Two Trades To Watch: Gold And EUR/GBP

Gold steady around two-week highs ahead of CPI. EUR/GBP edges lower ahead of EC quarterly economic forecasts & ECB/BoE talk.

Gold steady around two-week highs ahead of CPI.

Gold received a boost yesterday as US treasury yields eased, pulling the dollar lower. Russia – Ukraine tensions continued to act as a tailwind. Gold rose to $1836 a two-week high, before slipping slightly to 1833.

Gold is consolidating around these levels ahead of US CPI inflation data. Expectations are for CPI to reach 7.3% YoY in January, up from 7% in December.

High inflation would come following January’s impressive non-farm payroll report and December’s upward revision. A strong labor market and high inflation would prompt expectations of a more aggressive Fed which is bad news for non-yielding gold

Where next for Gold prices?

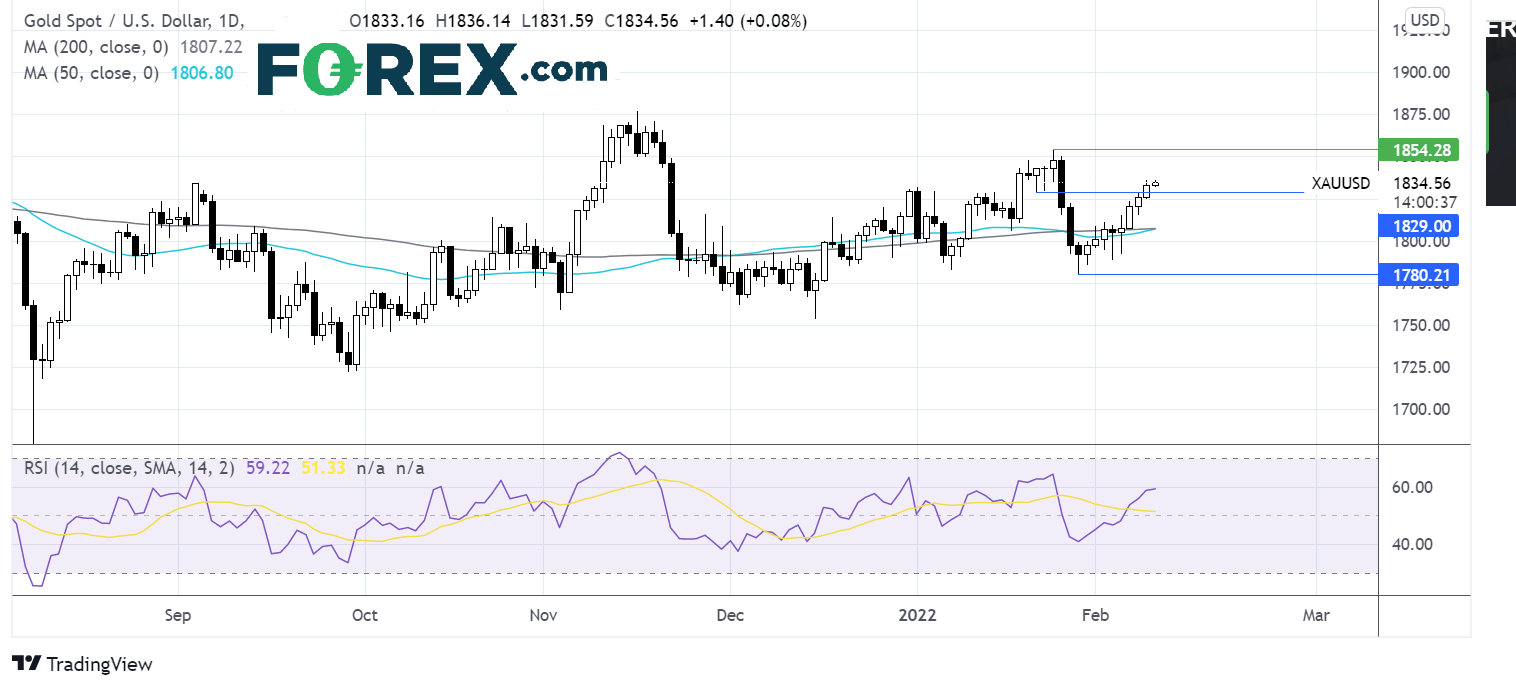

Gold is extending its rebound from 1780 to the 2022 low. The price has retaken the 50 & 200 sma and has run into resistance at 1836.

The 50 sma has crossed above the 200 sma in a golden cross bullish signal, and the RSI is also supportive of further upside.

Should buyers push above 1836 yesterday’s high, 1840 round number will be in focus ahead of 1850 psychological level?

A big beat on CPI could see gold prices come under pressure heading back to 1825 January 21 low. A move below the 50 & 200 sma at 1806 could see sellers gain traction.

(Click on image to enlarge)

EUR/GBP edges lower ahead of EC quarterly economic forecasts & ECB/BoE talk

EUR/GBP is edging lower after booking mild gains in the previous session. Comments from BoE Chief economist Pill weighed on the pound. He cautioned that it was better to adopt a more measured approach to rate rises.

Earlier in the week, the euro traded under pressure as ECB policymakers back-tracked on the hawkish ECB meeting.

Today we hear from ECB policymakers and BoE Governor Andrew Bailey for further insight into where monetary policy is going and at what speed.

The European Commission will also release its quarterly economic forecasts, should these show inflation is ex

Where next EUR/GBP?

EUR/GBP trades within a multi-month falling channel. The pair rebounded off the lower band of the channel, re-taking the 50 sma before running into resistance at 0.8478.

The price has eased off this high, falling below the 100 sma but remaining above the 50 sma. Whilst the RSI is supportive of further upside, buyers will look for a breakout above 0.8455 the 100 sma in order to attack resistance at 0.8480. A move above here could see buyers gain momentum.

On the flip side. Sellers could wait for a move below 0.8410 the 50 sma and yesterday’s low to target a move back towards 0.8335 January 18 high and 0.8310 the lower band of the falling channel.

(Click on image to enlarge)