Uranium Stocks Soar After U.S. Said To Weigh Sanctions On Russian Nuclear Giant Rosatom

Earlier today we asked if Putin would voluntarily put Russian enriched uranium exports on the list of banned Russian exports, in the process sending the stocks of uranium producers sharply higher (as Russia is currently 40%-45% of the world’s enriched Uranium supply). Well, moments ago Joe Biden may have made that decision for him.

According to Bloomberg, the Biden administration is considering imposing sanctions on Russia’s state-owned atomic energy company, Rosatom - a major supplier of fuel and technology to power plants around the world - although no final decision has been made and the White House is consulting with the nuclear power industry about the potential impact.

Rosatom is described as a "delicate target" because the company and its subsidiaries account for about 35% of global uranium enrichment and has agreements to ship the nuclear fuel to countries across Europe, which means any sanctions risk plunging Europe in darkness. Thus, any punishment would also have to exempt the work Rosatom does with Iran under the terms of the deal limiting the country’s nuclear program, which Biden is seeking to revive. In other words, if Rosatom is sanctioned, it likely means that the Iran nuclear deal - which is mediated by Russians - is dead, and oil prices will soar even higher.

It’s also unclear what the sanctions would mean for U.S. nuclear plants and importers of fuel. Russia accounted for 16.5% of the uranium imported into the U.S. in 2020 and 23% of the enriched uranium needed to power the fleet of U.S. commercial nuclear reactors; notably, uranium was not included when the Biden administration announced on Tuesday it was banning Russian imports of crude, coal, and other energy products because - you know - Hillary... The reactors typically need to refuel every 18 to 24 months, and utilities typically buy fuel years in advance and maintain significant inventories. It's also why we said earlier that companies that would benefit from an escalation in uranium sanctions would be the Sprott Physical Uranium Trust, as well as our old favorite Cameco, which we have urged readers to buy since 2020.

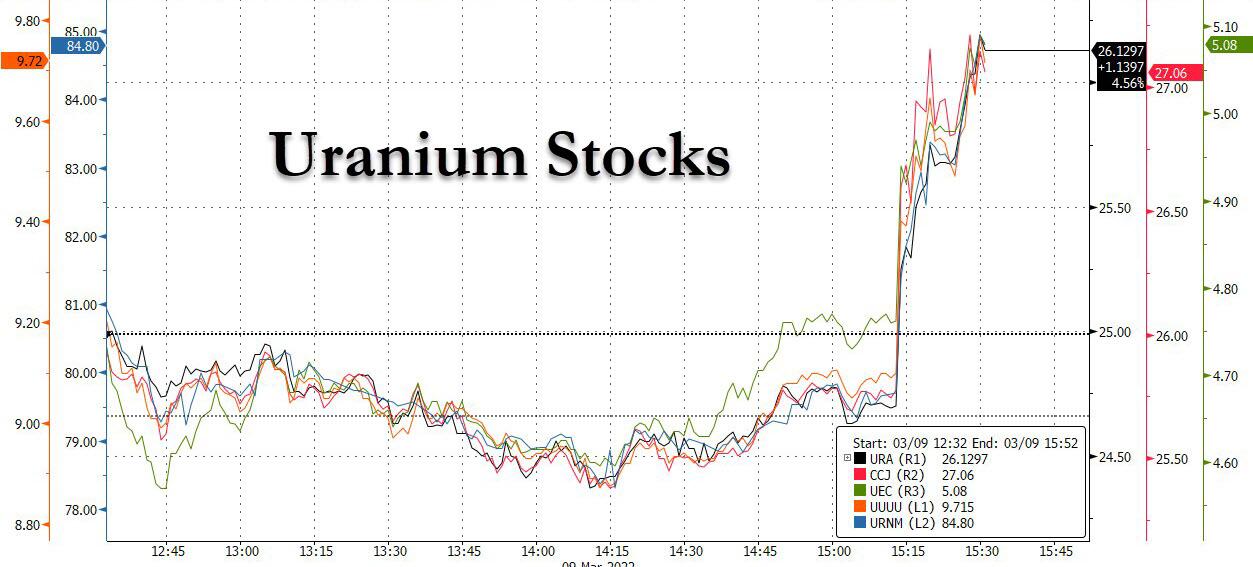

Needless to say, any such ban would send the price of uranium soaring and have a big impact on nuclear operators such as Southern and Exelon while a possible boon for domestic miners such as Energy Fuels Inc. and Ur-Energy Inc, as well as Cameco. In fact, the entire uranium sector is soaring.

(Click on image to enlarge)

“We can’t afford not to have Russian uranium and enrichment,” said Chris Gadomski, a nuclear industry analyst with Bloomberg NEF. “Russian uranium is cheaper and the U.S doesn’t produce any uranium.”

Which is precisely why the brilliant minds who control Biden's puppet strings will likely pass these sanctions.

As for how the U.S. finds itself in this predicament where its nuclear power is dependent on Russia...

... our suggestion is to ask Hillary Clinton.

Disclaimer: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies ...

more