Two Trades To Watch: GBP/USD, Oil - Friday, May 12

Photo by Colin Watts on Unsplash

GBP/USD rises as the UK economy sees small growth in Q1. Oil is set for a 4th weekly decline on demand concerns.

GBP/USD rises as the UK economy sees small growth in Q1

- UK Q1 GDP rises 0.1%

- BoE upwardly revised growth outlook

- GBP/USD rebounds off rising trendline support

GBP/USD Is rising, recovering from steep losses in the previous session as investors digest the latest GDP data and look ahead to US Michigan consumer confidence figures.

UK Q1 GDP rose 0.1% QoQ, a small gain that was in line with expectations and reduced the risk of a recession, although strikes in March saw the GDP contract -0.3% MoM that month. The figures leave the UK economy on track for stalled growth across the first half of the year as high inflation and rising interest rates squeeze households.

The data comes after the BoE hide interest rates by 25 basis points yesterday and upwardly revised the UK economic growth forecasts, with the central bank saying that it no longer expects a recession this year.

The BoE raised rates for the 12th straight meeting as inflation remains in double digits. However, the BoE expects inflation to fall sharply from April.

The USD is edging lower after strong gains yesterday as investors reined in Federal Reserve rate cut bets, even as PPI cooled to its lowest level since 2021 and jobless claims rose to a 1.5-year high.

Attention is now turning to US Michigan consumer confidence which is expected to ease slightly in May to 63 from 63.5 in June after the Federal Reserve continued to raise interest rates.

Debt ceiling worries could keep pressure on the USD, as a key meeting between congressional leaders is pushed back to next week.

GBP/USD outlook – technical analysis

GBP/USD found support on the rising trendline at 1.25 and is rebounding higher. This coupled with the RSI holding above 50 supports further upside.

Buyers need to break above resistance at 1.2550, the April high to make another attempt on 1.2680, a level which it has attempted to rise above on several occasions this month. A rise above here opens the day to 1.27 round number.

A break below the rising trendline open the door to 1.2435 the May low. A break below here exposes the 50 sma at 1.2360, also the mid-April low.

(Click on image to enlarge)

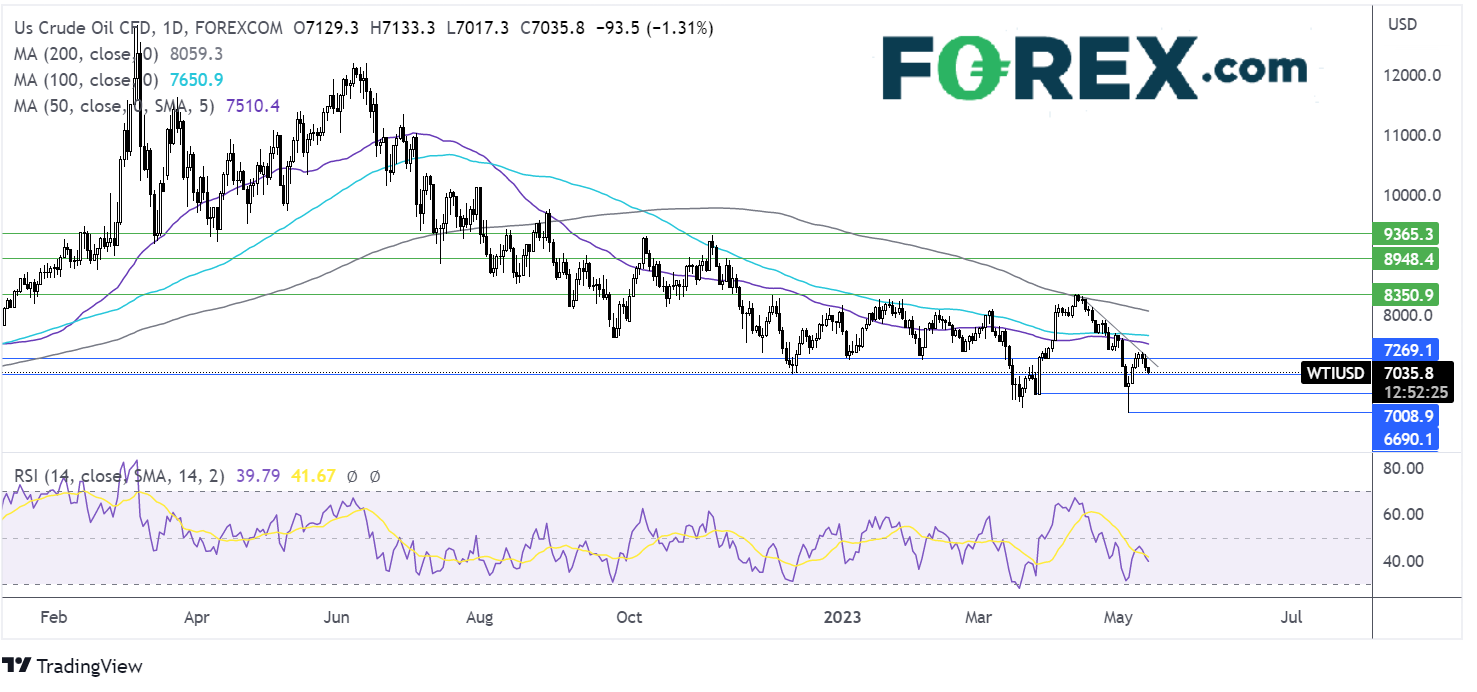

Oil set for a 4th weekly decline on demand concerns

- Weaker US & China data this week hurts oil demand outlook

- US debt ceiling worries

- WTI heads toward support at 70.00

Oil is falling for a third straight session and is set to fall across the week, marking the fourth straight week of losses as demand concerns rise.

Economic data this week from both the US and China this week has pointed to cooling economic growth.

A decline in new loans to businesses is the latest in a series of weaker data from China, raising concerns over the country’s recovery from Covid. The uneven and bumpy rebound is weighing on the oil demand outlook.

Oil prices are finding some support from comments from the US energy secretary that the US could repurchase oil for Strategic Petroleum Reserves (SPR) from June.

However, worries over the US debt ceiling could keep pressure on oil prices after a key meeting was pushed back to next week.

The market has shrugged off the OPEC global oil demand forecast for 2023, which points to rising demand in China, the world’s largest oil importer.

Oil outlook – technical analysis

Failure to retake the rising trendline combined with the RSI below 50 keeps sellers hopeful of further downside.

Sellers will look for a break below support at 70.00, the psychological level and the December low to create a lower low. Below here support at 66.85 the March 27 low comes into play ahead of 63.60 the 2023 low.

(Click on image to enlarge)

More By This Author:

Two Trades To Watch: EUR/GBP, USD/JPY - Thursday, May 11

Nasdaq 100 Forecast: Stocks rise As US inflation cools

Two Trades To Watch: USD, DAX

Disclaimer: The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such ...

more