Two Trades To Watch: Gold, FTSE

Image Source: Unsplash

Gold falls to a 6-week low on aggressive central bank bets rise. The FTSE falls to a 6-week low as Chinese manufacturing activity contracts.

Gold falls to a 6-week low

Gold is falling for a third straight day, falling towards 1700, a 6-week low. The precious metal is vulnerable amid aggressive ECB and Federal Reserve bets.

In August, Eurozone inflation hit a record 9.1% YoY, and US treasury yields have surged to a multi-month high lifting the USD northwards.

Investors shrugged off the weaker-than-forecast ADP payroll data yesterday, instead focusing on more hawkish rhetoric from the Fed.

Attention now turns to US jobless claims, which are expected to rise to 248k, up from 243k. Initial claims appear to have stabilized around this level. The data comes ahead of tomorrow’s non-farm payroll. A strong labor market could pave the way for a more aggressive Federal Reserve, which is bad news for non-yielding gold.

ISM manufacturing PMI is expected to be 52, still in expansion but slightly down from 52.8 in July.

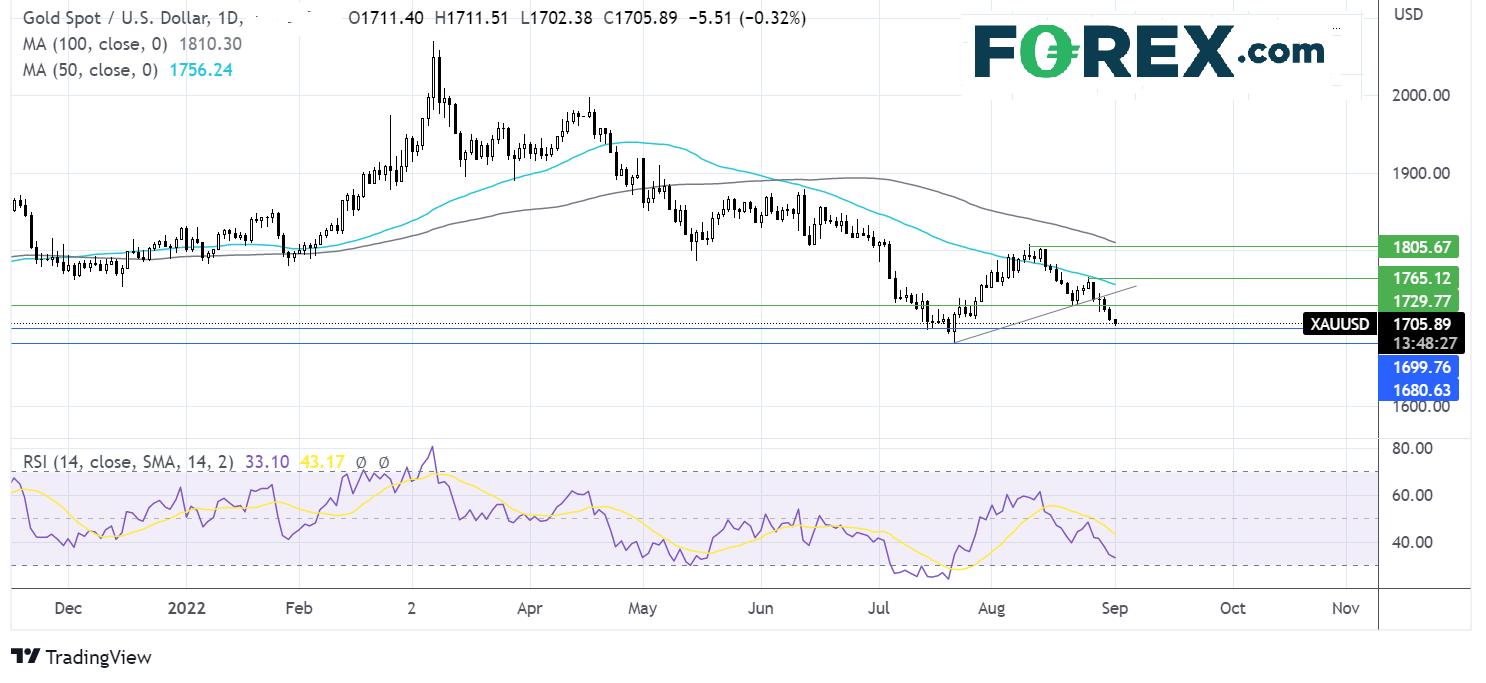

Where next for Gold?

Gold ran into resistance at 1805, falling below the 50 sma and the multi-week rising trendline. This, combined with the bearish RSI, points to further losses. Sellers will look to break below support at 1700 round number, ahead of 1681, the 2022 low.

On the flip side, resistance can be seen at 1710, yesterday’s low ahead of 1730, last week’s low. A move over 1763 creates a higher high.

