Uranium Price Chart: Unveiling A Thrilling Long-Term Opportunity

Uranium, an essential raw material for nuclear power, is currently undergoing a significant transformation in its market dynamics. Several factors are converging to reshape the uranium price and supply landscape, hinting at a potential increase in its value.

For many years, the uranium market has faced challenges, primarily due to insufficient investment in new production capacity due to low uranium prices after the Fukushima incident. This lack of investment, coupled with the concentration of mines in specific geographic regions, has delayed the introduction of new primary supplies into the market. Recent geopolitical events and disruptions caused by the COVID pandemic have added to the uncertainty surrounding the supply landscape.

On the demand side, nuclear power plays a crucial and expanding role in the global clean-energy strategy. As global energy consumption is projected to nearly double over the next two decades due to rapid population growth, economic expansion, and a shift toward clean energy sources, nuclear power is expected to fulfil a significant portion of the demand for stable power generation. This implies a substantial increase in the demand for uranium.

Furthermore, advancements in Small Modular Reactor (SMR) technology have broadened the applications of nuclear power beyond electricity generation, encompassing water desalination, hydrogen production, heat generation, and more. This development is anticipated to further drive the demand for uranium in the foreseeable future.

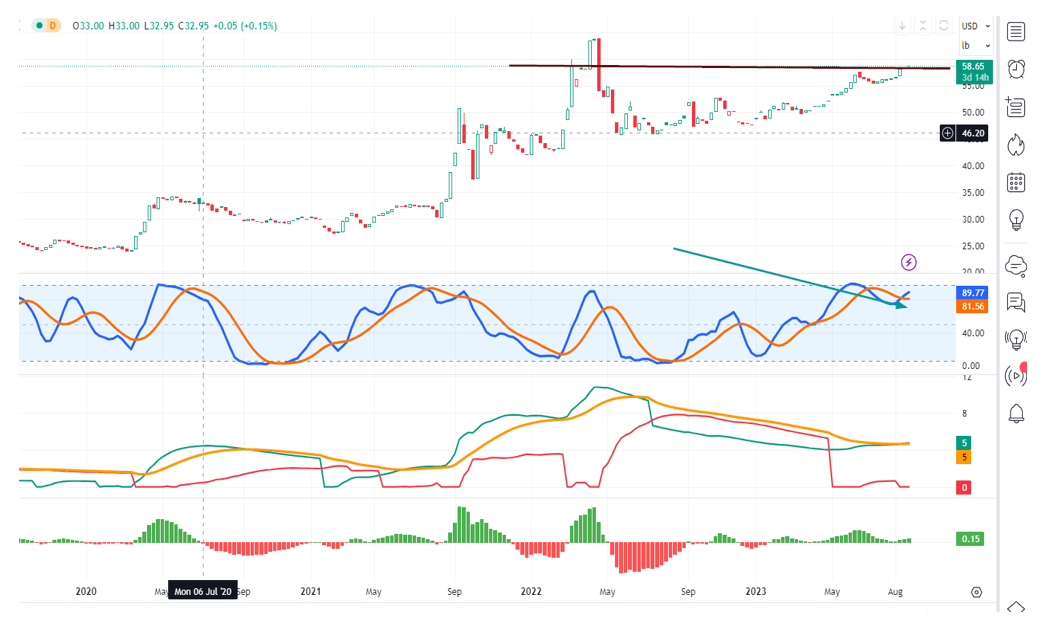

The Weekly Uranium Price Chart Outlook

The weekly chart reveals that Uranium (metal) is currently trading in an extremely overbought zone. However, if it can accomplish either of the following before undergoing a pullback, it could accelerate the upward trend cycle. Achieving a weekly close at or above 58.75 or experiencing a spike to new highs, which would involve surpassing 63.85.

(Click on image to enlarge)

If it fails to meet either of these objectives, nothing will change. The long-term perspective remains exceedingly bullish. As mentioned, the only variable affected would be the pace at which it tests and exceeds 120.00.

Conclusion

In summary, the uranium market faces a persistent supply gap amid surging demand. This, in conjunction with a positive long-term market outlook for price appreciation, indicates a potential upward trajectory for uranium prices. Even before factoring in the substantial future demand for nuclear power, the existing market dynamics suggest the likelihood of higher prices shortly, which may incentivize new supply and help bridge the supply gap.

More By This Author:

Optimal Strategies For The Best Stocks To Invest Long-TermFederal Fraud: Government’s Persistent Financial Mismanagement

Yuan Vs Yen: Yuan On Course To Challenge Yen