Two Trades To Watch: USD/JPY, Oil

Image Source: Unsplash

USD/JPY falls ahead of debt ceiling talks. Oil edges lower after Chines trade data, US CPI in focus.

USD/JPY falls ahead of debt ceiling talks

- USD/JPY falls ahead of the meeting between Biden & top politicians

- BoJ’s Ueda lifts the yen

- USD/JPY trades within a rising channel

USD/JPY is falling for a second straight day amid ongoing concerns over the US debt ceiling and as investors look cautiously ahead to tomorrow’s inflation data.

US President Biden and top politicians from both parties are due to meet later today in order to continue negotiations regarding raising the US debt ceiling. The limit of $31.4 trillion needs to be raised in order for the US to continue meeting its debt obligations. Treasury Secretary Janet Yellen has warned that failure to lift the debt ceiling could lead to catastrophic economic consequences.

While nerves are starting to show in the market, weighing on the USD, the broad expectation is that a last-minute deal will be struck.

The nervousness surrounding the debt ceiling comes at a time when there is already heightened uncertainty regarding the growth and inflation outlook.

Yesterday, the Federal Reserve Senior Loan Officer Opinion Survey (SLOOS), which tells us how banks are approaching lending and conditions, showed that credit conditions tightened and loan demand weakened, which points towards an economic slowdown.

Meanwhile, the yen is rising, boosted by comments from BoJ Governor Kazuo Ueda that the central bank will end its yield control curve policy and start shrinking its balance sheet once the prospects improve for inflation to sustainably hit the 2% target level.

Data overnight showed that Japanese household spending fell 1.9YoY in March, and real wages continued a year-long downturn. For now, the weak wage data could support the central bank in maintaining its ultra-loose policy.

USD/JPY outlook: technical analysis

USD/JPY continues to trade within its rising channel. The price found support on the 50 sma but is struggling to push above 135.00 as momentum fades and the RSI sits around the 50 mark.

Buyers will look for a rise above 135.30, the weekly high, to extend gains towards 136.00 round number and 137.00 the confluence o the 200 sma and the upper band of the rising channel.

Meanwhile, on the downside, sellers will look for a fall below 133.80, the 50 sma, and the lower band of the rising channel to extend losses to 132.80 the 100 sma, and last week’s low.

(Click on image to enlarge)

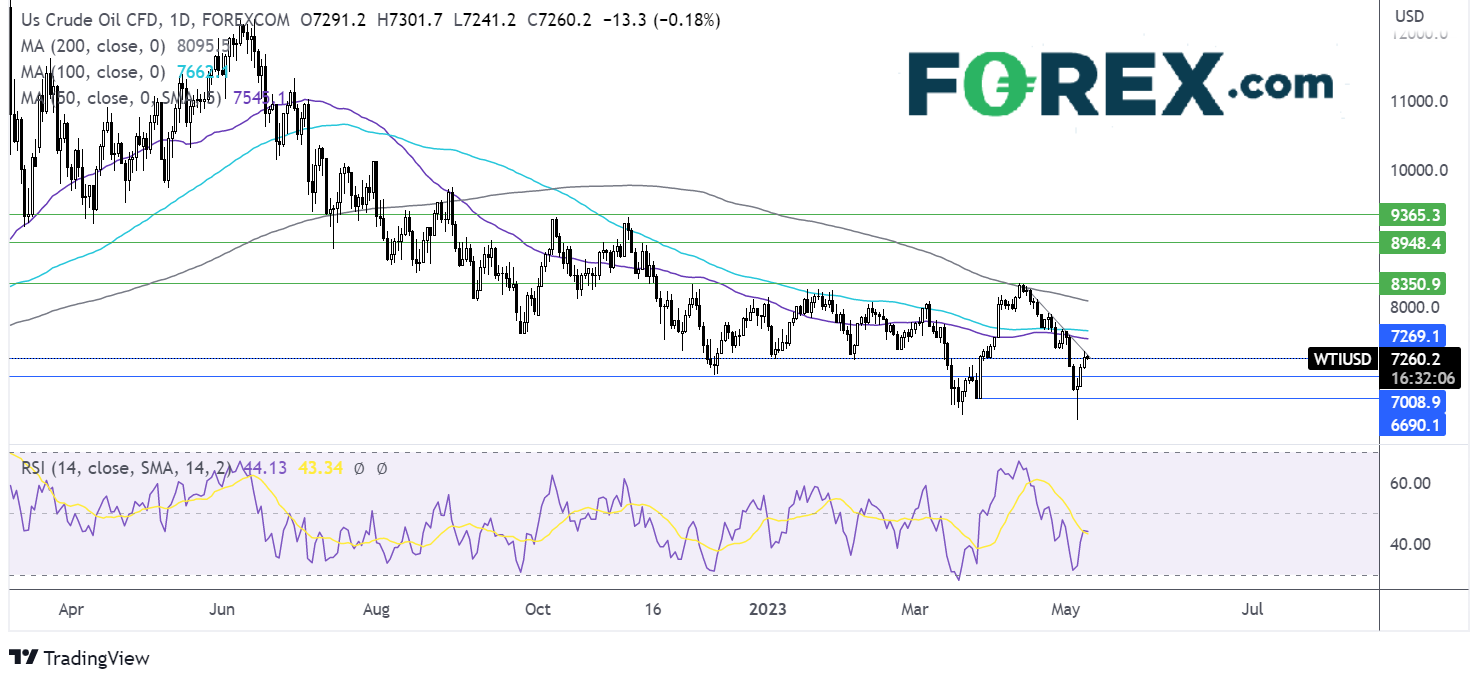

Oil edges lower after Chines trade data, US CPI in focus

- Oil slips after Chinese trade data raise questions over domestic recovery

- US CPI will be the next catalyst

- WTI oil failed tests support at 72.50

Oil prices are heading lower after two days of strong gains after mixed Chinese trade data and amid caution ahead of US inflation data tomorrow which will be key to the Federal Reserve's next interest rate decision.

China, the world's largest importer of oil saw export growth of 8.5% but imports unexpectedly fell 0.1%, raising concerns over the prospects of economic recovery in the world’s second-largest economy.

The API will release its weekly inventory data later today, ahead of the monthly OPEC report due on Thursday.

However, the key focus this week is on the US COI data, which could help to confirm whether the Fed will pause its rate hiking cycle, which would be considered positive for oil prices.

Oil outlook: technical analysis

WTI oil rose above resistance at 72.50, but the recovery stalled at the falling trendline resistance. While 72.50 is offering immediate support buyers need to break above the trendline at 73.60 to expose the 50 sma at 75.60.

Failure to rise above the falling trendline, and a break back below 72.50, opens the door to 70.00 round number and 66.90 the March 24 low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: Gold, USDCAD

Dow Jones Forecast: Stocks Fall Post Fed & As Banking Fears Persist

Two Trades To Watch: EUR/USD, DAX - Thursday, May 4

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more