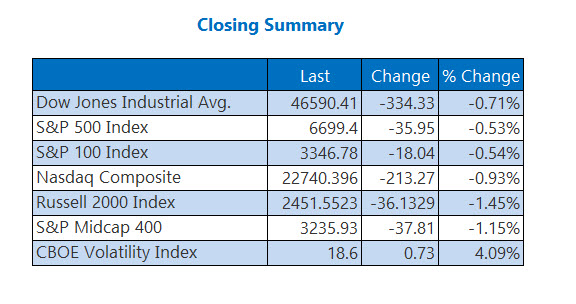

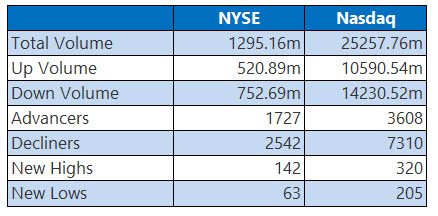

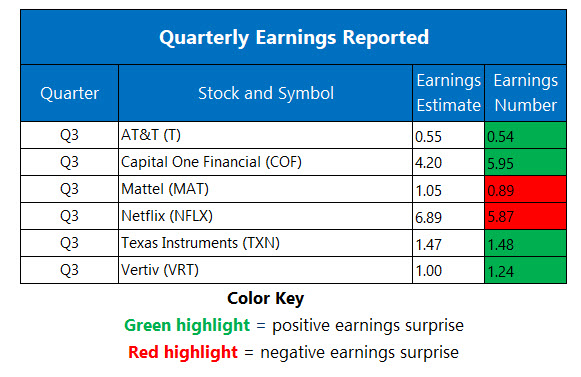

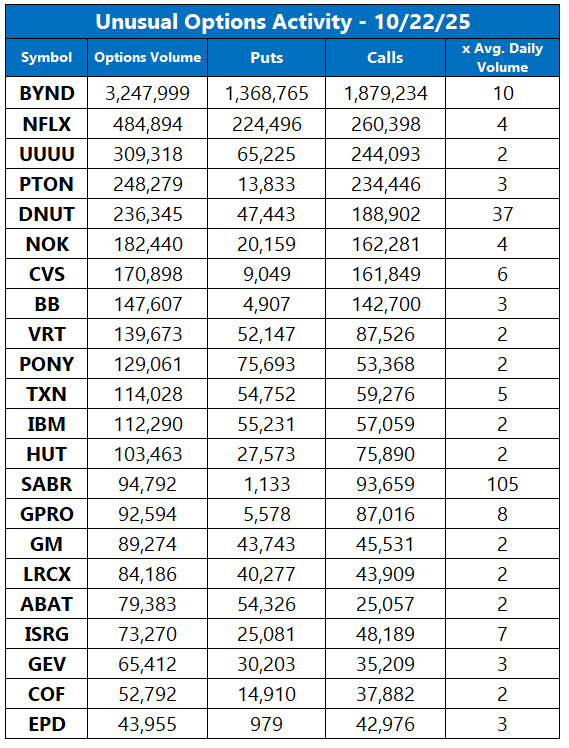

Netflix (NFLX) earnings drove market sentiment today, with the streamer's sour post-earnings performance pushing all three major indexes to a daily drop. Adding pressure was news that the Trump administration is now considering adding curbs on exports to China that are made with U.S. software. The Dow and tech-heavy Nasdaq struggled the most, both dropping triple digits. Tesla's (TSLA) quarterly report is on deck as small caps slide, with the Russell 2000 Index (RUT) down 1.5%.

OIL PRICES HIGHER ON HOPES OF U.S.-INDIA DEAL

Trade deal hopes between the U.S. and India and higher stateside energy consumption lifted crude today. December-dated West Texas Intermediate (WTI) crude rose 2.2%, or $1.26, to settle at $58.50 per barrel.

Profit taking on gold continued into Wednesday, as investors exited the safe haven in droves. December-dated gold futures fell $43.70, or 1.1%, to close at $4,065.40 per ounce.

More By This Author:

Stocks Lower As Netflix Earnings Drag The NasdaqDow Captures Record Close

Blue-Chip Earnings Push Dow To Fresh Record High