(Click on image to enlarge)

FTSE falls after Chinese manufacturing contracts

The FTSE is set to open sharply lower extending August’s selloff. The index dropped 1.8% in a painful August, although it fared much better than the DAX which dropped around 5%.

The FTSE found some support from the sharply weaker pound. GBP/USD dropped 4.4% in August, its worst selloff since October 2016.

Stocks are trading under pressure amid rising concerns over the health of the Chinese economy. C Chinese manufacturing PMI data showed an unexpected contraction in August as China’s zero-COVID policy and drought and energy issues hit the sector.

UK manufacturing PMI data is expected to confirm 46 the preliminary reading.

Separately UK house prices rose more than forecast in August, despite the ongoing cost of living crisis. The average house price rose 0.8% MoM, marking the 13th straight monthly increase. Looking ahead, the housing market is expected to cool as interest rates continue rising and the cost of living crisis deepens.

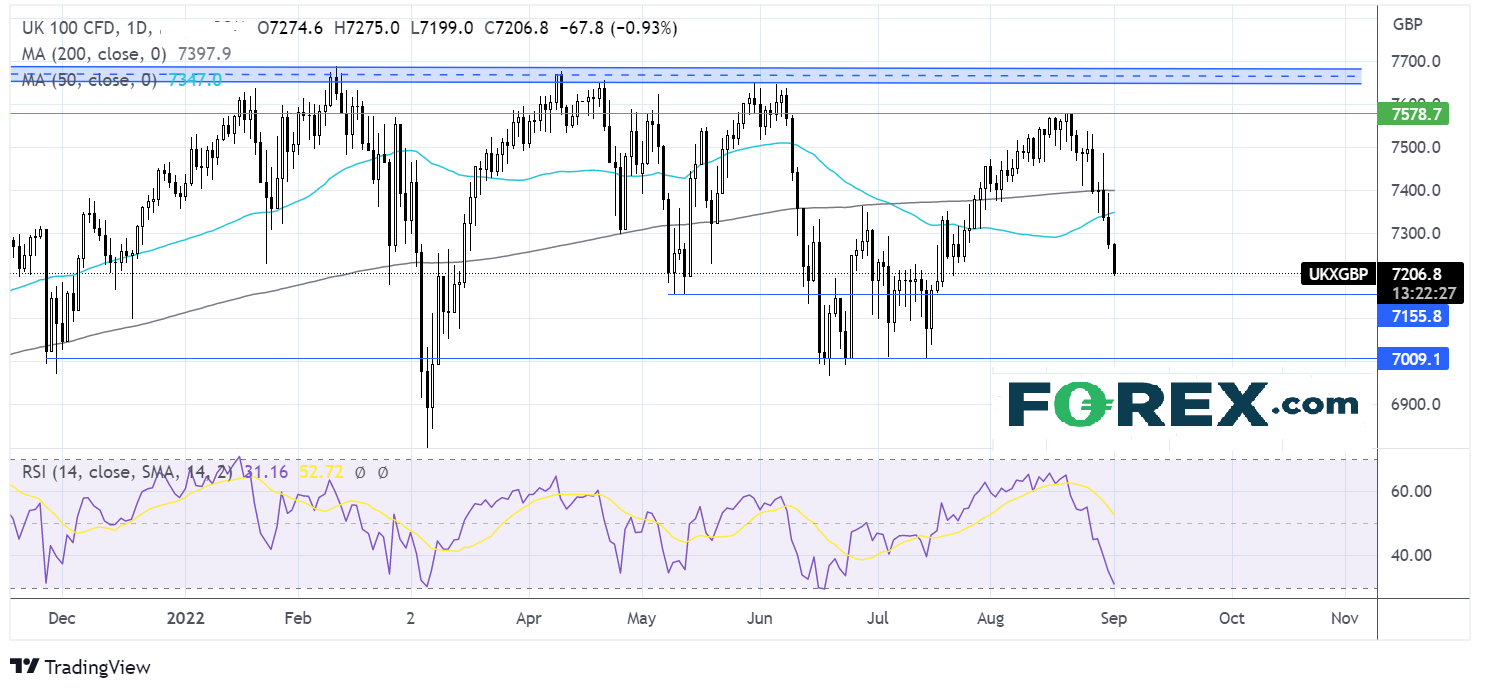

Where next for the FTSE?

The FTSE hit resistance at 7580 and has fallen lower, dropping through the 200 & 50 sma, and is testing support at 7200.

The RSI supports further losses while it remains out of oversold territory. Sellers will look for a move below 7200 to 7155 the May low, before targeting 7000 the psychological level.

Buyers will look for a move above 7350 the 50 sma to negate the near-term downtrend and 7400 the 200 sma.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/USD, Oil - Wednesday, Aug. 31Two Trades To Watch: DAX, GBP/USD - Tuesday, Aug. 30

Two Trades To Watch: Gold, DAX - Friday, Aug. 26

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more